The national security and strategic independence of India are supported by the defence industry. India’s defence capabilities have been improved overtime as a result of emerging geopolitical challenges and the modernisation requirements for its armed forces. Leading this move are Hindustan Aeronautics Ltd (HAL) and Bharat Electronics Ltd (BEL), two significant industry players.

HAL specialises in the aerospace domain, it was instrumental in outfitting the Indian Air Force with modern aircraft; nonetheless, BEL manufactures electronics products and systems that have made it possible for the military to acquire badly needed communication and radar capabilities.

By such means, their roles in improving India’s defence readiness are made evident and thus interested investors can also look closely at their stocks.

This article aims to explore a comparative analysis of HAL and BEL, their market positions, financial health as well as stock performance.

Defence manufacturing industry

India’s defence manufacturing sector has witnessed substantial changes in recent years. With significant investments, policy reforms, and strategic partnerships that the Indian government’s self-reliance move has backed, the sector is changing rapidly.

According to the India Brand Equity Foundation (IBEF), the Indian government’s Make in India plan and Defence Production and Export Promotion Policy (DPEPP) 2020 will result in unprecedented heights of growth for the Indian defence manufacturing sector.

The Indian government wants to sell aerospace and defence products plus services worth $25 billion including $5 billion in exports by 2025. A more extensive plan was implemented to reduce dependence on imports while promoting indigenous manufacturing capabilities.

Foreign direct investment (FDI) limits in defence manufacturing have been relaxed, currently allowing up to 74% under automatic route. Hence, there is a lot of global attention and money streaming into this field from abroad.

One cause behind this boom is the upgrade program taken up by the Indian armed forces that covers advanced equipment procurement and technology, embracing operational efficiency. This programme has seen an increase in orders for indigenous companies such as HAL and BEL, which play a significant role in the sector.

Must read: Best Defence stocks in India

Company profiles

Hindustan Aeronautics Ltd. (HAL)

HAL is one of India’s major aerospace and defence companies, with a rich history going back to December 23, 1940. As one of the world’s oldest and largest aerospace and defence manufacturers, it has had a lot of influence on India’s aviation business.

It is engaged as a state-owned company that also undertakes activities like development, designing, building, and supplying military aircraft, helicopters, avionics systems and communication devices for civil use too. It specialises in fighter jets, transport planes, and helicopters for various uses.

To ensure quality products are delivered as well as the reliability and longevity of its fleet, a comprehensive service offering comprising repair maintenance support, etc, is executed by HAL, exemplifying its commitment to excellence.

Bharat Electronics Ltd. (BEL)

Bharat Electronics Limited (BEL) is one of the ‘Navratna’ status Public Sector Undertakings under the Ministry of Defence operated by the Government of India. They work primarily with the army, navy, air force, etc under the Indian Defense Services. It is known for making cutting-edge electronics and systems in-house.

Started with a vision to become a world-class professional electronics organisation, BEL has emerged as a leader in the defence electronics sector in India over the years. Its product portfolio includes radar fire control systems weapon systems communication and network-centric systems (C4I) electronic warfare systems avionics anti-submarine warfare systems & sonars electro-optics etc.

BEL prides itself on having a comprehensive product range that aims at improving operational efficiency within the Indian defence forces. BEL emphasises research and development thus pushing technological frontiers which ultimately helps in realising dreams critical to national security.

Financial performance

Here are the key financial metrics of the companies for the year ending March 2024:

| Hindustan Aeronautics Ltd | Bharat Electronics Ltd | |

| Revenue | 30,381 | 20,268 |

| Net profit | 7,595 | 3,985 |

| EPS | 113.57 | 5.45 |

| Total assets | 77,984 | 39,527 |

| Equity capital | 334 | 731 |

Also read: Earnings Per Share (EPS): What it means and how to calculate it

Stock performance

Hindustan Aeronautics Ltd. (HAL)

