In the bustling landscape of India’s real estate sector, Godrej Properties Ltd. (GPL) stands out as a beacon of success, continually setting new benchmarks and reaching unprecedented heights.

The company’s recent performance in Q4 FY24 has impressed investors and highlighted its dominant position in the market.

Let’s delve into the key figures and trends that have propelled Godrej Properties to its current position.

You may also like: Indian elections & stock market volatility

Breaking down the numbers

Q4 FY24 performance:

- Booking Growth: Godrej Properties reported an impressive 135% year-on-year growth in bookings for Q4 FY24, totalling over ₹9,500 crore.

- Annual Bookings: FY24 bookings exceeded ₹22,500 crore, surpassing initial guidance by a whopping 61%.

- Sales Volume: In Q4 FY24, the company sold 5,331 homes covering a total area of over 8 million sq. ft.

| Particulars (INR Cr) | Q3 FY23 | Q3 FY24 | % Change | 9M FY24 | 9M FY23 | % Change |

| Total Income | 366 | 524 | 43% | 2,410 | 1,068 | 126% |

| Adjusted EBITDA | 160 | 167 | 5% | 662 | 390 | 70% |

| EBITDA | 153 | 152 | -1% | 548 | 364 | 51% |

| Profit before tax | 101 | 95 | -7% | 399 | 226 | 77% |

| Net Profit after tax | 59 | 62 | 6% | 254 | 159 | 60% |

Stock Performance:

- Share Price Surge: The stock soared by over 7.5% to hit a new all-time high of ₹2,791.20, driven by record-breaking sales.

- Year-on-Year Gain: Godrej Properties’ shares have more than doubled, surging by 130.35% over the past year.

- Market Cap: The current market capitalisation as of 9 April 2024 of Godrej Properties rose to an impressive ₹75,877.52 crore.

Driving forces behind success

Meeting the growing demand for luxury homes

The surge in Godrej Properties’ sales can be attributed to the increasing demand for luxury homes in India. With the expanding economy and significant investments from high-net-worth individuals (HNIs) and ultra-high-net-worth individuals (UHNIs), the demand for premium residences is on the rise.

Strategic project launches and market dominance

Godrej Properties’ strategic project launches, such as Godrej Zenith in Gurugram and Godrej Reserve in Mumbai, have contributed significantly to its sales achievements.

| Particulars | Q3 FY23 | Q3 FY24 | Growth | 9M FY23 | 9M FY24 | Growth |

| Area Sold (million sq. ft.) | 4.42 | 4.34 | -2% | 9.96 | 11.83 | 19% |

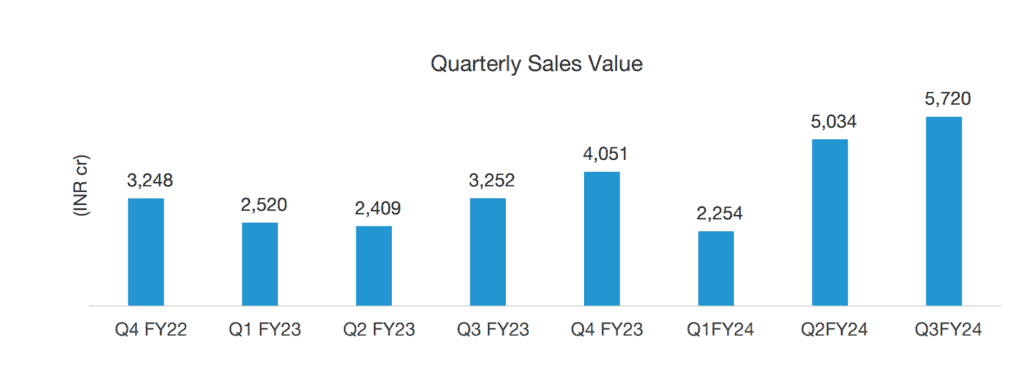

| Booking Value (INR Cr) | 3,252 | 5,720 | 76% | 8,181 | 13,008 | 59% |

| Customer Collections (INR Cr) | 1,684 | 2,411 | 43% | 5,169 | 6,743 | 30% |

These projects have not only met but exceeded sales targets, demonstrating the company’s ability to identify and capitalise on market opportunities. The company’s dominance in key cities like Delhi, Mumbai, and Bengaluru has further solidified its position as a market leader.

Unprecedented success in gurugram

Godrej Properties’ The Godrej Zenith project in Sector 89 of Gurugram witnessed an extraordinary achievement, with over 1,050 homes sold within three days, amounting to ₹3,000 crore.

Gurugram witnessed a 473% year-on-year increase in sales in FY24 for Godrej Properties. This milestone marks Godrej Properties’ most successful launch ever, reflecting a robust demand for luxury housing in major Indian cities.

Also Read: Your guide to real estate investment trusts

Looking ahead

Strong pipeline for future growth

Godrej Properties has a robust pipeline of projects lined up for fiscal year 2025. Planned launches in sectors like Sector 103, Sector 43, and Sector 54 of Gurugram are expected further to strengthen the company’s presence in key markets and drive future growth.

Analyst perspectives on godrej properties’ performance

Industry analysts have praised Godrej Properties’ outstanding performance in Q4FY24 and throughout the fiscal year. Dolat Capital, in particular, emphasised GPL’s narrowing execution gap compared to peers and expressed confidence in meeting its FY24 guidance of 12.5 million square feet in project completion.

While optimistic, they cautioned against closely monitoring the increase in debt levels due to the robust business development plan. Retaining an ‘Accumulate’ rating, Dolat Capital set a target price of Rs 2,650 for the stock.

Other analysts also expressed optimism about GPL’s future prospects in the Indian real estate sector.

Also Read: RBI keeps repo rate unchanged: What does it mean for you

Conclusion

In conclusion, Godrej Properties’ record-breaking sales performance is a testament to its strength and resilience in the real estate market.

With strategic project launches, market dominance in key cities, and a focus on sustainability, the company is well-positioned for continued success in the years to come.

As the demand for luxury housing continues to grow, Godrej Properties stands out in India’s real estate landscape.