The rise of generative AI has ignited a fiery debate about the dangers of artificial intelligence. But amidst the controversy, this cutting-edge technology is already making waves in the financial services industry.

It’s a game-changer that can revolutionise how we invest, manage portfolios, and interact with financial advisors. Let’s explore the exciting world of Generative AI and its impact on the investment landscape.

The economic potential of Generative AI

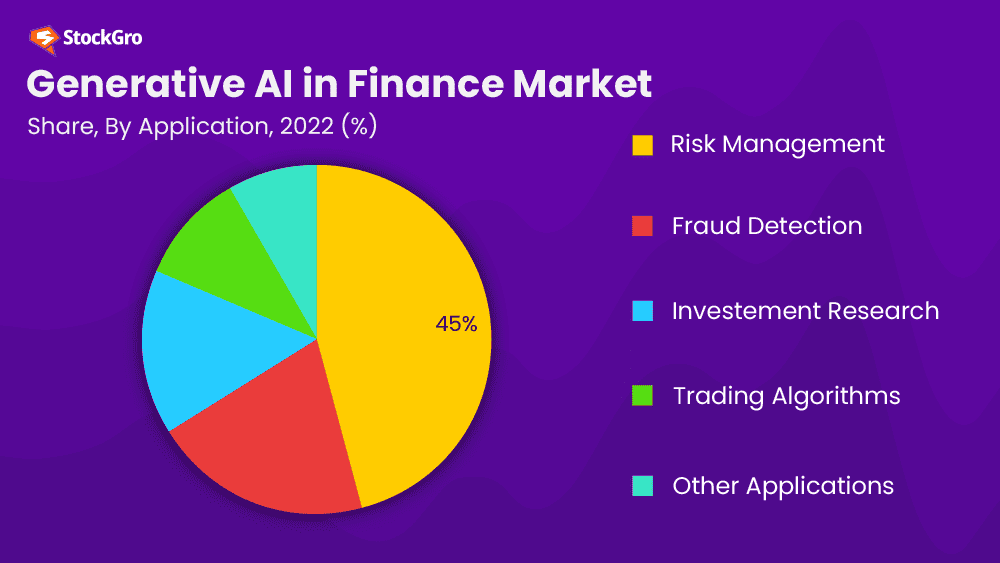

The economic potential of generative AI is vast. According to market research, the global generative AI in the finance market is projected to be worth around USD 27,430.7 million by 2032. Growing at a remarkable CAGR of 35.70% during the forecast period from 2023 to 2032.

The impact of Generative AI extends beyond finance, with potential value additions of $2.6 trillion to $4.4 trillion annually across various use cases. To put this in perspective, the entire GDP of the United Kingdom in 2021 was $3.1 trillion.

Industries such as banking, high-tech, and life sciences stand to benefit significantly from Generative AI. The potential additional value of $200 billion to $340 billion per year in the banking sector alone.

How can generative AI impact the investment world?

Generative AI, in simple terms, refers to AI systems that can generate new data or information based on patterns and structures learned from existing data.

It utilises deep learning techniques, such as neural networks, to create models capable of simulating human creativity and intelligence. These models can generate text, images, videos, audio, and code.

Here are some ways generative AI can impact the investment world:

- Improved decision-making: Generative AI can assist investors in making better decisions by analysing vast amounts of financial data, market trends, and historical patterns. It can provide valuable insights, identify potential risks, and uncover hidden opportunities.

- Portfolio management: With generative AI, portfolio managers can optimise their investment strategies. By simulating different scenarios and predicting market outcomes, AI models can help maximise returns and minimise risks.

- Automated trading: Generative AI can automate trading processes by analysing market data in real time. It can swiftly identify trading patterns and execute trades based on predefined parameters, saving time and minimising human errors.

- Risk assessment: By analysing historical data and market conditions, generative AI can assist in risk assessment and portfolio diversification. It can identify correlations between different assets and suggest risk mitigation strategies.

