In the quarter 3 results season, investors are usually searching for potential investment opportunities as financials play a crucial role in analysis. Recently, HDFC Life Insurance Company Ltd also announced its quarterly results for the quarter ended in December 2024. It is one of the most popular and efficient brands in the life insurance industry.

Its year-on-year profit has increased, but quarterly profit has dipped by nearly 4%. This HDFC stock rose substantially on the next day. However, the mixed results may create ambiguity among the investors regarding the company’s financial performance and potential investment opportunities.

Read this blog to interpret these results in detail and analyse HDFC Life Insurance Company Ltd holistically.

Highlights of HDFC Life Insurance Company Ltd Q3 results

HDFC Life Insurance Company has been a key player in India’s insurance market. It has covered 6.6 crore life insurance as of FY 2024. Moreover, based on the market capitalisation, it is the third largest listed domestic entity in the insurance sector.

The company has recorded steady financial growth over the past few years. Its third quarter results for FY 2024-25 were announced on January 15, 2024. These results had a mix of some positive and negative aspects. The year-on-year net profit increased by more than 14%, but its revenues are lagging. Based on quarterly financials, the company’s profit and revenue growth slowed significantly.

Quarterly expenses of HDFC Life Insurance Company Ltd, like selling and administration, increased by nearly 43% against a drop of more than 25% in the quarterly revenue. The balance sheet figures have also recorded moderate to low growth. It may concern investors. However, being a strong brand, the market experts are bullish about this HDFC stock.

Also, read: From colonial legacy to global ambition: The Indian insurance sector

HDFC Life Insurance Company Ltd Financial Performance

The company has been in the insurance industry for more than 20 years. Its financials indicate its zeal for tapping the market gap and contributing to industry growth. It has a strong network of agents and 80+ varied products.

| Particulars | 9M FY 2025 | 9M FY 2024 | FY 2023-24 |

| Revenue (₹ crores) | 72,731 | 73,440 | 1,01,482 |

| Net Profit (₹ crores) | 1,335 | 1,162 | 1,574 |

| Net Profit Margin (%) | 1,8% | 1.5% | 1.5% |

| Networth (₹ crores) | 15,806 | 14.180 | 14,651 |

| EPS (₹) | 8.12 | 5.61 | 7.32 |

| Debt Equity ratio (times) | 0.12 | 0.07 | 0.06 |

EPS = Earnings Per Share

Source: Q3 Financial Report

The company’s financials have been strongly growing for the past 5 years despite the industry and market pressure. Its compounded sales growth has been 21%, and profit growth has been 6% in this period.

Based on the recent Q3 results, the company’s operating profit, net profit and net worth have surged potentially. Despite the pressure on its revenue, the company’s policy sales have been up by 15% in this quarter. Market experts indicate a potential rise in the company’s revenue and profits for the last quarter of FY 2024-25.

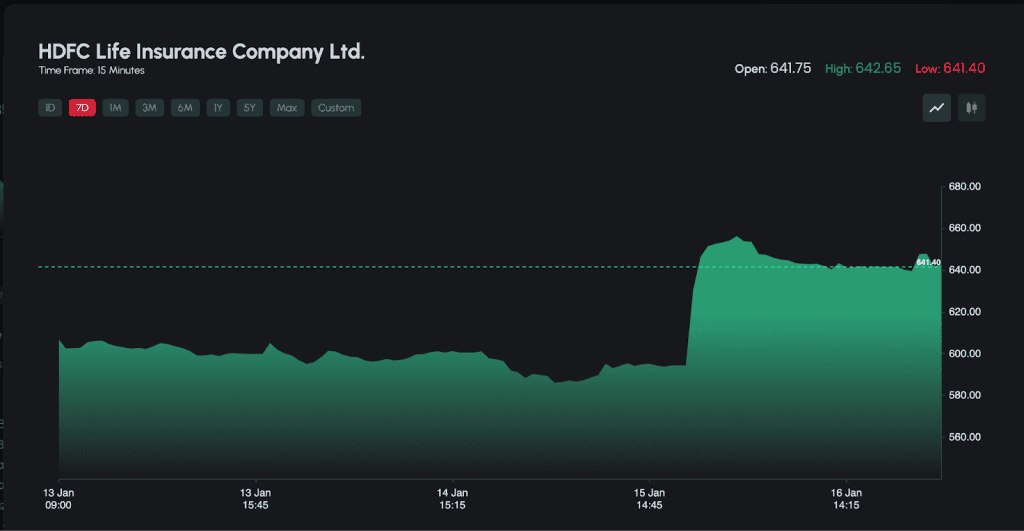

Share price movement

Positive HDFC Q3 results were welcomed in the market. The results were declared on January 15, 2025. Due to this announcement, the company’s share price closed at a nearly 8% high on January 16, 2024.

Source: NSE

The past 6 months have been tough for this HDFC stock due to market pressure. It fell nearly 23% in this period despite good earnings in the 2nd quarter of FY 2024-25.

However, the recent announcement regarding the earnings has indicated a positive sentiment to surge the stock by 8%. This surge is also the result of bullish ratings and high targets from some of the top analysts in the industry, such as Nuvama, HSBC, Nomura, etc..

SWOT analysis: HDFC Life Insurance Company Ltd

| Strengths | Weaknesses | Opportunities | Threats |

| The value of business for the company has been growing significantly. In Q3 it rose by nearly 8.5%. | Since Q4 FY 2022, the recent quarter has registered a strong decline in quarterly revenues. | Its stock has generated nearly 5% returns in the past year, and analysts project a strong rise ahead. | HDFC Life Insurance is surrounded by strong competitors such as LIC and SBI Life Insurance. |

| Investor’s sentiments are positive about the company in the stock market. | The earnings per share are quite low compared to other competitors in the market. | Increasing income per capita, health-related issues and financial uncertainties can create a place for the company. | High regulatory hurdles in the industry can be tough for the private industry. |

| Strong business value chain and more than 80 varied products. | The operating expense ratio has been rising for the company. | Modern policies and products are needed in the insurance industry. Fulfilling it can help the company cover a significant market gap. | The high Price-to-Earning (P/E) ratio and a decreasing promoter’s share can discourage investors. |

An important read: Insuring your peace of mind: The ultimate guide to insurance cover

Bottomline

HDFC Life Insurance is a crucial market player in the insurance segment in India. Its recent announcement of its 3rd quarter results for FY 2024-25 was significant to affect the market. Its profit, business value, policy sales and EPS have surged significantly in this quarter. However, its revenue has dipped. Market experts and investors are showcasing bullish sentiment for this HDFC stock. Therefore, investors should analyse the company and its stock holistically based on these mixed signals.

Dive deeper into the topic: India’s insurance landscape: SBI Life and HDFC Life’s path to dominance