The dairy industry is a remarkable example of human innovation and our ability to harness the resources of the natural world. India’s dairy sector holds significant importance both domestically and internationally, as it holds the top position in milk production, accounting for 25% of the global milk output.

In the midst of this ever-changing landscape, Heritage Foods Ltd has established a remarkable legacy that is as valuable as the milk it produces. Established in 1992 by Mr. Nara Chandrababu Naidu, Heritage Foods combines the rich heritage of Indian dairy traditions with the advancements of modern technology and practices.

It started with the simple goal of delivering nutritious and high-quality milk to every home. Today, it has expanded its reach as a diversified enterprise, exploring opportunities beyond the dairy industry to encompass renewables, retail, and agri-business sectors. In recent news, Heritage Foods’ share price has surged doubling in just 12 trading sessions.

This article offers a thorough examination of Heritage Foods Ltd, shedding light on its significant share market surge.

Heritage Foods Ltd: Company profile

Heritage Foods Ltd was founded on June 5, 1992, by Mr. Nara Chandrababu Naidu, with the aim of making a substantial difference in the farming community and the dairy sector.

The company went public in 1994, and the response from investors was incredibly positive, oversubscribed by 54 times. Today, Heritage Foods is widely acknowledged as one of the leading dairy enterprises in Southern India.

Heritage Foods operates with five primary business divisions: Dairy, Retail, Agri, Bakery, and Renewable Energy. Every division has a vital role in the company’s growth and market presence. The Dairy division is the biggest contributor to the company’s revenue, closely followed by the retail division.

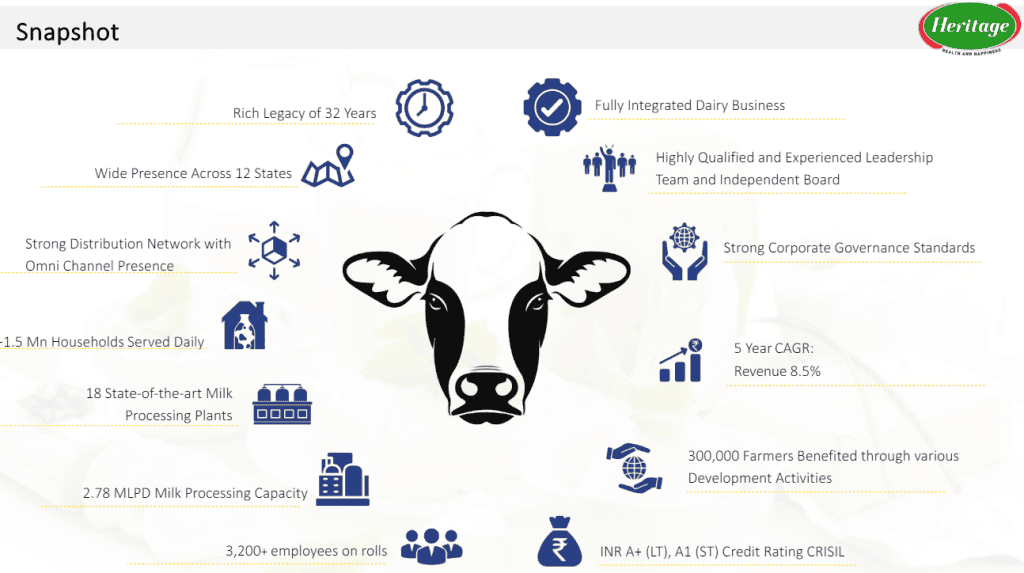

This is a snapshot of a few of the company’s highlights:

Source: Heritage Foods Ltd

Heritage Foods Ltd has shown a strong dedication to maintaining high standards of quality and fostering a culture of innovation. This commitment has played a crucial role in the company’s impressive growth and continuous development.

The company is consistently growing its product offerings and market presence, remaining committed to its mission of providing consumers with fresh and healthy products while also supporting the farming community.

Here is the shareholding of the company:

| Particulars | Shareholdings (%) |

| Promoter | 41% |

| Mutual funds | 12% |

| FPI | 2% |

| Public | 45% |

Source: Heritage Foods Ltd

Must read: Foreign portfolio investments (FPI): benefits and risks

Financial performance

Heritage Foods Ltd has demonstrated robust financial performance with impressive year-over-year growth. For the fiscal year, the company reported:

| For the period ending March 2024 (₹ crores) | For the period ending March 2023 (₹ crores) | |

