In the 21st century, the world has become a tangled place where everything else is affected by demand, supply, finances, etc, of various resources. No nation in the world is totally independent. Everyone relies on each other for resources. The flow of demand and supply will continue eternally.

Money has become a crucial aspect, in this connected world and its management drives the overall finances. The stock market is a sensitive entity that offers an opportunity for the investment of excess money and also indicates the investor’s confidence.

Today, a disaster in one country can affect the stock market of another, indirectly affecting the investments in that nation. Several such factors can impact the stock market.

The efficient market hypothesis suggests that all information is available in the price of a stock. It resembles global events too. Almost every crucial event has made an impact on the stock markets of the world to diverse degrees.

Moreover, investors today are not restricted to investing in their home countries. They can invest in different markets as foreign portfolio investors or foreign institutional investors.

Let’s explore the causes and impacts of global events on the stock market and understand them with historical and recent examples!

- Economic events

Economic factors

A country’s economic condition is assessed by several factors such as gross domestic product (GDP), unemployment data, inflation, etc. This directly or indirectly paves the path for investor’s confidence in the country’s growth.

Disclosure of this data marks a crucial event for every economy. The sense of caution, fear, assumptions, estimations, etc, amalgamate to decide the market mood. For example:

US job market data

Recently, on August 5, 2024, the unemployment data of the United States of America (USA) was announced at 4.3%, which marked its 3-year high. The string of crashes in almost all the stock markets worldwide started.

Prominent indices, like the S&P 500 and Nikkei 225, plunged by nearly 3% and 13%, respectively.

Usually in India, the Information Technology (IT) sector stocks are affected when the markets crash globally or majorly in countries like the USA. The Nifty IT index was down by 3.2% on August, 5, 2024. Infosys stock also closed nearly 3.8% low on the similar day.

Sensex and Nifty 50 also saw a plunge in the early trading hours. Sensex plummeted 2.95%, opening at 78,588.19. Meanwhile, Nifty 50 saw a 2% drop, opening at 24,302.85.

Japan rate hike

Japan had kept its interest rate low to 0%-0.1%, for the last two decades. This benefitted investors to borrow in yen and invest in dollars (with high interest rollouts).

However, it depreciated the value of yen and resulted in expensive imports. So, when the Bank of Japan hiked the rate by 0.25%, the market panicked. The fall of stock markets on Monday (August 5, 2024) was also catalysed due to this.

As of July 2024, there are nearly 2.2 lakhs Japanese Foreign Portfolio Investors (FPIs) in the Indian markets. Out of this 2.1 lakhs are in equity markets. So, their participation can be affected at the end of this month.

Since the hike, stocks of Japanese companies have experienced considerable effect. Hitachi energy ltd, stock closed 3.7% down on August 5, 2024, from previous closing. Similarly, Sumitomo chemicals was down by 3.3%.

Economic crisis

History provides evidence of how economic blunders lead to stock market bubbles and eventually crash a hyped market. In such a scenario, the investors are collectively very bullish on a specific aspect. It leads to overvaluation and thus crashes the market. It also creates a series of market falls all over the world. For example:

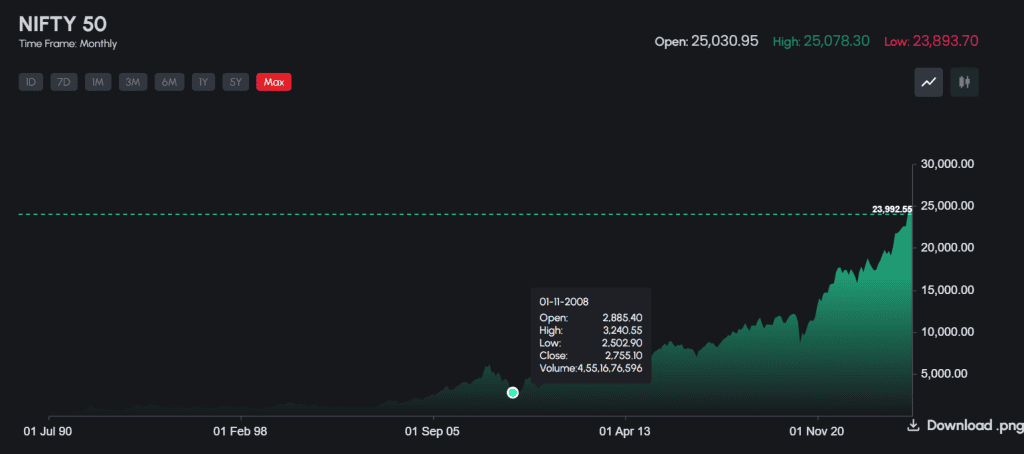

2008 market crash

The 2008 market crash was the product of the burst of the real estate market bubble and the Lehman Brothers bankruptcy. It wiped off a large amount in the US market, and affected almost all the stock markets in the world due to the dominance of the US dollar. India also witnessed a massive crash:

Source: Cogencis iINVEST

Check this out! How to build financial resilience in times of economic uncertainty?

