Mordor Intelligence predicts that the Indian battery market will expand at a rapid rate over the next few years. It is projected to reach $15.65 billion by 2029, expanding at a CAGR of 16.80%.

Today, we are going to delve into the titans of this industry – Exide Industries and Amara Raja Batteries. These businesses have distinct strategies and strengths. They stand for progress, new ideas, and never-ending quests for greatness.

This article unravels the journey of these two industry leaders, their strategic manoeuvres, and their growth trajectories.

Also read: https://www.stockgro.club/blogs/trending/lithium-ion-battery-manufacturing-industry-in-india/

Company profiles

Exide Industries

Exide Industries is a prominent Indian multinational storage battery manufacturer with its headquarters in Kolkata, India. Among the many power storage solutions it offers, its lead-acid storage batteries are unrivalled.

India, Sri Lanka, the United Kingdom, and Singapore are among the many places where the corporation runs its manufacturing operations. Additionally, it has a strong global presence with exports to over 60 countries.

Exide has expanded its operations into the Indian electric vehicle market and stationary applications by introducing lithium-ion battery modules and packs. Exide Energy Private Ltd., a wholly-owned company, is executing this transaction. Exide operates state-of-the-art lead recycling facilities through its subsidiary Chloride Metals Limited, showcasing its dedication to sustainability.

Exide Industries’ market share is dominant in the automobile batteries market. This is a result of the company’s established presence, its distribution network/ brand and product quality.

Exide Industries’ share price

If we check the Exide Industries share price history, it has provided a return of 74.29% in the past 5 years as of 12th April 2024.

Exide Industries news: As of April 12, 2024, the Exide Industries share price is ₹385.00. The recent analysis by JPMorgan has a positive outlook on Exide Industries’ share price target, setting a price target of ₹480.

Amara Raja Batteries

Amara Raja Energy & Mobility Limited, previously known as Amara Raja Batteries, is a prominent technology company in India. It is a major player in the industry, making lead-acid batteries for cars and other heavy machinery.

Amara Raja’s products are exported to over 50 countries worldwide, serving prestigious original equipment manufacturers (OEMs) and various other clients with a strong focus on quality and innovation.

The company is dedicated to environmentally friendly manufacturing, striving to contribute to a more sustainable future through the use of clean energy solutions.

The company has seen a compound annual growth rate of 13% over the past decade, enhancing the Amara Raja batteries market share in both industrial and automotive markets.

Amara Raja Batteries’ share price

If we check the Amara Raja Batteries’ share price history, it has provided a return of 27.13% in the past 5 years as of 12th April 2024.

Amara Raja Batteries news: As of April 12, 2024, the Amara Raja Batteries share price is ₹880.50.

Financial profiles

Now, let’s compare Amara Raja Batteries result with Exide Industries results:

| Exide Industries (March 2023) | Amara Raja Batteries (March 2023) | |

| EPS (Rs.) | 10.63 | 40.65 |

| Net Profit/Share (Rs.) | 10.63 | 40.66 |

| PBIT Margin (%) | 8.52 | 9.79 |

| Net Profit Margin (%) | 6.19 | 6.68 |

| Return on Capital Employed (%) | 10.77 | 18.04 |

| Asset Turnover Ratio (%) | 1.07 | 1.54 |

| Current Ratio (X) | 2.03 | 2.25 |

| Inventory Turnover Ratio (X) | 3.85 | 3.85 |

| Earnings Yield | 0.06 | 0.07 |

These ratios provide insights into the financial year 2023.

Also read: https://www.stockgro.club/blogs/personal-finance/ratio-analysis/

Exide Industries released the following results in the third quarter of FY2024.