| Revenue | 3,794 | 3,241 |

| Operating profit | 203 | 132 |

| Profit before tax | 145 | 82 |

| Net profit | 107 | 58 |

| EPS (₹) | 11.48 | 6.25 |

Share price analysis

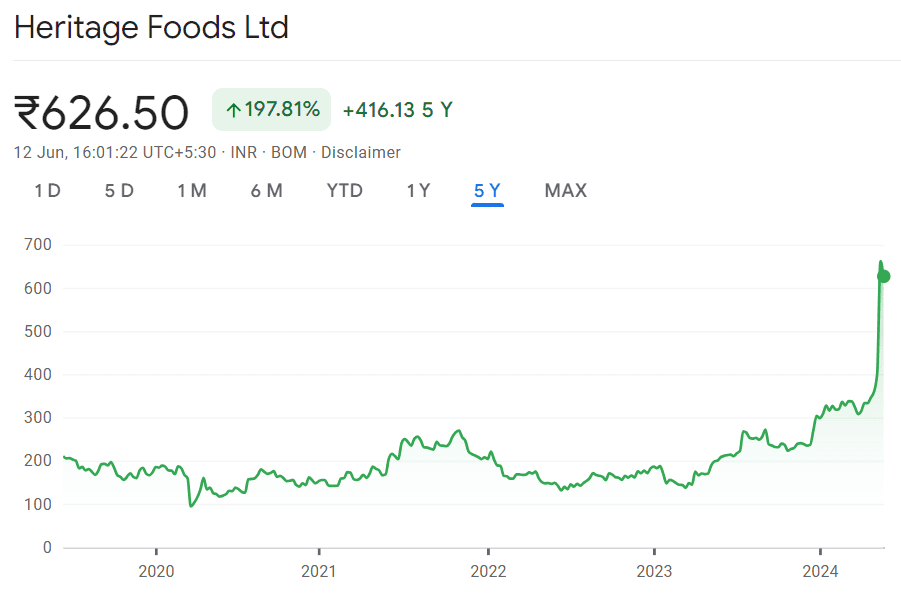

The Heritage Foods share price is ₹626.50 (as of June 12, 2024). Considering Heritage Foods’ share price history for the last 5 years, the stock gave a return of 197.81%.

The year’s range of Heritage Foods shares is ₹207.20 – ₹727.90.

Heritage Foods news – Political influence on market performance

Political events can have a significant impact on the stock market, as they have the potential to shape economic policies and business environments. Heritage Foods Ltd has witnessed the direct impact of political fluctuations on its share prices, which are closely tied to the owner of Heritage Foods, Mr Nara Chandrababu Naidu.

Mr Naidu, the visionary behind Heritage Foods, has played a pivotal role in shaping the company’s trajectory as well as influencing the political scene in Andhra Pradesh (AP). His ascension to the Chief Minister’s office in AP has significantly affected the market valuation of Heritage Foods.

The company’s stock prices saw a significant surge, doubling in value within just 12 trading days. This impressive growth was fueled by a positive shift in investor sentiment following the release of exit polls and the announcement of the election results.

The Naidu family has significant ownership in Heritage Foods, with Mrs Naidu and Mr Naidu’s son, Nara Lokesh, holding stakes of 24.37% and 10.82% respectively. This combined stake, worth more than ₹2,300 crore, showcases the strong performance of the company.

The net worth of Heritage Foods’ owners, the Naidu family has witnessed a substantial increase, attributed to the robust performance of Heritage Foods, with the family’s wealth escalating by around ₹1,200 crore in a brief period. This uptick reflects the direct impact of Heritage Foods’ market success on the family’s financial standing.

You may also like: Exit poll frenzy: Nifty PSU Bank hits record high with 5% leap!

Peer analysis

Let’s compare the key financial ratios of Heritage Foods Ltd with that of its competitors:

| Company | CMP (₹) | Market cap(₹ crores) | P/E | Earnings Yield (%) |

| Heritage Foods Ltd | 626.5 | 5,814 | 54.6 | 2.50 |

| Dodla Dairy Ltd | 1,038 | 6,174 | 37.1 | 4.00 |

| Vadilal Industries Ltd | 4,620 | 3,322 | 22.8 | 5.70 |

| Parag Milk Foods Ltd | 183 | 2,180 | 24.0 | 5.79 |

| Bombay Burmah Trading Corporation Ltd | 1,670 | 11,652 | 16.4 | 23.6 |

| Sheetal Cool Products Ltd | 585 | 615 | 29.5 | 5.20 |

| Milkfood Ltd | 524 | 269 | 37.7 | 5.77 |

| Umang Dairies Ltd | 95.3 | 210 | 157 | 2.72 |

Further reading: Prime focus: Sectors to monitor as Modi 3.0 shapes economic policies

Bottomline

Heritage Foods Ltd stands out as a shining example of resilience, innovation, and strategic growth within India’s dynamic dairy industry. The company, founded by Mr Nara Chandrababu Naidu, has successfully merged traditional dairy practices with modern technology, resulting in a diversified enterprise that extends beyond dairy into the renewables, retail, and agri-business sectors.

As Heritage Foods continues to expand its product offerings and market presence, it remains dedicated to supporting the farming community and delivering fresh, healthy products to consumers. This dedication, combined with strategic investments and political influences, positions Heritage Foods Ltd for sustained success and continued growth in the future.