- Customer engagement: Whether it’s personalised investment advice or interactive financial planning tools, AI can engage customers in a meaningful way.

You may also like: ICICI Bank’s surprise move: Delisting ICICI Securities

The rise of generative AI in financial services

Embracing the power of AI

While some financial institutions like Bank of America, JP Morgan, Citigroup, Goldman Sachs, and Wells Fargo are cautious about using OpenAI’s ChatGPT. Others are embracing it with open arms.

Morgan Stanley, for instance, has deployed a chatbot powered by OpenAI to assist their financial advisors in utilising the organisation’s vast research and data resources.

You essentially have the knowledge of the most knowledgeable person in Wealth Management—instantly” “Think of it as having our Chief Investment Strategist, Chief Global Economist, Global Equities Strategist, and every other analyst around the globe on call for every advisor every day. We believe that is a transformative capability for our company.

Jeff McMillan ( Managing Director Morgan Stanley )

Even Citadel Securities is negotiating to adopt ChatGPT for a wide range of applications. From code writing to language translation and data analysis.

Bloomberg has launched BloombergGPT, an AI tool tailored specifically for the financial services industry.

Other financial giants are also exploring the potential of generative AI. JPMorgan Chase has submitted a trademark application for its AI-based program, IndexGPT, which focuses on analysing and recommending investments to customers. Goldman Sachs is testing large language models (LLMs) for internal use.

The future of finance and accounting

Imagine the possibilities in the realm of Finance and Accounting (F&A). Large Language Models (LLMs) are already capable of researching, summarising, translating, interpreting, generating, creating, comprehending, and reporting based on vast datasets used in F&A.

However, it’s important to consider regulatory constraints and other factors when implementing this technology on a larger scale.

Also Read: El Nino: A threat to India’s economy

Addressing privacy concerns

While the integration of AI into wealth management holds tremendous potential, it also raises valid concerns regarding data privacy, specifically Personally Identifiable Information (PII). Client confidentiality is of utmost importance, and any breach of fiduciary laws would be unacceptable.

To address these concerns, it’s crucial to distinguish between the public domain analysis data used by ChatGPT and the confidential PII data.

AI-powered tools like GPT-4 are designed to assist advisors with research analysis and data that are readily available in the public domain.

Asking ChatGPT to build an investment portfolio based on personal funding inputs could cross the line, as it would involve sharing sensitive client information.

Tech stocks soar with massive inflows

In the first week of June, tech stocks experienced a whopping $8.5 billion of inflows, contributing to the overall $14.8 billion inflow in stocks—the largest weekly inflow since February.

The Nasdaq and S&P 500 reached nine-month closing highs, and chipmaker Nvidia’s shares surged 30% in just three sessions, propelling its market valuation above $1 trillion.

The “magnificent seven” tech stocks—Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta, and Tesla—have accounted for a remarkable 8.8 percentage points of the S&P 500’s 10% year-to-date return.

This concentration of success raises concerns about the broader market’s health and the potential for increased volatility if investors abandon these mega-cap holdings.

So, why are we witnessing such massive inflows and a tech stock frenzy amidst a weakening global economic landscape? It all comes down to one thing—artificial intelligence (AI).

This technological revolution represents the biggest platform shift since the mobile and internet era, with an enormous total addressable market.

The impact of A.I. is tangible and not just hype. Nvidia, a company at the forefront of A.I. development, provided a staggering revenue guidance of $11 billion. This substantial figure demonstrates the real dollars generated by a company that sells the metaphorical “shovels” in the A.I. gold rush.

Also Read: The mega merger of HDFC and HDFC Bank

Generative AI is revolutionising the way we approach investments. With its ability to analyse data, generate insights, and automate processes, it’s set to reshape the finance industry.

Are you ready to embrace the power of generative AI and unlock new possibilities in your financial endeavours? The future looks promising, and the time to ride this transformative wave is now.