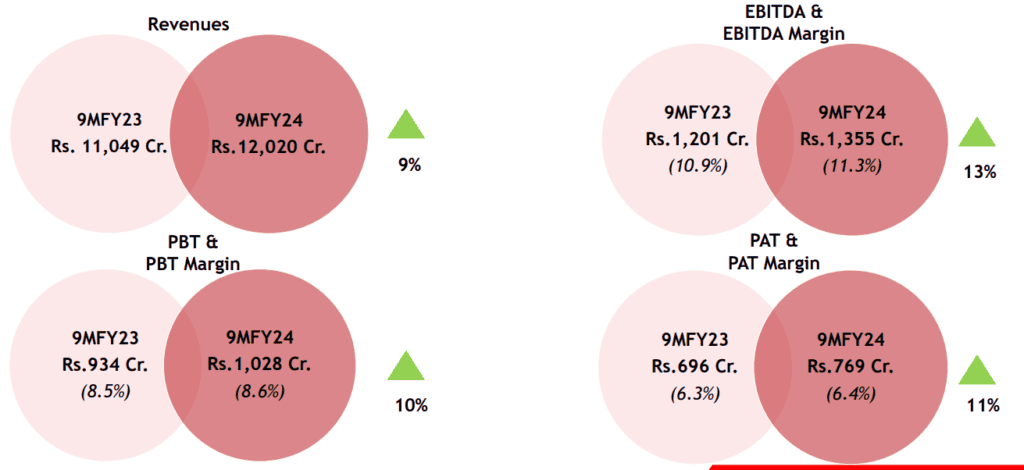

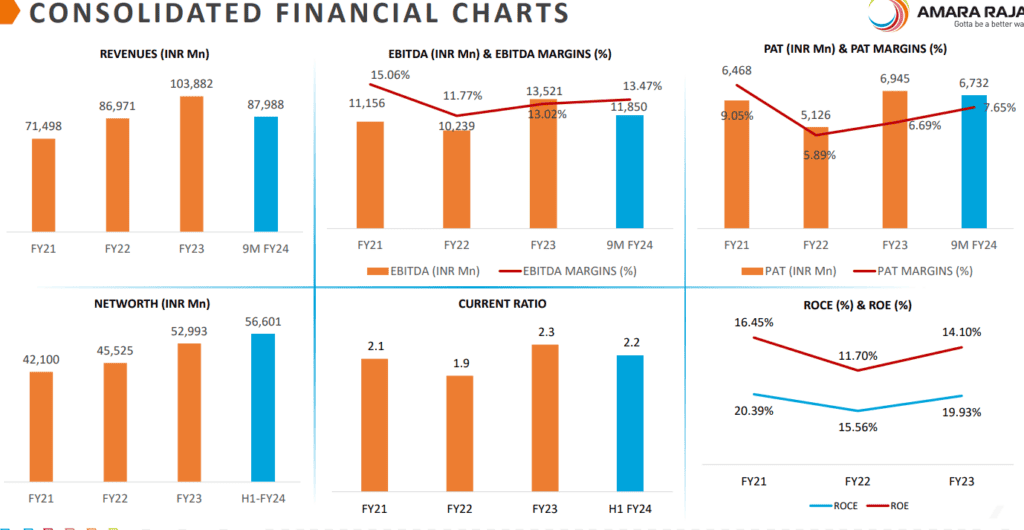

Moreover, Amara Raja Batteries released the following results in the third quarter of FY2024.

Moreover, Amara Raja Batteries released the following results in the third quarter of FY2024.

Reasons for growth

Exide Industries

- Diverse product range: Providing a wide range of products for various applications in the automotive and industrial sectors, including cutting-edge batteries to meet the demands of modern times.

- Strategic expansion: Expanding the domestic distribution network and global presence, with a strong emphasis on exports and penetrating international markets.

- Innovation and R&D: With a keen emphasis on research and development, we consistently deliver cutting-edge products and solutions that meet the ever-changing demands of the market.

- Financial strength: Consistent financial performance, a strong balance sheet, and a dedication to maximising investor returns.

Also read: https://www.stockgro.club/blogs/stock-market-101/product-portfolio/

Amara Raja Batteries

ARE&M has expanded and updated its operations, providing a diverse array of products for customers in both local and global markets. This involves transitioning from exclusively manufacturing batteries to becoming a complete provider of Energy & Mobility solutions.

The company’s growth has been strengthened by strategic choices, like the technical collaboration with Clarios for automotive batteries and the expansion into the New Energy business through its subsidiary.

ARE&M is a dominant player in the Telecom and Data Centre Industry, renowned for its flagship brands ‘Amaron’ and ‘PowerZone’. In addition, it has a strong export presence in more than 50 countries.

The company places a strong emphasis on innovation, exemplified by its development of India’s first 21700 Cylindrical Cell (NMC 811). Additionally, they prioritise sustainability by actively increasing the usage of renewable power and adopting a circular economy approach.

Company strategies

Exide Industries

- Profitable growth: Emphasise the importance of generating profitable growth in the core lead-acid battery business.

- Leadership in new business: Explore opportunities in the field of lithium-ion batteries and other emerging energy solutions.

- Innovation: Invest in R&D to remain ahead of the competition and make unique products.

- Digital transformation: Make better use of digital technologies to simplify processes and provide better service to customers.

Amara Raja Batteries

- Domestic market expansion: The company is focused on strengthening business relations with OEMs to enhance its market share and expand its presence in the market.

- Global market penetration: Efforts are being made to establish a strong global presence by expanding into new regions and utilising cutting-edge technologies.

- Product innovation: Introducing the innovative ‘Duraframe’ plate technology and expanding their product portfolio to include AGM and EFB technologies.

- Digitisation: Investing heavily in digitising the entire supply chain to ensure real-time visibility and enable better decision-making.

- Outsourcing: Outsourcing the manufacturing of tubular batteries to ensure top-notch quality while keeping up with the demand.

Future outlook

Exide Industries is focusing on sustainable growth and operational excellence, with a special emphasis on Green Technologies Solutions, including lithium-ion cell manufacturing. The company aims to drive growth in lead-acid battery and storage solutions, use digital transformation for cost efficiencies, and leverage a strong financial foundation.

Exide’s innovation, customer-centric product development, and global expansion, particularly in the EV battery market, prepare it to meet the changing demands of the automotive and industrial sectors. With robust R&D, strategic partnerships, and a scalable operations model, Exide is poised to benefit from the expected increase in electrification demand.

After years of making batteries, Amara Raja Energy & Mobility Limited (ARE&M) has expanded into providing end-to-end energy and mobility solutions. The company’s significant investment of ₹95 billion for a Giga Corridor in Telangana highlights its commitment to innovation and sustainability.

ARE&M’s increased focus on renewable energy and its leadership role in the telecom and data centre industries showcase its adaptability and growth potential. With a strong foundation, robust network, and diverse portfolio including ‘Amaron’ and ‘PowerZone’, ARE&M is well-positioned to meet the growing demand for electrification and energy storage solutions.

Bottomline

Exide Industries and Amara Raja Batteries are trailblazers in the Indian battery industry, demonstrating innovation, resilience, and strategic vision. They’ve set new standards in energy storage, committed to excellence and sustainability.

As they navigate dynamic markets and adopt new technologies, their focus on product innovation, market expansion, and customer-centricity is unwavering.

With advanced research, strategic partnerships, and a forward-thinking approach, they’re leading the shift towards a sustainable future. Their relentless pursuit of excellence underscores their leadership in energy storage solutions.