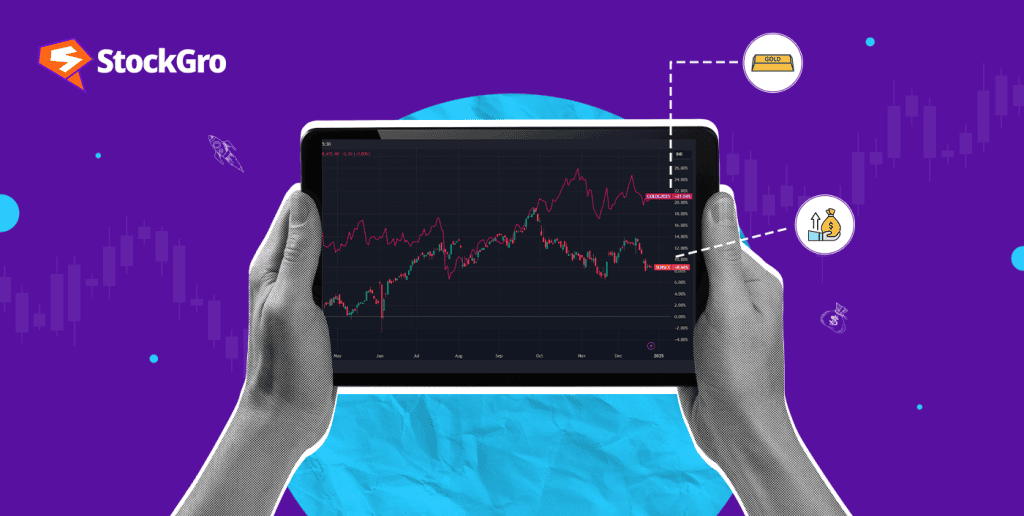

2024 was a year where gold outperformed equities significantly. While the Sensex posted a modest 8.9% YTD return, gold surged by 20.5% YTD (as of December 24). In USD terms, gold’s performance stood even stronger at 29% YTD, making it one of the best-performing assets of the year.

So, why did gold shine while equities lagged behind? Let’s break down the factors behind this divergence and explore what lies ahead for 2025.

Also Read: How the 2024 budget will transform economy and stock market – Key Insights!

Gold’s strong performance: A safe haven in uncertain times

Gold’s 20.5% YTD returns weren’t by chance. A combination of economic uncertainty, inflation concerns, and geopolitical risks drove investors towards the yellow metal.

Here’s a quick snapshot of how gold performed against equities:

| Asset | YTD Returns (2024) |

| Gold (MCX) | 20.50% |

| Gold (USD terms) | 29% |

| Sensex | 8.90% |

What drove gold’s outperformance?

- Safe-haven appeal

Whenever global markets face volatility, gold becomes a preferred investment. In 2024, geopolitical tensions and economic uncertainty led investors to flock towards gold, boosting its prices. - Inflation and rupee depreciation

Gold has traditionally been viewed as a hedge against inflation. With India’s retail inflation crossing 6.21% in October 2024, gold became a safer bet. Additionally, the rupee’s 2.4% depreciation YTD made gold’s international appeal stronger. - Policy support

India’s Union Budget 2024 reduced long-term capital gains (LTCG) tax on gold from three years to two, with a lower tax rate. This move enhanced the attractiveness of gold as an investment option. - Interest rate cuts

The U.S. Federal Reserve’s rate cut cycle made bonds less attractive. As bonds’ appeal declined, gold gained traction as a store of value.

Equities faced headwinds in 2024

In contrast to gold’s stellar performance, equities faced challenges throughout 2024.

| Metric | Gold | Equities (Sensex) |

| YTD Returns | 20.50% | 8.90% |

| Inflation Impact | Positive (hedge) | Negative |

| Geopolitical Tensions | Positive | Negative |

| Interest Rate Sensitivity | Positive | Negative |

You may also read: US Fed Rate Cut Sparks Market Turmoil: Dow Falls 1,100 Points

Why did equities underperform?

- Earnings slowdown

Over 50% of Nifty 50 companies reported weaker-than-expected earnings in the July-September quarter. This sluggish performance dragged overall market returns. - Profit booking

After a strong 20% return in 2023, many investors booked profits. Foreign investors offloaded nearly ₹3 lakh crore worth of Indian equities in 2024. - Inflationary pressures

Rising food prices and surging inflation dampened consumer demand, affecting corporate earnings and market sentiment. - Rupee depreciation

The 2.4% YTD rupee depreciation further reduced the attractiveness of Indian equities for foreign investors.

The outlook for 2025: Will gold continue to outperform?

Looking ahead, analysts remain bullish on gold, forecasting price targets between $2,800 to $3,000 per ounce by the end of 2025.

- UBS predicts gold could hit $2,900/oz by 2025, while Citi and Goldman Sachs estimate prices touching $3,000/oz.

- Factors like geopolitical instability, inflation, and interest rate cuts are expected to sustain gold’s momentum.

However, risks remain:

- If equity markets recover and interest rates stabilize, gold’s upside could be capped.

- A prolonged high-interest rate environment could reduce gold’s appeal.

Can equities bounce back in 2025?

Despite the challenging 2024, equities still have a strong long-term growth potential. The market outlook for the second half of FY25 remains optimistic.

- Government spending revival

The Indian government is expected to accelerate capital expenditure (CAPEX). By August 2024, the government had spent only ₹3.09 lakh crore (27% of its target). The remaining 73% could boost sectors like infrastructure and manufacturing. - Normalisation of economic activity

Weather disruptions that affected demand in sectors like construction are expected to ease, leading to better performance in Q1 2025. - Earnings growth

Top 100 Indian companies are projected to deliver double-digit earnings growth over the next fiscal year, indicating long-term resilience.

Why should investors maintain a balanced portfolio?

Gold and equities serve different roles in a portfolio. While gold offers stability and hedging, equities provide growth potential over the long term.

- Gold mitigates risk during uncertain times but lacks the growth potential of equities.

- Equities offer higher returns but come with volatility.

Key takeaway:

Diversifying across gold and equities allows investors to balance risk and reward, ensuring steady returns regardless of market conditions.

Bottomline

In 2024, gold emerged as the better-performing asset, but equities are poised for recovery. While gold provides a cushion against uncertainty, equities remain essential for long-term wealth creation.

A smart investor knows the value of balance—gold for stability, equities for growth. As 2025 approaches, keeping an eye on economic indicators, government spending, and global markets will help investors navigate these diverging trends.