- Natural disasters

The disasters caused by extreme weather and disturbance become a hurdle in the supply chain, disrupt infrastructure, cost lives and strike instability in the market. For example:

Gujarat earthquake

On January 26, 2001, India experienced a huge earthquake measuring 7.7 scale in Gujarat. There was a massive disruption of the supply chain and a loss of human resources. During that time, the Nifty plunged by nearly 2% and 15% in the subsequent months.

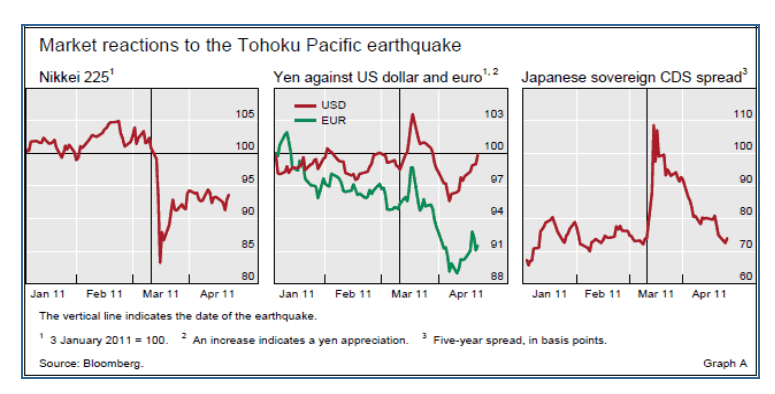

Tohoku earthquake and tsunami

Similarly, the Tohoku earthquake and tsunami in 2011 impacted Japan so adversely that its GDP declined by 0.9%, and the market experienced a huge crash.

Source: Bank of International Settlement

- Political events

A country’s ruling structure and markets run in a loop with each other. The change in ruling structure or autonomy also leads to changes in market regulations and impacts the overall business environment in that country. Thanks to globalisation, this impact expands to other countries too. Trade relations, taxation and policies can drive this impact.

Stock markets desire stability more than a particular side of a political war. Moreover, political figures are a strong component of relations between countries, which in turn drive business feasibility. For example:

India General Elections 2024

Recently, in India during the general elections of 2024, investors anticipated the market to rise after the results. A day before the result, on June 3, 2024, the NIFTY 50 index was soaring high, and after the declaration of results on June 4, 2024, the index fell by nearly 6%. heavy losses were incurred by the investors.

Bangladesh crisis

Started in early July 2024, the unrest of students in Bangladesh has become dangerous. The ex-prime minister, Sheikh Hasina, has resigned, and an interim government has been appointed.

However, massive destruction of supply chains and businesses is ongoing in the country. Indian company Marico, earns 40% of its international business from Bangladesh. Similarly, Dabur has a subsidiary and a manufacturing unit in Bangladesh. So, the stocks of these companies may get affected in the upcoming days.

Also, read: The anatomy of a stock market crash

- Wars and unrest

The world is divided into different war fronts these days. Several countries are at war simultaneously, which has created a massive disruption of the supply chain, washout of funds and loss of human resources. Internal and external unrest are adversely affecting businesses in the world.

Ultimately, world stock markets have been unstable since March 2022, when the Russia-Ukraine war started. This war is not over yet, and several fronts have already taken over the world’s peace. Middle-east tension between Israel and Palestine, Israel and Iran, along with the Houthi attacks in the Red Sea, disrupted the supply of goods such as crude, fertilisers, wheat, etc. For example:

Houthi Red Sea attack

During February 2024 and April 2024, the Houthi attacks on ships in the Red Sea increased. The stocks like Oil and Natural Gas Corporation (ONGC), Hindalco, and Indian Oil Corporation Limited (IOCL) (related to crude) experienced a grave fall. In a similar duration, a slight increase was observed in pharmaceutical stocks.

- Psychological

Investor’s confidence is the core driving force behind the price movement in the stock market. Fear and greed motivate investors to buy or sell stock. When such sentiments collectively affect a stock or overall market, major price movements take place. For example:

Adani-Hindenburg case

On January 24, 2023, a short-selling entity Hindenburg, accused Adani group of stock manipulation and accounting fraud. Investors panicked and massive selling started. Shares such as Adani Enterprise, and Adani Power fell by nearly 42% and 35% in just one week.

Bottomline

Stock markets are products of investor’s sentiments. The supply, demand and volume in the markets govern investor’s hard-earned money. However, the markets are driven by several factors. As globalisation increases, the number of global events impacting the economy also increases. Similarly, there are several types of global events, which drive major changes in the stock markets.

Economic impacts like country-specific data and crisis effects, natural disasters, political events, wars and behavioural patterns of investors are some prominent events driving stock markets worldwide.

Must read: How Global Economic Events Affect Personal Finances