In India, all the stocks, that the government of India holds a stake in, are in the name of the President. Recently, the shareholding pattern of Hardwyn India Limited revealed that this stock is added to the President of India’s portfolio.

This article gives insights into the latest Hardwyn India news and all the information about Hardwyn India limited stock.

Hardwyn India Limited

Hardwyn India Limited is involved in the business of manufacturing architectural hardware and glass fittings for both residential and commercial clients. The company offers a wide range of products, such as hardware for kitchen, furniture, doors, glass fittings etc.

The chairman of the company is Mr. Swaranjit Singh Sayal, who started the company in 1967, and has extensive experience in the industry. Mr. Rubaljeet Singh Sayal is the managing director of the company.

This company belongs to the small-cap category with a market capitalization of ₹879.18 crores as on January 20, 2025. The promoters own 43.77% stake in the company.

The recent shareholding pattern details filed by Hardwyn India limited on 16th January, 2025 revealed that the President of India has acquired 22,68,924 shares, that represents 0.46% of the entire company.

The exact rationale for adding this stock isn’t entirely clear. However, several plausible factors could have influenced this decision:

- Hardwyn India ltd. has signed a two-year Memorandum of Understanding (MoU) with a Bhutanese company, Gyalsung Infra to supply architectural hardware and glass fitting for various projects, thereby foraying into the Bhutanese market.

- With 27th December 2024, as record date Hardwyn issued bonus shares to the ratio of 2:5 (2 equity shares allotted for every 5 equity shares previously held). And, on 18th December, 2024 the company increased its authorized share capital from 35.10 crore share to 50 crore shares, with a face value of ₹1.

- Prior to that the company issued bonus shares in the ratio of 1:3 in June 2023 and in the ratio of 1:2 in July 2022.

Also read: SIP investment: Your path to wealth building

Financial Performance of Hardwyn India limited

| Particulars | Q2 FY2025 | Q1 FY2025 | FY24 |

| Sales (₹ crores) | 51.65 | 40.93 | 153 |

| Expenses | 45.43 | 38.49 | 136 |

| Profit before tax | 5.70 | 1.89 | 15 |

| Net Profit (₹ crores) | 4.04 | 1.34 | 10 |

| Net Profit Margin | 7.82% | 3.27% | 6.53% |

| EPS | 0.08 | 0.03 | 0.21 |

(Consolidated Financial Statement)

The company reported a 26.19% jump in quarterly consolidated sales from Q1 to Q2 in FY25, reaching total sales of ₹51.65 crores. In the same period, the net profit for the company jumped 201.49%, to reach ₹4.04 crores.

Hardwyn also reported an increase in net profit margin from 3.27% in the first quarter of FY25 to 7.82% in the second quarter of FY25. The earnings per share increased from ₹0.03 to ₹0.08, in the same period.

The company was incorporated in 2017, and since March 2018 the company has been posting increasing standalone sales every year. Since FY21, the company has also been reporting consistently rising net profits.

As on January 20, 2025, the company has a price to earnings ratio of 67.3 and a price to book ratio of 2.25.

Also read: Unlocking financial insights: The power of ratio analysis

Price Movement of Hardwyn India Ltd.

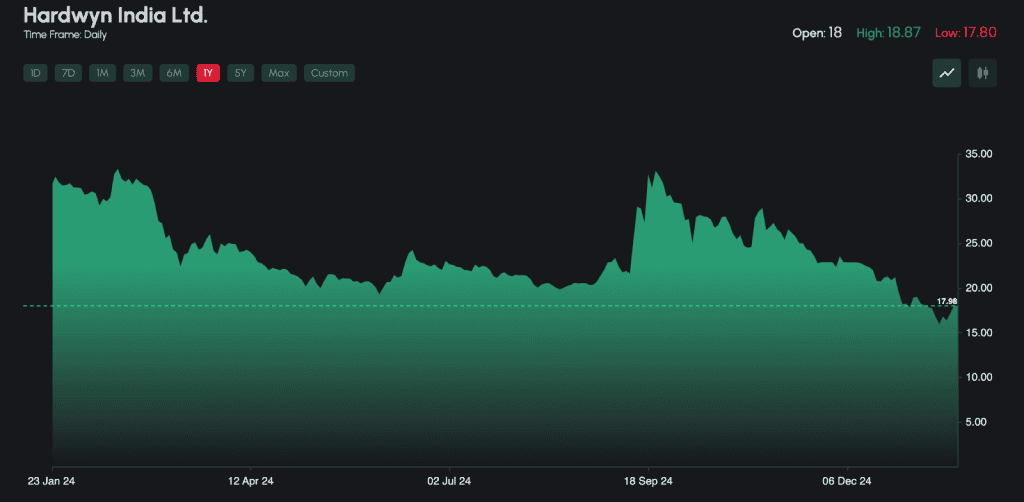

Following this development, the Hardwyn India ltd share price opened at ₹18 on January 20,2025. It then registered a high of ₹18.87, rising 4.83% indicating that traders and investors welcomed the news very positively. But as the session closed, the stock closed at ₹18, giving up gains it made throughout the day.

The share price of Hardwyn has been struggling for the past one year. Since 20th January 2024, the stock has plummeted 42.66%, registering a 52-week high of ₹48.50 on 19th February 2024. The company is trading very close to its 52 week low of ₹15.26, registered on 10th January, 2025. In 2023, the shares of the company touched a high of ₹622.65.

Source: NSE

SWOT Analysis of Hardwyn India limited

| Strengths | Weakness | Opportunities | Threats |

| The company has very low debt levels indicating prudent management | The price to earnings ratio of the company is very high | The company has a potential to grow outside India too. | The scale of company is very small and it can face intense competition |

| The management of the company is very experienced and has been in this line of business since 1967 | The company has low Return on capital employed (ROCE) at 3.92% | Growth in the infrastructure sector can bring more business opportunities for the company. | Any major fluctuations in raw material cost can affect the company’s profitability. |

| The company has displayed consistent sales growth since 2017. | The President of India has picked up 0.46% stake in the company that could possibly bring government contracts | Adoption of new technology can possibly strain the company’s finances. |

Also read: Diversification: Why it is important for your portfolio

Bottomline

Hardwyn India limited is a small cap company that manufactures architectural and glass fitting hardware. The President of India has picked up a 0.46% stake in the company. Therefore, opening the possibility of this company receiving government contracts in the future. But the company still has various risks such as its price falling from ₹622.65 in 2023 to ₹18 in 2025. Investors must conduct a thorough research before investing in this company or any other company for that matter.