What does a common man want? A millionaire lifestyle, no financial burden, and possibly a degressive tax structure? Well, that may be a far-fetched dream. But low financial stress and liberated tax structures are always on their ideal Budget checklist!

Yes, the 2025-2026 Budget announcements by Finance Minister Nirmala Sitharaman on 1st Feb 2025 has considered these!

But who exactly is the common man? There is no one-size-fits-all definition of a common man. They are classified as the majority of the population in India, and mainly those who come under the lower-income tax bracket. With tax reliefs, and agricultural, insurance, and MSME sector reforms underway, the common man is bound to be happy.

Here we will throw some light on the key takeaways from the announced Budget 2025-2026 and how it impacts the common man. So, let’s begin!

Also Read: Post Budget 2025: Five Sectors to Watch Out For

Key financial takeaways from the budget for the common man

Tax relief

The core of a middle class’s financial stress stems from taxation. And the government went ‘bulls-eye’ this year, with a major move to reduce the tax burden on the middle-class sector. The increase in the income tax exemption threshold was a significant update, that eases the financial burden for millions of taxpayers!

What exactly is this update?

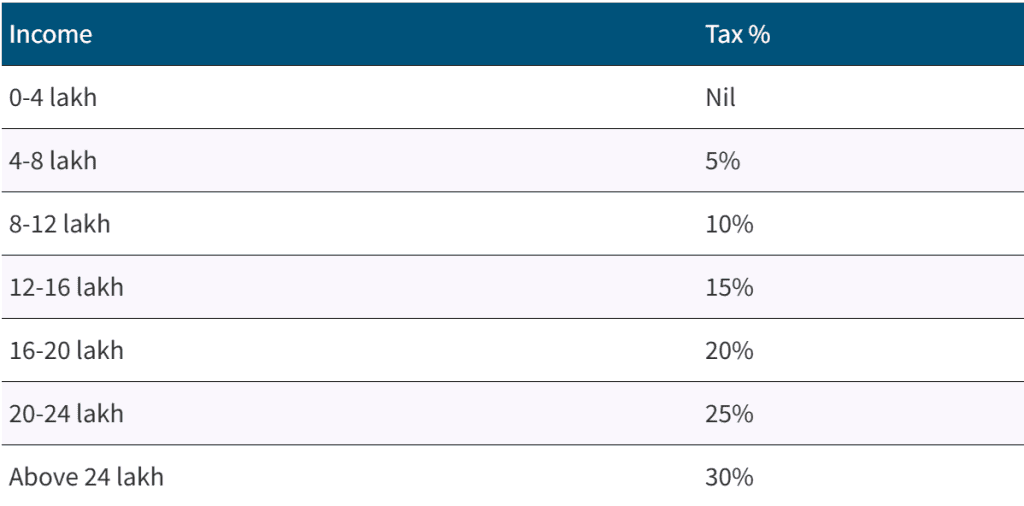

For individuals earning up to ₹12 lakhs per annum, there will be nil income tax. The same goes for salaried individuals earning up to ₹12.75 lakhs per annum, considering ₹75,000 in standard deductions. Additionally, the modified tax rates for those earning more than ₹12 lakhs (₹12.75 lakhs for salaried individuals) are as follows:

Source: Government of India

As seen above, the Basic Exemption Limit has been increased to ₹4 Lakhs per annum, up from the previous ₹3 Lakhs per annum. The tax rebate under Section 87A has also been hiked to ₹60,000 as compared to the previous ₹25,000, under the newly proposed tax regime.

Fiscal measures like these are commonly used by the government to increase disposable income, thereby encouraging spending and boosting economic activity.

Some additional measures such as Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) rationalisation along with an extension of the timeline for filing updated returns from 2 to 4 years, are expected to benefit the common man.

Agriculture sector

Agriculture was a highlight in the announced budget, being one of the four pillars to drive the nation’s development (Agriculture, MSMEs, Investment, Export). Agriculture plays a vital role in the economy, with around 65% of the population engaged in agriculture or allied activities.

From basic staple food to the fancy outfits you wear, agriculture forms the basis for it some way or the other. Therefore, any reforms made in agriculture directly impact the common man, as the entire population is dependent on the sector for their livelihood.

During the budget, the Finance Minister announced several new initiatives that cater to this sector. The Prime Minister Dhan-Dhaanya Krishi Yojana initiative is launched in partnership with the states to improve productivity, promote sustainable agricultural practices, adopt crop diversification, etc.

