On 25 April 2024, GPT Infraprojects’ share price saw another increase, this time by 10%. Throughout this year, the shares have already risen by nearly 24%. When comparing the last year to now, the overall growth is a remarkable 366%.

This incline raises the question: why are GPT Infraprojects shares surging? Let’s delve into the reasons behind this significant market movement.

About GPT Infraprojects Limited

GPT Infraprojects Limited, headquartered in Kolkata, serves as the primary arm of the GPT Group. The company specialises in infrastructure development, particularly in the railway sector, including the construction of large bridges and railway overbridges (ROBs).

Additionally, it has expertise in manufacturing concrete sleepers necessary for railway tracks, a segment where it holds significant proficiency. It stands out as one of the few Indian companies in this sector with a presence outside India, operating in countries like South Africa, Namibia, and Ghana.

Financial performance

GPT Infraprojects’ financial performance has shown substantial growth in the recent quarter, demonstrating solid execution across its business segments. In Q3 FY24, GPT Infraprojects Limited turnover reached ₹254.4 crore, marking a 25% increase compared to the same period last year. This growth was primarily driven by the infrastructure segment, which saw a revenue of ₹232 crore and accounted for 91% of the company’s revenue from operations.

The robust revenue figures are largely attributed to the effective execution of large-scale contracts within the infrastructure sector. Additionally, the concrete sleepers segment contributed ₹21 crore to the revenue, indicating ongoing momentum in both domestic operations and preparations for international expansion, particularly in Ghana.

The company’s earnings before interest, tax, depreciation, and amortisation (EBITDA) rose by 30% YoY to ₹30.2 crore but declined 6.40% QoQ. Net profit for the quarter nearly doubled to ₹14.9 crore, underscoring efficient operational management and profitability improvements.

| Particulars (₹ Cr) | Q3FY24 | Q2FY24 | QoQ % | Q3FY23 | YoY % |

| Net Sales | 254.4 | 202.2 | 8.50% | 234.5 | 25.80% |

| EBITDA | 30.2 | 32.3 | -6.40% | 23.1 | 30.90% |

| EBITDA Margin | 11.90% | 13.80% | -13.60% | 11.50% | 3.60% |

| PAT | 14.9 | 13.5 | 10.50% | 7.6 | 97.10% |

| PAT Margin | 5.90% | 5.80% | 1.30% | 3.80% | 54.70% |

GPT Infraprojects share price performance

GPT Infraprojects’ share price has demonstrated notable performance over the past several years. On 25 April 2024, the stock continued its upward trend, increasing by 10% to ₹207 per share. This gain followed a robust performance in the previous trading session, which saw a nearly 9% rise.

