For investors seeking opportunities in the luxury goods sector, Goldiam International has emerged as a well-known name. This global diamond jewellery manufacturer has consistently delivered impressive financial performances, which is reflected in their latest Q4 earnings report.

This global powerhouse in the diamond and jewellery industry has consistently pushed the boundaries of innovation and quality, but is it a good investment in FY25? Let’s find out.

Also read: Gold vs Equities- Which is the right investment option?

About Goldiam International

Established in 1986, Goldiam International Ltd is a company that manufactures and exports jewellery made of gold and diamonds to stores all over the world. Perfectly crafted and luxurious diamond jewellery has been exported by Goldiam International Limited for three decades.

The company is unique among diamond jewellery manufacturers in that it handles every step of the supply chain in-house, from growing and cutting lab-grown diamonds to manufacturing and distributing the finished products. This guarantees effective product development cycle management, quicker response times, and seamless communication.

Despite being a producer for several well-known worldwide brands sold in the US and EU, the firm has effectively kept its net debt at zero. Goldiam plans to go on with a strong foundation and constant dedication in pursuit of a better future.

Goldiam International Q4 results: Quarterly performance

Goldiam International has recently released its Q4 results for FY24 and demonstrated a robust performance marked by a commendable 12% year-on-year growth in revenue.

The company’s operational efficiency is evident from its EBITDA, which surged by 21% YoY to ₹274 million, alongside an impressive margin expansion of 140 basis points to 18.1%. A notable highlight is the lab-grown diamonds segment, which now accounts for a substantial 49% of the total revenue in FY24, up from 21% in FY23, reflecting the company’s strategic pivot and market foresight.

As of March 2024, the order book stands strong at ₹120 crores, complemented by additional export orders of ₹60 crores, signalling sustained demand and business growth.

Looking ahead, the company is poised to make significant strides in retail expansion. With the planned launch of ERA, the company is planning to expand its retail brand for lab-grown diamonds in the domestic market.

Below is a snapshot of Goldiam International’s performance over the past quarters of FY24.

| CONSOLIDATED RESULTS | JUN ’23 – Q1 | Sept ‘23- Q2 | Dec ‘23- Q3 | Mar ‘24- Q4 |

| Sales (₹ cr.) | 120 | 133 | 202 | 148 |

| Net Profit (₹ Cr.) | 17 | 23 | 32 | 18 |

| EPS (₹) | 1.58 | 2.19 | 3.04 | 1.67 |

Financial summary: FY24 growth over FY23

| Consolidated results | FY24 | vs. FY23 | % change |

| Revenue (₹ cr.) | 603 | 533 | +13.13 |

| Profit before tax (₹ cr.) | 122 | 117 | +4.27 |

| Net profit (₹ cr.) | 91 | 85 | +7.05 |

Goldiam International share price news

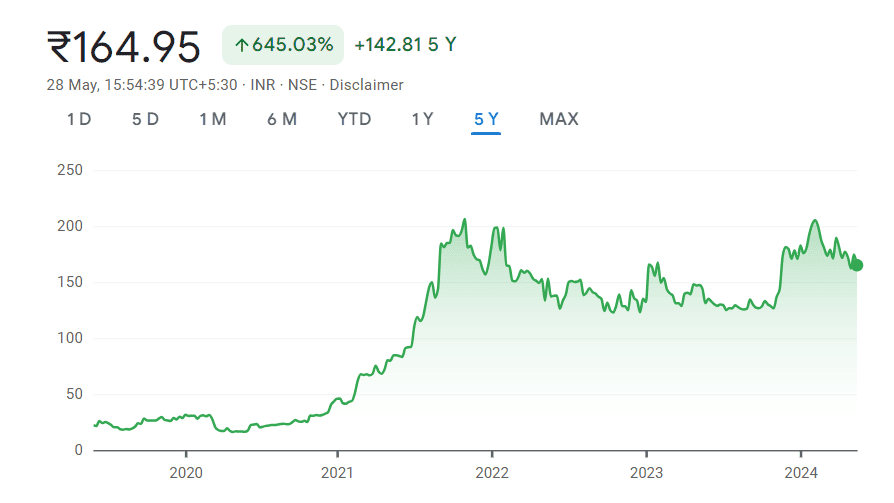

Goldiam International Ltd. currently trades at ₹164.95 per share (as of May 28, 2024), with a market capitalisation of approximately ₹1,762 crores. Over the past year, the stock has seen a 52-week high of ₹216.50 and a 52-week low of ₹120.25.

