In the 2024-25 financial year, the total Goods and Services Tax collection stood at ₹3.83 lakh crores, marking a year-on-year growth of 11.3%. A statutory body known as the GST Council observes and suggests recommendations for the successful implementation of the GST rates.

Also read: Understanding GST: The tax superhero of India.

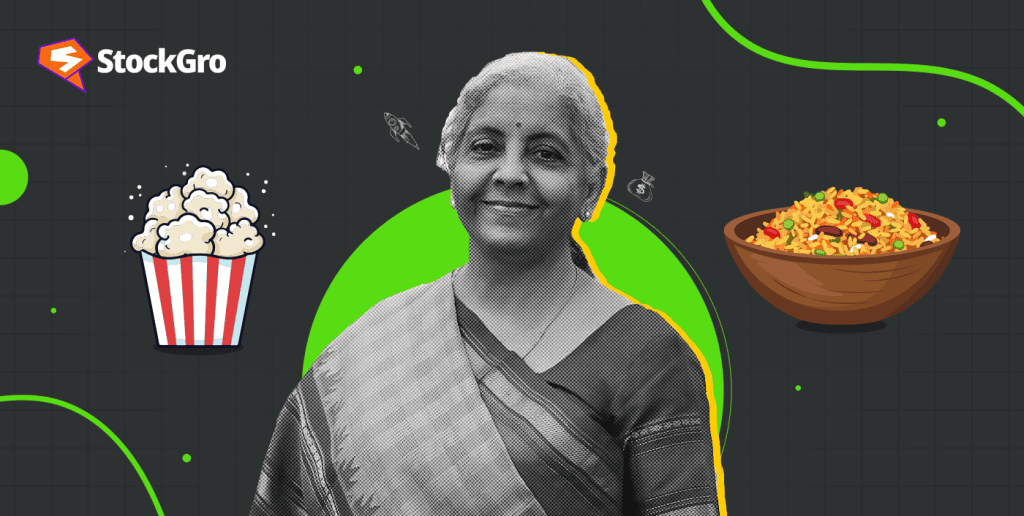

55th GST Council meeting

The recent GST Council meeting was held in Rajasthan on 21st December 2024. It was chaired by Nirmala . The Union Minister of State for Finance was also present at the meeting.

The GST Council included chief ministers and deputy chief ministers from multiple states. Several top executives from the Ministry of Finance and the States/UTs also attended the conference.

Various commodity taxes were discussed and modified for the successful implementation of GST rates.

Also read: The Finance Minister’s finances: Nirmala Sitharaman.

Product-wise changes in GST rates

Following are the changes in Goods and Services Taxes applicable to various commodities.

Promotion of Electronic Vehicles

In the automobile industry, the Goods and Service Tax Council authorised a rise in the GST rate on the sales of second-hand automobiles by companies, particularly electric vehicles, from 12% to 18%. However, this rise is not applicable to private sales. Presently, used automobiles (except some petrol and diesel types) are taxable at 12% GST.

Taxation on Popcorn

The GST Council has addressed the taxation of popcorn, stating that pre-packaged and labelled ready-to-eat non-caramelised and savoury popcorn would be taxed at 12%, whereas caramelised popcorn would be taxed at 18% because it contains added sugar. The tax rate on popcorn in the raw state remains unchanged.

Rice, raisins and more

The GST Council has reduced the GST rate on fortified rice kernels utilised for distribution to the public to 5% from 18%. The Finance Minister confirmed that ACC (Autoclave Aerated Concrete) blocks comprising 50% fly ash will charge a 12% GST rate.

The finance minister also announced that black pepper and raisins provided directly by farmers will be free from GST. It means that black pepper and raisins provided by an agriculturalist are not subject to GST payment.

Bank penal charges

The Finance Minister declared that no GST will be paid on penal charges assessed by banks and non-banking financial corporations (NBFCs) against borrowers for failing to comply with loan terms.

Clothes and accessories

Garments priced up to ₹1,500 will be subject to 5% GST. Those valued between ₹1,500 and ₹10,000 will be at 18%. Garments priced above ₹10,000 are subject to a 28% GST. The GST Council also proposed raising the GST rate for highly valuable shoes (above ₹15,000) and wristwatches (over ₹25,000) to 28%.

Also read: GST on Gold and How to Calculate It.

Cess to create a disaster management fund

The Finance Minister stated that the Group of Ministers will reconsider the suggestion for a cess to support disaster relief. The GST council will decide whether such a cess should be applicable to all state-level catastrophes. States have diverse views on the issue, with some favouring a flood management cess and others arguing that it should be used to alleviate droughts.

Aviation Turbine Fuel

States have criticised a plan to include ATF in the Goods and Services Tax system. Despite recurrent efforts from the Civil Aviation Ministry and the aviation sector to incorporate ATF in the GST framework, the GST Council failed to achieve a consensus during their meetings.

Measures for better compliance

There were various procedures observed by the GST Council for better compliance with the GST rates.

- The GST Council has suggested explanations regarding the definitions of municipal funds and local funds as mentioned in section 2(69) of the CGST Act, 2017.

- The GST Council came up with suggestions to approve a temporary identification number for individuals who are not registered under the CGST Act by tax officers.

Conclusion

The GST Council made significant decisions in its 55th meeting. There are various future indications made during the meeting. For instance, the GST Council discussed the GST rates applicable to food delivery applications and other quick commerce businesses.

Although the effect of these modifications and suggestions on tax collection can only be testified in the future, these decisions give capital market investors and finance enthusiasts significant insights into future trends which enjoy government support.

FAQs

- What is the 55th GST meeting?

The 55th GST Council meeting took place in Jaisalmer, Rajasthan, on 21 December 2024. It was presided over by Srimati Nirmala Sitharaman, the federal finance and corporate affairs minister. Shri Pankaj Chaudhary, the Union Minister of State for Finance, attended the meeting. GST Council is a statutory body that observes and suggests recommendations for the successful implementation of the GST rates.

- What is the new GST update for 2024?

There are various updates suggested by the GST Council. There is a rise in GST rates applicable to the sale of electronic vehicles. However, this rise is not applicable to individual sales. The rate on caramelised popcorn was increased to 18% whereas others are fixed at 12%. Various other recommendations and observations were made by the GST Council.

- When was the 54th GST Council meeting held?

The Goods and Services Tax Council suggested revisions to the GST legislation at its meeting on 9 September 2024, including rate rationalisation, and explanations on numerous topics, processes, and systems for claiming amnesty advantages, therefore easing commerce.

- Were there any changes in the GST rates on EVs?

In the automotive industry, the GST Council approved an increase in the GST rate on company sales of old and used autos, notably electric vehicles, from 12% to 18%. However, this increase does not apply to private sales. Used autos are now subject to a 12% GST (except some petrol and diesel kinds).

- What happened to GST rates on popcorn?

The GST Council has addressed the taxation of popcorn, declaring that pre-packaged and labelled ready-to-eat non-caramelised and savoury popcorn would be taxed at 12%, but caramelised popcorn would be taxed at 18% due to the additional sugar. The tax rate for uncooked popcorn stays constant.