It’s time for some exciting news, the latest GDP data for India is in, and it’s got everyone buzzing! According to the National Statistical Organisation, the Indian economy recorded a stunning 6.1 % growth in the fourth quarter (Q4) of FY23, reaching a whopping ₹43.6 lakh crore.

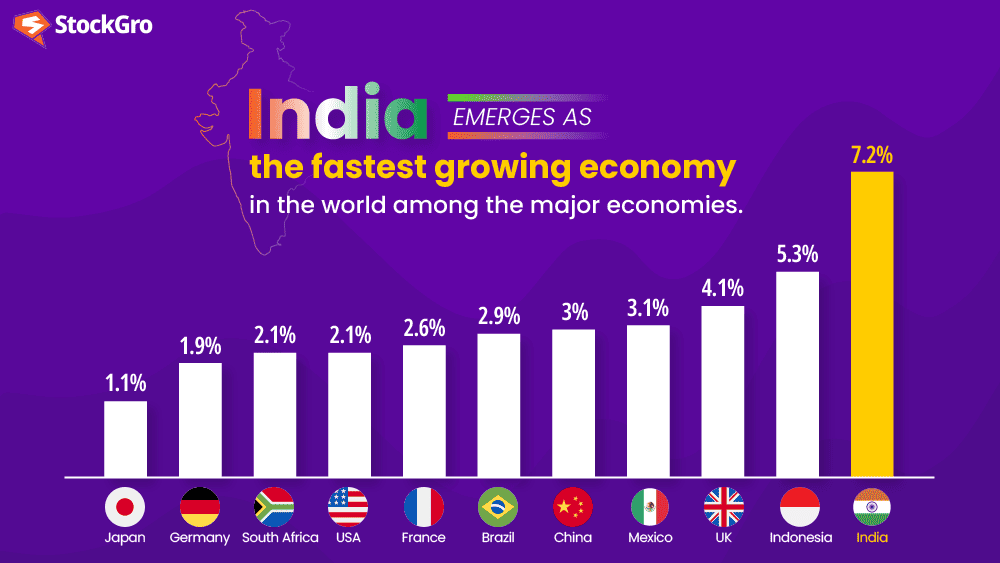

That’s a significant increase from the 4.4 % growth in the previous quarter (Q3). But here’s the real kicker: India remains one of the fastest-growing economies among major global players. Even with a slightly lower growth rate compared to the previous year.

India’s GDP growth for FY 2022-23 stands at a remarkable 7.2 %, surpassing both the median estimate of 7 % in a Bloomberg survey and the government’s own forecast made three months ago.

Goldilocks situation: Not too hot, not too cold

India finds itself in a Goldilocks situation. The economy is not overheating with skyrocketing inflation, nor is it shrinking into a recession. This balanced scenario is music to investors’ ears, as it means companies can thrive, and stocks can rally.

With strong GDP data for Q4 FY23 and a cool-off in inflation. India is perfectly positioned to attract investors and enjoy economic stability despite global headwinds.

You may also like: Why IRCTC shares plummeted 3% after Q4 Results

Behind the GDP numbers: Key drivers of growth

What’s fueling this impressive growth? Well, let’s give credit where it’s due. Manufacturing, construction, agriculture, and financial services have emerged as the key drivers of India’s economic success in Q4 of FY23.

- Manufacturing activity experienced a growth of 4.5 %, marking a refreshing change after two consecutive quarters of contraction. And guess what? This refreshing growth spurt can be attributed to the easing of pass-through from high input costs and the reduction in global oil and food prices.

- Construction sector experienced a staggering growth rate of 10.4 %, surpassing the previous quarter’s growth of 8.4 %. Reflecting the government’s push toward infrastructure development and job creation.

- Agriculture sector sprouted with a growth rate of 5.5 %, surpassing the previous quarter’s growth of 3.7 %. The agriculture sector registered an impressive year-on-year growth of 4 % in FY23.

- With promising crop production and expanded Rabi acreage, things were looking great. Except for those pesky unseasonal rains that caused some damage in parts of the country in March 2023.

- Financial services sector flexed its muscles with an impressive growth rate of 7.1 %, outshining the previous quarter’s growth of 5.8 %.

But hold on, there’s more! Despite the positive expectations from analysts, activities involving trade, hotels, and transport experienced a slight contraction from 9.7 % in Q3 to 9.1 % in Q4. Well, you can’t win them all, right?