Also read: Key agriculture sector stocks to watch in 2024

Alongside, an allocation of ₹1,000 Crores towards a 6-year mission to boost the production of pulses: tur, urad and masoor has been announced. This could incentivize farmers in Punjab and other states, to uplift pulses production and overcome the supply gap that has widened over the years.

Many other initiatives, such as the National Mission on High-Yielding Seeds, Cotton Productivity Mission, and enhanced loan limit for farmers will also be in place!

Check this out: Understanding Agricultural Income: Types, Exemptions, and Tax Implications

Insurance sector

The government announced a 100% Foreign Direct Investment limit in Insurance. But what does this mean? Well, with more foreign investment, the insurance market will have more players in the market, intensifying competition, and offering variety and better quality insurance products to the common man.

The utmost goal is to achieve “Insurance for all” by 2047, by encouraging more participation and capital inflows in the insurance industry.

With increasing capital inflows in the market, there will also be higher employment generation– a positive impact for the common man!

Also read: Insurance Stocks Fluctuate Ahead of Union Budget 2025

MSMEs

Micro, Small and Medium Enterprises (MSMEs) form the backbone of the Indian Industrial economy, with the Micro sector contributing to more than 97% of the category. These micro-enterprises are often associated with the common man.

This Budget also recognised the need for uplifting the MSME sector as a key driver for the development of the economy. Some of the reforms particularly target the manufacturing industry to boost long-term growth and maximise sustainability. With the Credit Guarantee Scheme, MSMEs can avail of collateral-free loans with up to ₹100 Crore as a guarantee. This allows MSMEs to get hold of financial assistance without stringent barriers.

The Trade Receivables Discounting System (TReDS) onboarding criteria has also been revised from the earlier threshold of ₹500 Crores to ₹250 Crores turnover. This is updated so small businesses can use the platform freely.

Also, the decriminalisation of over 100 laws and regulations through the Jan Vishwas 2.0 will provide businesses with a better work environment.

Multiple other initiatives are in place to shape the growth trajectory for the MSME sector, to ensure greater flexibility, and easy capital access, and to foster an innovative culture.

Also read: Micro, Small and Medium Enterprises in India – StockGro

Senior Citizens

The Budget has successfully introduced special initiatives for senior citizens, easing their financial stress as well. Two major changes were announced in the TDS limit of their fixed deposits and income through rent.

For senior citizens who invest in Fixed deposits, the new threshold for paying TDS of 10% is ₹1 Lakh as compared to the previous threshold of ₹50,000. This comes as a major relief to senior citizens, who are highly dependent on fixed deposits.

The Budget also raised the annual TDS limit on rent from ₹2.4 Lakh to ₹6 Lakh per year, drastically reducing TDS transactions for those receiving modest rental income. Previously, tenants used to deduct 10% TDS before transferring the rent to landlords. Senior citizens dependent on rental income will majorly benefit from this move as it will ensure better cash flows.

You may also like: Budget 2025: Higher Tax Exemptions & Perks for Senior …

Other reforms

Amongst the many reforms announced by the government, the exemption of customs duties from several life-saving critical drugs caught the eyes of the common public. Battling cancer or any other rare disease is already a mental struggle for the common man. To consider the financial burden of this becomes extremely overwhelming. This move will essentially, nominalise the medical expenses and improve affordability.

The opening of daycare cancer centers across all district hospitals in the coming three years will greatly improve medical infrastructure in the country. This will enhance the common man’s access to critical treatments and medical facilities.

Several other reforms such as tourism, medical tourism, skilling, and AI Development centers are also announced. These reforms too will boost the common man’s livelihood and strengthen the economy.

Must Read: Sectors in decline after the 2025 budget

Conclusion

The budget 2025-2026 served as a roadmap to prosperity through empowering initiatives that uplifted household sentiments while outlining the path to a ‘Viksit Bharat’ or a developed India.

Simplified tax reforms, boost in agriculture, insurance, and MSME sectors, along with significant reforms in healthcare, technology, and skills have been set keeping in mind the needs of the common man.

The budget aims to boost consumption, strengthen the MSME ecosystem, enhance agriculture productivity, and focus on public infrastructure. With the arrow pointed in the right direction, the common man cannot be disappointed!