Today, let’s talk about real estate. An expensive investment, long-term commitment and, of course, gigantic loans. But hey, nothing is more reassuring than a solid roof over your head. But what if there was another way of investing in real estate? Presenting real estate investment trust (REIT)!

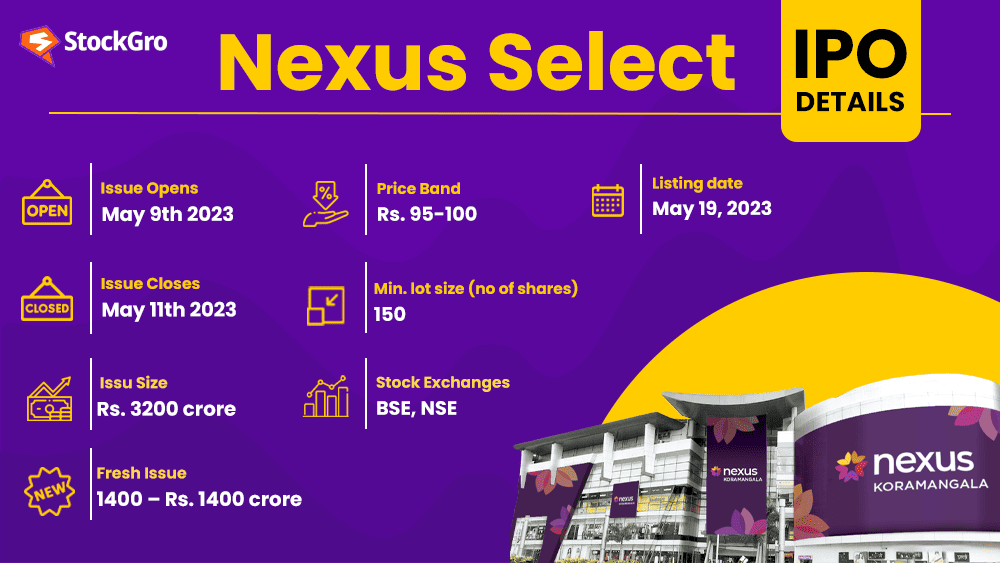

Coincidentally, India is on the brink of getting its first retail REIT, ‘ Nexus REIT’. The bidding for Nexus REIT‘s initial public offering (IPO) opened from May 09 to 11, 2023. It will officially go live on May 19, 2023, on both BSE and NSE.

But all this investment hullabaloo means nothing if REITs are foreign to you. So, let’s dive deep into this new-age, newly-thriving real estate investment.

What is a real estate investment trust (REIT)?

Simply put, REIT is a type of trust or organisation that operates income-producing real estate and other related assets. Thus, when you invest in a REIT, your funds are channelled towards such investable assets in the real-estate sector.

The basic aim behind a REIT is three-fold:

- Providing a way to earn extremely liquid stakes in real estate

- Creating an outlet for regular income

- Diversifying investment portfolio

REITs also aim at investor inclusivity. Meaning they enable big and small investors to earn regular income from real estate investment.

Although an entirely different name, REIT functions just like a mutual fund; except you get a taste of India’s real estate. Consider REIT as an asset management company (AMC) that puts your money into property assets.

You don’t need to track the market every day. The trust would be doing that for you. See, just like a mutual fund. So, sit back, relax and enjoy wealth creation. But, subject to market fluctuations, of course.

You may like: Alia Bhatt named Gucci’s first Indian Global Ambassador – How much will she earn?

How many REITs are listed in India?

According to the Securities and Exchange Board of India, a total of three REITs currently exist in India. And the Nexus REIT will soon join this coveted group. The listed entities include:

| Name of REIT | Listed on | Value as of May 15, 2023, 12:30 pm | Loss/Profit as of May 15, 2023, 12:30 pm |

| Brookfield Indian Real Estate Trust | BSE, NSE | Rs. 270.16 | Loss – 0.11% |

| Embassy Office Parks REIT | BSE, NSE | Rs. 311.00 | Loss – 0.084% |

| Mindspace Business Parks REIT | BSE, NSE | Rs. 324.29 | Gain – 0.14% |

Clearly, REITs are still an upcoming investment instrument, even though they are more than 50 years old. They were first listed on the New York Stock Exchange (NYSE) and gradually expanded to other stock exchanges in Europe, Australia and Japan.

In India, however, the first REIT entered the market no sooner than 2007, but only in the concept stage. The draft regulations proposed by SEBI were not acceptable at that time. Delaying the process further, REITs officially became a part of Dalal Street in September 2014.

Is a REIT like a mutual fund?

Early on, it was stated that investing in REIT is similar to putting your money in a mutual fund. But both instruments still have key differences. This is why REITs are a different instrument altogether.

The differences include:

- REITs tend to invest in the real estate sector directly while owning property of their own. Or fund companies that develop the property. On the other hand, real-estate-based mutual funds invest in REITs and real-estate-related stocks.