The services sector takes the lead

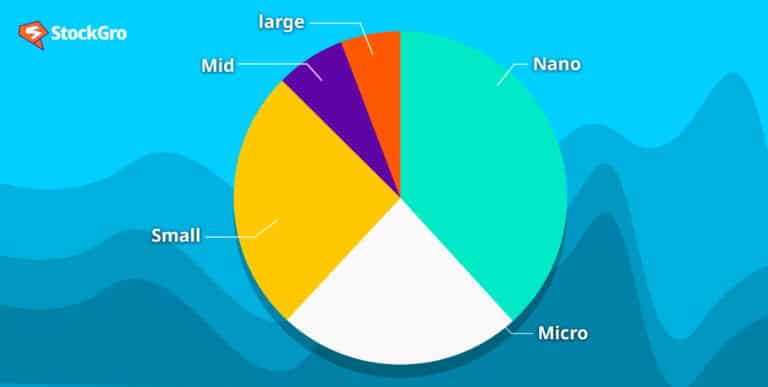

Services have taken centre stage in driving India’s economy, accounting for more than half of the nation’s GDP. India has become a global player in information technology and business consulting, propelling services activity to its highest point in nearly 13 years.

This surge in the services sector has boosted overall economic growth and positioned India as a global player in the digital revolution.

This stellar performance of sectors propels India’s economy to a value of $3.3 trillion, inching closer to its ambitious target of $5 trillion in the next few years.

A closer look at the GDP data reveals an interesting dance between exports and imports. Net exports, thanks to an increase in exports and a decrease in imports, contributed a hefty 1.4 % points to the headline growth figure.

Challenges and outlook: Sustaining growth amidst global headwinds

While India has plenty to celebrate, there are still challenges on the horizon. One major concern is the slowdown in private consumption expenditure, which recorded a meagre 2.8 % year-on-year growth.

Factors such as elevated inflation, rising interest rates, and increased borrowing costs have impacted consumer spending and need to be addressed to sustain India’s growth amidst global headwinds.

The global economic landscape also poses risks, with rising debt levels in low and middle-income countries and potential spillover effects from recent banking sector collapses.

Moreover, India needs to keep a close eye on the upcoming decisions of the US Federal Reserve regarding interest rates. However, if the Fed doesn’t opt for an accelerated rate hike, India should be able to navigate through these challenges successfully.

And speaking of keeping an eye out, we should also be mindful of the upcoming monsoon season, which plays a vital role in India’s agricultural sector. The timely arrival and proper distribution of rainfall are crucial for agricultural productivity and rural income. So, let’s cross our fingers and hope that the rain gods smile favourably upon us this year.

There’s the possibility of deficient rainfall during the South West Monsoon season, all thanks to a potential El Niño event. (El Niño refers to a climate pattern characterised by warmer ocean temperatures in the Pacific, which can disrupt weather patterns worldwide.) This climatic phenomenon could cast a shadow over India’s growth prospects and kharif crop production.

Also Read: Germany falls into recession as inflation hits the economy; Here’s why

Global comparisons: China, The US, and more

Let’s take a glance at the global landscape and see how India’s growth compares to other giants!

China’s economy expanded by 4.5% year-on-year, while the United States saw an anemic growth of 1.1%. China’s rebound after the end of zero-Covid measures brings relief, but it’s also facing its fair share of headaches. The United States battles persistently elevated inflation.

Germany experiences a technical recession due to an energy crisis triggered by the Ukraine war, and Japan sees modest growth of just 0.4% in the first quarter.

RBI’s decision

The resilient growth of the Indian economy could provide the Reserve Bank of India with the confidence to pause key rates during their upcoming meeting on June 8. Economists predict that the RBI might maintain rates for the rest of the year before considering lowering borrowing costs in 2024. The benchmark repo rate is currently at 6.5%.

Forex reserves: A shield in troubled waters

Amidst the turbulence, there’s a silver lining. India’s foreign exchange reserve is rock solid, giving us a comfortable position to weather any storm.

Commerce and industry Minister Piyush Goyal assures us that India is well-prepared to meet any requirements, even in the worst-case scenario over the next five to six years.

In fact, India’s forex kitty soared by a whopping USD 3.553 billion to reach USD 599.529 billion for the week ending May 12

Also Read: Over $3 billion in the month of May! FII dollars pouring non-stop on Dalal Street

The snowball effect: India’s growth projections

According to World Economic Forum (WEF) President Borge Brende, India is expected to clock the highest growth among the world’s big economies this year. It’s like a snowball rolling down a hill, gathering momentum and attracting more investments and creating more jobs. What’s the secret?

Well, India’s been rolling out some impressive reforms, cutting down red tape(excessive regulations), and creating a better climate for investments. And let’s not forget about the digital revolution that’s sweeping the nation.

In conclusion, the latest GDP data has brought a glimmer of hope and excitement to the Indian economy. The economy is not only on the path to recovery but also continuing its journey towards becoming a global economic powerhouse.