As India unfurls its tricolour flag this Independence Day, it’s not just a celebration of freedom from colonial rule but also an acknowledgement of the nation’s economic journey. From the evolution of the rupee to the burgeoning defence sector, India’s financial landscape has seen monumental shifts.

Let’s delve deep into India’s financial journey post-independence, from the rupee’s evolution to the stock market’s rise and the defence budget’s significance.

Journey of the Indian rupee (₹)

Post-independence, the Indian Rupee (INR) was pegged to the British Pound. It was only in 1966 that the Rupee was decimalised and started its journey against the US Dollar. From being valued at less than 4 rupees to a dollar in 1947, it has seen fluctuations, reaching up to 83 in recent times.

These shifts have been influenced by global economic events, India’s economic policies, and trade dynamics.

Read more here: The world of currency fluctuations: How does it impact your investments?

Factors influencing the rupee

- Economic Reforms: The liberalisation in 1991 opened doors for foreign investments, impacting the rupee’s strength. 21st century brought global limelight, with the rupee a top player.

- Global Scenarios: Events like the global financial crisis in 2008 have had ripple effects on the rupee’s valuation.

- Trade Deficits: India’s trade balance has often influenced the rupee’s strength against global currencies.

India’s not backing down. The rupee’s eyeing global domination. Agreements with UAE and Russia to trade in local currencies? Just the beginning.

Indian stock market: A saga of growth

From the humble beginnings of the Bombay Stock Exchange in 1875 to the tech-savvy National Stock Exchange, the Indian stock market has come a long way.

Stockbrokers, in the late 1800s, huddled under a banyan tree, trading stocks. Fast forward to today, and India boasts the fifth-largest market capitalisation globally. Quite the glow-up, right?

In 1872, 22 stock brokers operated opposite the Town Hall of Bombay. They later moved to Dalal Street in 1874, and by 1875, they organised themselves as the Bombay Stock Exchange (BSE).

Regional Exchanges:

After the establishment of BSE, several regional exchanges emerged:

- 1894: Ahmedabad Stock Exchange

- 1908: The Calcutta Stock Exchange

- 1920: The Madras Stock Exchange

- 1944: Hyderabad Stock Exchange

After India’s independence in 1947, the stock market began formalising with the introduction of the Securities Contracts Act in 1956. BSE became the first exchange to receive permanent recognition under this act.

And then, in 1963, the Mutual Fund industry planted its roots with the Unit Trust of India. Today? We’re talking about a whopping ₹37.75 Lakh Crore of AUM.

Fast forward to 1986, and we saw the entry of SENSEX, India’s first benchmark index.

In 2017, NSE IFSC began trading at GIFT City, allowing Indian investors to diversify their portfolios internationally.

Also Read: SGX Nifty to GIFT Nifty brings new opportunities

In 2022, the biggest ever IPO of ₹ 21,000 crore, listing LIC at 6 lakhs crore valuation!