The Goldiam International share price has increased 25.53% in the past 1 year and 645.03% in the last 5 years.

Current financials

| Metric | Value (as of May 28, 2024) |

| Market cap (₹ Cr.) | 1,762 |

| Book value (₹) | 59.0 |

| Dividend Yield | 1.21% |

| ROCE | 19.8% |

| ROE | 15.0 % |

| Stock PE | 19.4 |

Competitor information of Goldiam International

| Companies | P/E | Market cap(₹ crores) | ROE (%) | Net profit for the latest quarter(₹ crores) |

| Titan Company | 86.55 | 302646.26 | 32.91 | 771.00 |

| Kalyan Jewellers | 69.70 | 41554.35 | 15.24 | 137.49 |

| Rajesh Exports | 12.13 | 8902.10 | 10.54 | 12.43 |

Also read: Senco Gold & Diamonds’ ONDC integration: Will it transform the jewellery retail landscape?

Shareholding pattern of Goldiam International

The shareholding pattern (as of March 2024) of Goldiam International is as follows:

| Promoters | 64.26% |

| Foreign Institutional Investors (FIIs) | 0.07% |

| Domestic Institutional Investors (DIIs) | 0.00% |

| Public | 35.67% |

Investing in Goldiam International

Pros

- Lab-grown diamond transition:

Goldiam International’s strategic shift from a pure natural diamond in-store jewellery company to a major supplier of Lab Grown Diamond (LGD) Jewellery is a significant advantage. The company’s omnichannel sales strategy has contributed to this transition.

Lab-grown diamonds now constitute 54% of the share, up from 23% in Q4FY23, and 49% of the full-year revenue in FY24, compared to 21% in FY23. For investors, this shift represents Goldiam as a company that is adapting to industry changes and positioning itself for long-term growth, with lab-grown diamonds contributing to a significant portion of revenue.

- Online sales growth:

Goldiam International’s online sales have been on an upward trajectory. Overall online sales increased from 25% in Q4FY23 to 26% in Q4FY24. Specifically, online sales of lab-grown diamonds witnessed robust traction, with the share increasing from 8.2% in Q4FY23 to 12.8% in Q4FY24 and from 5.5% in FY23 to 15.4% in FY24.

The increase in online sales, particularly for lab-grown diamonds, indicates a successful adoption of digital channels, which is crucial in today’s retail landscape. Investors can view this as a sign of operational agility and an ability to capture a growing segment of the market, which can lead to sustained revenue streams.

- Market acceptance and expansion plans:

The positive market acceptance in the US, Middle East, and Europe, along with plans to launch retail operations under the brand ERA, showcases the company’s ambition and potential for international growth.

Cons

- Declining return on capital employed:

A key indicator of financial efficiency is the return on capital employed, which has been on a downward trend for Goldiam International. From a high of 29% in March 2022, it has declined to 21% in March 2023, and further to 19.8% in March 2024.

This decline suggests that the company is becoming less efficient at turning capital into profits, which could be a red flag for investors looking for optimal capital utilisation.

- Market saturation risks:

As the lab-grown diamond industry grows, there is a potential risk of market saturation. With more players entering the market, the competition could lead to price wars and reduced margins.

The global market volume of lab-grown diamonds is forecast to be nearly 19.2 million carats by 2030. This rapid growth and increased production could contribute to the risk of market saturation.

Also read: SGBs: A smarter way to invest in gold

Conclusion

Goldiam International’s fourth-quarter results are proof of the company’s ability to adapt to changing market dynamics. As the world’s appetite for lab-grown diamonds continues to grow, Goldiam International’s strategic shift positions it favourably to capture this emerging market.

For investors seeking exposure to a company with a strong brand, innovative products, and a proven track record of success, Goldiam International presents a compelling investment opportunity with the potential for sustained growth. However, considering the risks, one should do their own research before investing.