So, when investing in a real estate mutual fund, you channel money into trusts and stocks. Plus, these funds are operated by AMCs, which may not directly relate to property dealing.

- You tend to treat REITs like a typical stock listed on NSE or BSE. You can observe their price fluctuations throughout the trading session. So, there is active involvement. Mutual funds, however, have no such instant fluctuations. Their prices are only updated once a day.

The point is, you invest money in an AMC that manages a particular real estate mutual fund. But in the case of REITs, your money is going directly into the real-estate company.

- As much as 90 percent of income earned by REITs is paid out in the form of dividends to shareholders. And with you pocketing consistent dividends, it’s as good as earning a monthly income. This is not possible with mutual funds. Real estate mutual funds grow in value depending on the market’s performance. The resultant value is what you earn if you withdraw your funds.

So, while REITs create a separate income source for you, mutual funds encourage you to increase savings. So where you invest your capital entirely depends on your investment goal – grow your savings or grow your earnings!

This is all you need to know before getting into the main topic – Nexus Select IPO!

Also read: Why did Pakistan’s rupee, & bonds plunge to record low after Imran Khan’s arrest?

Nexus Select IPO – India’s first retail REIT

What comes to your mind when you think of ‘real estate’? A home, right? An apartment…2-BHK, 3-BHK or a bungalow in the city’s outskirts. How about a mall, or as real-estate giants like to call it – urban consumption centres?

Clearly, a mall would not pop up. Why? Because it’s not a property type that most of India’s population can think of owning. The upcoming Nexus Select IPO will likely eliminate this ‘far-fetched’ thought process. How? Here’s a dive into Nexus Select Trust –

What is Nexus Select Trust?

Nexus Select IPO, India’s first retail REIT, is being launched by Nexus Select Trust, one of India’s largest developers of urban consumption centres, or “malls”. A REIT typically owns its own property. So, it surprises no one that Nexus’s:

Portfolio comprises 17 Grade A urban consumption centres (malls) with a total leasable area of 9.2 MSF, two complementary hotel assets (354 keys) and three office assets (1.3 MSF) as of December 31, 2022.

ICICI Direct

(MSF – Million Square Feet)

The portfolio of Nexus Select trust comprises of:

- 17 urban consumption centres

- Three corporate offices

- Two hotels, part of wider chains

- One renewable solar power park

Together, these amount to a market valuation of Rs. 23,449 crore, with as many as 1,044 domestic and international brands being accommodated. The majority portfolio is also directed to serve shopping, entertainment as well as social destinations, suggests the ICICI Direct report.

| Key Figures | FY20 | FY2021 | FY2022 | FY2023 (9 months) |

| Operational revenue | Rs. 1,622 crore | Rs. 907 crore | Rs. 1,318 crore | Rs. 1,463 crore |

| Total income | Rs. 1,708 crore | Rs. 1,048 crore | Rs. 1,398 crore | Rs. 1,498 crore |

| Profit after tax (PAT) | Profit of Rs. 206.7 | Loss of Rs. 199.1 | Loss of Rs. 11 crore | Profit of Rs. 257 crore |

A key point to remember is that Nexus Select Trust’s net operating revenue is likely to grow by 17.1 percent, between the financial year 2024-26, even as real estate expansion remains a constraint in the post-pandemic phase.

Nexus Select IPO details

If you have missed out on participating in the Nexus Select REIT, you can still invest in its shares once the trust goes public. Here are key details of the initial public offering:

Superficially speaking, the figures look promising to invest. But there are some major market concerns. And it’s important to know what you’re getting yourself into rather than acting on excitement. Cardinal rule, of course!

Should you invest in Nexus Select REIT?

Let’s understand the answer while considering the following risks:

- Invariably, the two years of COVID-19 impacted the footfall count of its malls. While the company is showing signs of recovery, its future revenues may still be impacted by the pandemic.

- The company leases property to a very limited number of large net-worth tenants. So, their revenue can be constricted due to this limited number.

- Although the company has initiated an IPO, it plans to acquire external financing to repay a chunk of this debt. And this inability to service, repay or fund its own debt can reflect in the distribution of shares to unit holders. And by extension, a possibility of poor performance in the stock exchange.

- The company’s revenues are largely dependent on the occupancy of its properties. As well as renting levels of its malls, hotels, and office spaces.

- Given the extent of competition, they would always run a risk of low occupancy. And this can impact the firm’s revenue and REIT share price.

- Any future plans to expand or undertake any construction projects face several risks. Why? Because the retail sector is still recovering from the pandemic losses.

There’s no denying that India’s investment avenues are expanding. Regular, small-scale investors can, too, profit from gigantic real-estate projects. And yet, there are some risks involved.

The question is – are you willing to take the risk? Or you prefer to wait and watch? The choice remains in your hands. i.e., the investor’s hand.