Great Eastern Shipping Company had a fantastic Q4 in fiscal year 2024, according to their results released on May 10th. Their profits jumped 25% compared to last year, which is a positive news for investors. This strong profit growth is a positive indicator of the company’s future.

Let’s dive deeper into the details of their performance, including revenue and net profit figures, to see where GE Shipping is headed next.

About Great Eastern Shipping Company

Founded in 1948, the Great Eastern Shipping Company Ltd is India’s largest private-sector shipping company. With a fleet of 43 ships and 23 offshore assets (as of FY24), GE Shipping plays a vital role in transporting various commodities across the globe.

Diverse services

Shipping: GE Shipping specialises in transporting crude oil, gas, petroleum products, and dry bulk cargo through its tankers and dry bulk carriers.

Offshore services: A subsidiary, Greatship India Ltd., provides offshore oilfield services using offshore supply vessels and mobile offshore drilling rigs.

GE Shipping boasts an impressive clientele of industry leaders, international oil companies, and governments, solidifying its position as a preferred shipping service provider.

As of March 31st 2024, the shareholding pattern of the company is as follows:

| Shareholders | Holding |

| Promoters | 30% |

| FII/FPI | 27% |

| Public | 26% |

| Government/DIIs | 17% |

Source: GE Shipping Q4 & FY24 Earnings Presentation

Also read: Maritime industry: How India’s shipping and port industry is making waves

Great Eastern Shipping Company Q4 results

Great Eastern Shipping Company announced strong Q4 performance:

- The company’s consolidated profit after tax (PAT) surged 25.37% to ₹905.08 crores in the March quarter compared to ₹721.94 crores last year in the same period.

- Consolidated revenue also grew, reaching ₹1,726.25 crores in Q4FY24 from ₹1,550.27 crores in Q4FY23.

- The company successfully reduced expenses, with a decline from ₹853.22 crores to ₹784.66 crores year-over-year.

- For the full year, net profit saw a modest increase of 1.52% to ₹2,614.18 crores in March 2024 against ₹2,575.01 crores in March 2023.

QoQ performance

Here is a quick comparison of the QoQ results as per the Great Eastern Shipping Company annual report:

| Consolidated Income Statement (in ₹ crores) | Q4 FY24 | Q3 FY24 | QoQ change |

| Revenue from Operations | 1497.33 | 1245.13 | 20.25% |

| Total Income | 1726.58 | 1395.95 | 23.68% |

| Total Expenses | 784.66 | 856.28 | (8.36%) |

| Profit Before Tax | 941.92 | 539.67 | 74.53% |

| Net Profit | 905.08 | 538.17 | 68.17% |

Source: GE Shipping Q4FY24 Results

YoY performance

| Consolidated Income Statement (in ₹ crores) | FY24 | FY23 | YoY change |

| Revenue from Operations | 5255.17 | 5690.46 | (7.64%) |

| Total Income | 5918.70 | 6171.14 | (4.09%) |

| Total Expenses | 3224.32 | 3617.60 | (10.87%) |

| Profit Before Tax | 2694.38 | 2553.54 | 5.51% |

| Net Profit | 2614.18 | 2575.01 | 1.52% |

Source: GE Shipping Q4FY24 Results

Must read: SBI Bank Q4 results – Analysis & highlights

Great Eastern Shipping’s competitors

Here are some of the market competitors of GE Shipping:

| Name | P/E | ROE % | D/E | ROCE % |

| Great Eastern Shipping Company Ltd | 5.74 | 23.06 | 0.25 | 20.15 |

| Shipping Corporation of India Ltd | 14.39 | 13.32 | 0.35 | 10.29 |

| SEAMEC Ltd | 41.14 | 3.72 | 0.35 | 3.35 |

| Shreyas Shipping & Logistics Ltd | – | 25.45 | 0.57 | 18.79 |

Source: Screener (as of May 14, 2024)

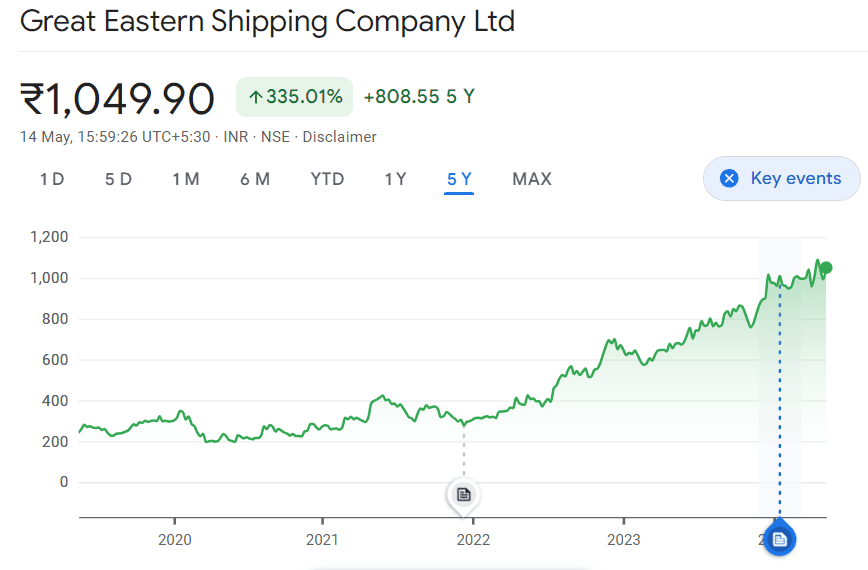

Great Eastern Shipping Company share price performance

Looking at the Great Eastern Shipping Company share price history, the stock offered a return of 335.01% over the past five years as of May 14 2024.

Source: Google Finance

If we check out the past year’s return, the stock offered a 45% return as of May 14, 2024.

Also read: Piramal Enterprises Q4 results: Key takeaways

GE Shipping – Strengths and weaknesses

Strengths

- The company distinguishes itself through its wide variety of services. The company’s shipping division offers comprehensive transportation for petroleum products, crude oil, gas, and dry bulk commodities.

Additionally, the wholly-owned subsidiary Greatship (India) Limited expands its reach into offshore exploration and production (E&P). Greatship provides exploratory drilling rigs, offshore support vessels, and likely other equipment to facilitate these activities. With subsidiaries worldwide, the company boasts a strong global presence.

- The company boasts a relatively youthful fleet, with 43 vessels averaging 14 years, an offshore fleet also averaging 14 years, and 4 jack-up rigs averaging 12 years.

This youthful fleet translates into several advantages for the company. Firstly, it allows them to command better charter rates due to the increased desirability of newer vessels. Secondly, it grants them a significant competitive edge in the market. Finally, the young fleet contributes to achieving superior operating efficiency.

Weaknesses

- The shipping industry rides the waves of global economics. Highly capital-intensive and cyclical, it thrives on international trade flows. Booming economies send demand for vessels soaring, pushing charter rates and ship operator profits higher. However, downturns bring the opposite: plummeting demand, rock-bottom charter rates, and ship operators saddled with debt and idle vessels.

- The business is heavily exposed to currency fluctuations. Both earnings and expenses are in USD, mirroring freight rates and ship values. Even liabilities are USD-denominated. This exposes the company to financial swings caused by currency movements. While some natural hedging exists, foreign exchange and derivative risks remain.

Bottomline

GE Shipping’s future is well positioned with a youthful fleet, a diverse service portfolio, and a strong global presence. However, investors must consider the risk associated with the shipping industry.

Overall, GE Shipping’s Q4 results are a positive sign for the company’s future. Their financial health and strategic positioning suggest they are well-equipped to navigate the challenges of the shipping industry.