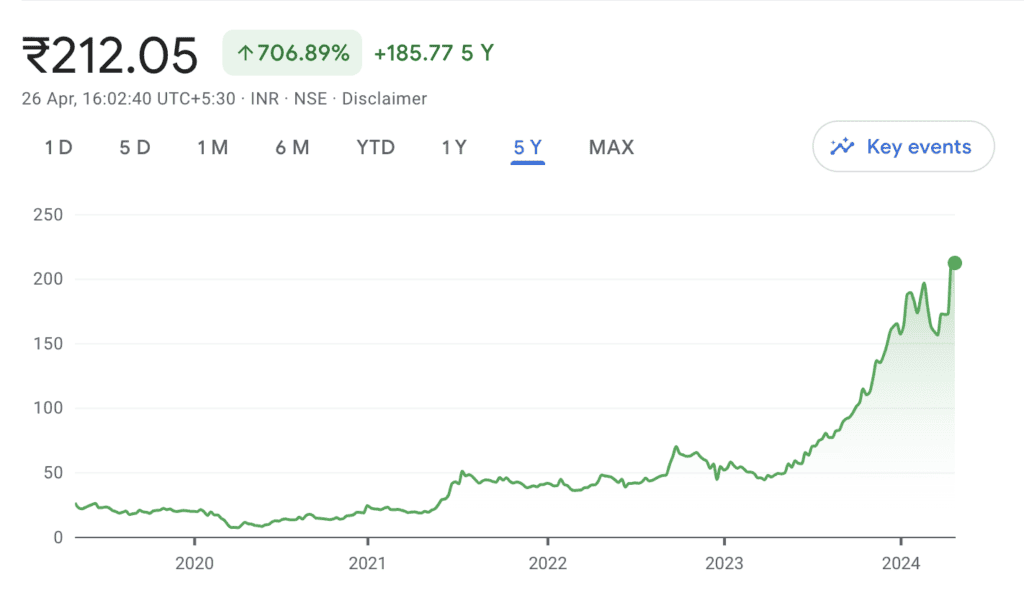

Throughout the current year, GPT Infraprojects shares have increased by almost 24%. This follows a significant return of 203% in calendar year 2023. The shares have consistently shown positive annual returns, with 34% in 2022, 71.40% in 2021, and 23% in 2020. Notably, the shares have closed in positive territory for ten consecutive months up to January, with November recording the highest monthly gain of 25%. Over the last year alone, the stock has climbed by 366%.

As of 26 April 2024, the shares of GPT Infraprojects have delivered a cumulative return of 706.89% over the past five years, reflecting sustained investor confidence and the company’s robust operational performance.

Source: Google Finance

Why did the share price surge?

The recent surge in GPT Infraprojects’ share price can be attributed to a series of successful contract wins and a robust order book, signalling strong business momentum and investor confidence.

In the latest development, the company and its joint venture partner secured a significant ₹487 crore order from Central Railway, Mumbai, for constructing a new broad gauge line in the Solapur Division.

This update, prominent in GPT Infraprojects Ltd news, follows closely on the heels of two other substantial orders, including a ₹135 crore contract from North Central Railway in Agra and a ₹114 crore project from East Central Railway in Patna.

Moreover, in October 2023, the company secured the largest single order in its history, a ₹739 crore project from NHAI for constructing the Prayagraj Southern Bypass in Uttar Pradesh under the EPC mode. Adding to this momentum, GPT Infraprojects secured a ₹64 crore contract in July 2023 from the Principal Materials Manager of South Eastern Railway.

These consecutive wins contribute to GPT Infraprojects’ highest-ever order book, which stood at ₹2,990.8 crore at the end of Q3 FY24, approximately 3.67 times the revenue of FY23. The infrastructure segment, representing 92% of the order book, highlights the company’s strong positioning and specialisation in executing large-scale infrastructure projects, particularly for notable clients such as Indian Railways and NHAI.

Investing pros & cons

Pros:

- Strong project execution: GPT Infraprojects benefits from the promoters’ four decades of industry experience, enhancing its project execution capabilities and strengthening relationships with key stakeholders.

- Healthy order book: A robust pipeline of ₹2,990.8 crore provides clear revenue visibility over the next 2-3 years, ensuring a steady flow of projects.

Cons:

- High working capital requirement: Despite improvements, the working capital cycle remains extended due to the nature of the construction business, where payments are linked to project milestones.

- Competitive market pressures: The intense competition in the tender-based business can limit operating margins, as companies may bid aggressively to secure contracts.

- Cyclical nature of the industry: The inherent cyclicality in the construction sector requires efficient operations to sustain profit margins, especially when large parts of work remain uncertified and thus unbilled.

Bottomline

GPT Infraprojects has shown strong performance, driven by strategic project wins and a significant order book. The company’s extensive industry experience helps it secure important contracts and ensures a steady revenue stream.

However, potential investors should consider the challenges of high working capital needs and competitive market pressures that may affect profitability. As GPT Infraprojects Limited leverages opportunities in infrastructure development, it is crucial for investors to weigh both the advantages and risks of investing in the company.