With government policies around the world easing up to allow more EVs on the roads, more and more investors are looking to learn more about what’s happening. Companies that pivoted to the EV shift on time have seen a rapid rise in revenues in the last few years, while others that failed to do so saw losses as well.

In this article, we’re going to explore the consumer preference shift to EV vehicles, and how that change might affect automobile stocks in the Indian markets.

You may also like: The pharmaceutical industry in India and its contribution to the world

The electric vehicle boom

India is all set to embrace a future in electric vehicles. 70% of tier-one Indian car consumers state that they’re willing to consider an electric car for their next vehicle, as compared to the record-high global average of 52%. This preference shift is driven by global climate policies, push for sustainability, and subsidies for the sales of EVs.

EVs have also become accessible to the typical automobile consumer in the country, with manufacturers announcing EV alternatives to vehicles in almost all segments. Today, the cost of ownership of an EV vehicle has achieved parity with the cost of owning a regular vehicle.

India is one of the fastest-growing vehicle markets in the world and now has millions of EV owners. More than 90% of its 2.3 million electric vehicles are the cheaper and more popular two- or three-wheelers — that’s motorbikes, scooters and rickshaws — and over half of India’s three-wheeler registrations in 2022 were electric, according to an IEA report

Here are some reasons why consumer preferences are shifting in favour of EVs:

- Environmental concerns: One of the primary reasons for the shift to EVs is the growing awareness of climate change and the desire to reduce greenhouse gas emissions. EVs produce zero tailpipe emissions, which significantly reduces air pollution and reliance on fossil fuels.

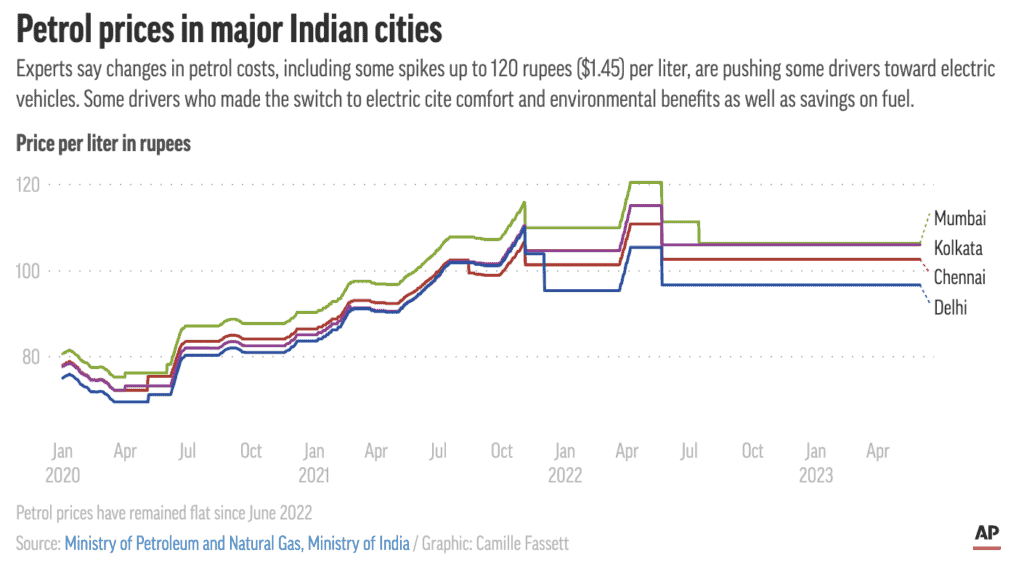

- Lower operating costs: EVs have lower operating costs compared to traditional internal combustion engine vehicles. Electricity is often cheaper than gasoline, and EVs require less maintenance due to fewer moving parts.

- Better driving experience: Electric vehicles offer instant torque and a smooth, quiet driving experience. This contributes to a positive perception of EVs in terms of performance, especially in acceleration and handling.

- Improving technology: Advancements in battery technology have significantly increased the range and efficiency of EVs. As battery costs decrease and energy density increases, EVs become more practical and cost-effective.

Also Read: Fast-Moving Consumer Goods (FMCG) Sector- A Safe Haven in Bear Markets?

Can the EV boom cause regular auto stocks to fall?

The relationship between the electric boom and the potential fall in traditional auto stocks is not a straightforward cause-and-effect scenario. While the rise of EVs can impact some aspects of the traditional auto industry, numerous other factors are also at play.

Diversification within companies and categories is a big factor. Auto stocks don’t necessarily fall when EV stocks rise because of one simple reason: most companies that traditionally manufactured regular cars are also expanding to the EV segment.

For instance, companies like Tata Motors and Mahindra & Mahindra are pioneering the development of electric vehicles in India, both on the consumer and commercial side.

How are Indian auto stocks performing right now?

Auto stocks, surprisingly, are in the money right now. Margins have already started to improve on most auto stocks in India like Maruti Suzuki and Mahindra & Mahindra (M&M).

Although both these stocks have historically underperformed the benchmark, they have given decent returns. While Maruti rose almost 12 percent in this period, M&M advanced over 10 percent. In comparison, the benchmark Nifty Auto gained around 20 percent in the last 1 year.

Meanwhile, in 2023 YTD, Maruti and M&M rose 23 per cent and 18 percent, respectively, again underperforming the benchmark Nifty Auto, which added over 26 percent in this period.

In terms of earnings, Maruti recorded its highest ever earnings this year, posting a standalone profit of ₹3,716.5 crore in Q2FY24 versus ₹2,061.5 crore in the same quarter last year.

Also Read: Sahara Group – The corporate giant’s infamous story

What does this mean for investments in auto stocks?

EV stocks are a great industry to get in if you’re looking to capitalise on long-term growth that’s not only sustainable, but also has proof of concept. Here are some stocks in India you should consider looking into if you want to capture significant value in the long-term:

- Reliance Industries

- TVS Motor Company Ltd.

- Tata Motors Ltd.

- Indian Oil Corporation Ltd.

- Mahindra & Mahindra Ltd.

- Hindalco Industries Ltd.

Make sure that you research industry leaders in the EV industry before investing. Bigger companies with larger R&D budgets have a higher chance of growing in the long-term even if they move slower with product launches.

Mergers and acquisitions in the EV space are also highly prevalent, so looking at a company’s acquisitions history might also help. M&A data will help you understand whether a company is identifying potential competitors and buying them, and if it’s generating enough cash flows to finance them in some way.

Conclusion

Hence, while the growth of EVs may impact certain segments of the traditional auto industry in the long term, the overall movement of stock prices is influenced by a myriad of factors beyond the rise of EVs, making a direct cause-and-effect relationship less straightforward or deterministic.

By analysing industry leaders, researching them fundamentally, and making investments with hedged risk, you stand a good chance to capitalise on the EV shift.