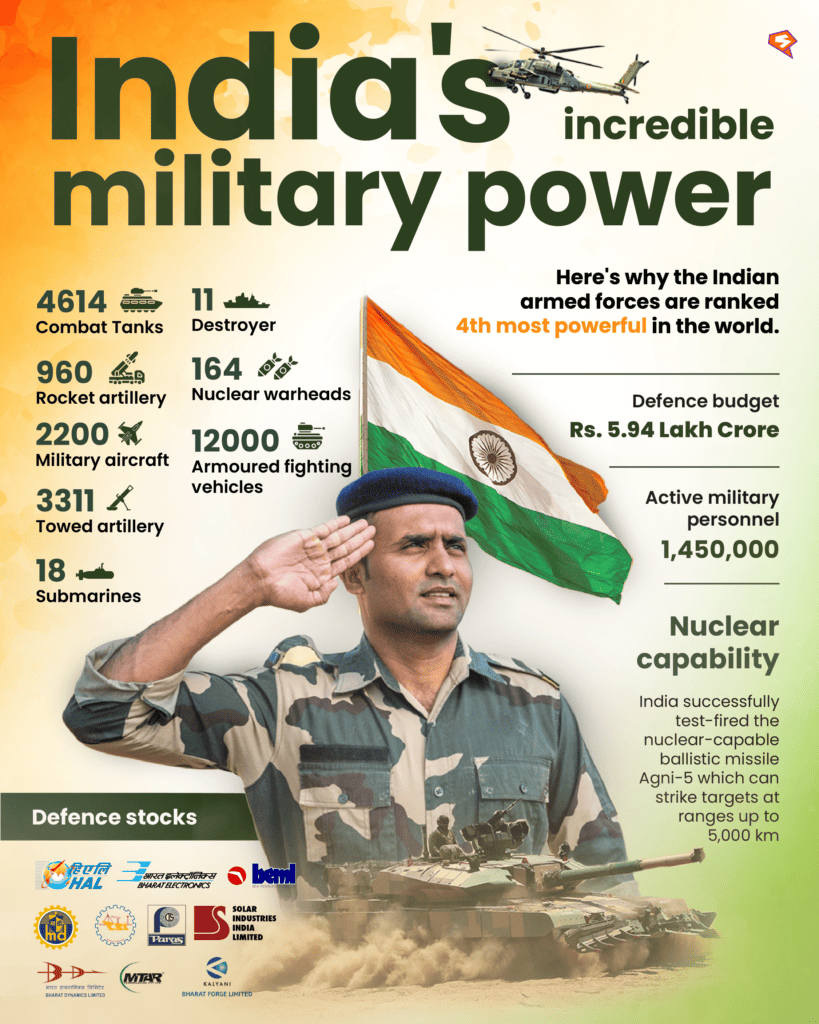

Defence expenditure: A pillar of strength

India’s defence budget is not just about securing borders. It’s an intricate web of research, development, and collaborations. With rising geopolitical tensions, the defence budget has seen consistent growth, emphasising modernisation and self-reliance.

India flexed a whopping Rs.5.94 lakh crore for defence in Budget 2023-24, up 13% from the previous year. The government’s been rallying for local production and scaling down defence exports. The result? Exports soared from Rs. 1,521 crore in 2016-17 to a stunning Rs.12,815 crore in 2021-22.

Ministry of Defence aims for a whopping INR 1.75 lakh crore turnover in aerospace and defence manufacturing by 2025. A target of INR 35,000 crore in exports is on the horizon.

You may also like: Zee-Sony merger to pave way for $10 billion media giant after NCLT nod

606 Industrial Licences have already been handed out to 369 Defence Sector companies by April 2023.

Let’s look at some numbers:

- 2.1% of GDP for defence (2021-22)

- India claims 15% of the global arms import market.

- $11.3 billion – the defence sector’s market size

- 19% jump in Defence Capital Expenditure (FY21-22)

- FDI flowing in around $62 million since policy liberalisation in 2020

Investing in defence: A lucrative avenue?

With its consistent budget allocations and push for indigenous technologies, the defence sector offers investment opportunities. Companies engaged in defence production, research, and collaborations have shown promise in stock markets.

With the government’s push for ‘Make in India’, many private players are entering the defence production arena, opening avenues for potential investors.

Here are some of the top listed companies which are significantly impacting the industry.

Navigating the defence investment landscape

The Innovations for Defence Excellence program (iDEX) is waving the innovation flag. It’s all about backing startups and innovators with a $68 million budget for research and development.

A solid 25% of the Defence R&D Budget is getting pumped into setting up Defence R&D for startups, industry, and academia.

India isn’t holding back in the military spending department. It ranks 3rd globally, pumping a solid 2.15% of its GDP into defence. Over the next 5-7 years, a whopping $130 Bn is geared towards modernising the fleet across the armed services.

From a currency that has weathered many storms to a stock market that stands tall and a defence budget that promises growth and security, India’s financial journey is one of resilience and promise.

For the discerning investor, understanding this journey offers not just a lesson in history but a roadmap for future investments.