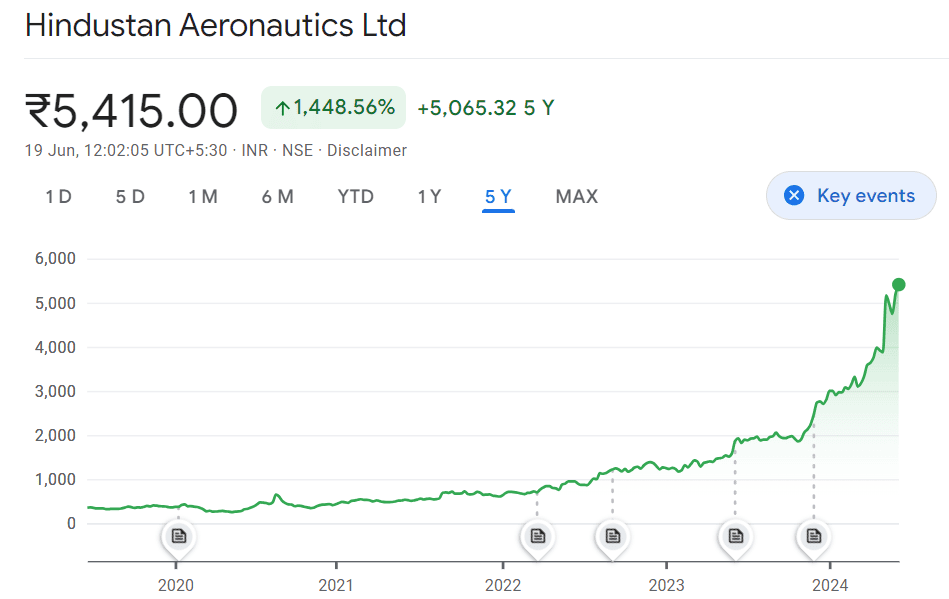

The share price for Hindustan Aeronautics Ltd is ₹5,415.00 on June 19, 2024. Over 7% more than the previous day’s finish, the share price hit a 52-week high of ₹5,567.00 the day before.

In the last five years, the stock has delivered an impressive return of 1,448.56%.

Jefferies analysts say that HAL share prices should achieve a target price of ₹5,725; this means that this stock has further room to grow from its present level.

Bharat Electronics Ltd. (BEL)

The share price for Bharat Electronics Ltd is ₹312.85 on June 19, 2024. Bharat Electronics Ltd. stock has given a return of 741.67% over the last 5 years, based on its share price data.

The following is what analysts think will happen with Bharat Electronics Ltd. (BEL):

- Current rating: The consensus among analysts is to ‘buy’ BEL shares.

- Price targets: The median analyst price target stands at ₹210.0, 34.01% below the current market price.

- Target range: Between the low of ₹130.0 through a high of ₹280.0 are analysts’ estimates about BEL’s target price.

Recent developments

Hindustan Aeronautics Ltd. (HAL)

- Stock performance: HAL shares reached their all-time high on June 18, 2024, after the Defense Ministry came out with a Request for Proposal (RFP) for 156 light combat helicopters.

- Market recovery: On 14 June 2024, the defence sector including HAL, experienced a transformative phase. With the target to boost defence exports by ₹50,000 crores, HAL is likely to benefit from this government’s policy.

Bharat Electronics Ltd. (BEL)

- Financial growth: BEL stocks surged about 9% on May 21, 2024, as Q4 and FY24 results reflected massive growth in net profits and revenues respectively.

- Market performance: The market reacted positively by soaring to 17.6% in the intraday trade of June 14, 2024, after the Defence Minister’s announcement to elevate the defence exports surpassing ₹50,000 crores within the coming 5 years.

Further reading: India’s soaring electronics manufacturing services sector

Bottomline

HAL and BEL have strong fundamentals, strategic importance, and promising future prospects, making them worth considering. It is possible to make smart investment choices by looking at a company’s marketplace, financial health, and stock performance.

HAL and BEL’s roles in India’s economic and strategic landscape are anticipated to increase as the country works to improve its defence powers.