The medicine industry in India has been growing fast in recent years and companies like Ajanta Pharma are leading the way. Recently, the pharma company’s Q4 results were released. And after that, the stock price reached its all-time high on May 3, 2024.

With its strong financials, Ajanta Pharma could be an enticing investment prospect. However, the company comes with some weaknesses as well. Let’s get into the detailed analysis of Ajanta Pharma for you to decide upon: Should you buy Ajanta Pharma shares today?

Also read: The pharmaceutical industry in India and its contribution to the world

About Ajanta Pharma Ltd.

The specialty pharmaceutical formulation firm Ajanta Pharma primarily serves the branded generic market in India, several Asian countries, and Africa. The company has a physical presence in all of these nations. When it comes to their respective sub-therapeutic domains, some of the company’s products are first-to-market.

The company has a foothold in both the generic and institutional markets in Africa and the United States. In India, its cutting-edge research and development facility is in Mumbai. India is home to seven of the company’s world-class manufacturing sites.

The company’s revenue has grown at a solid 13% CAGR and its profit after tax has grown significantly higher to 15% during the last five fiscal years.

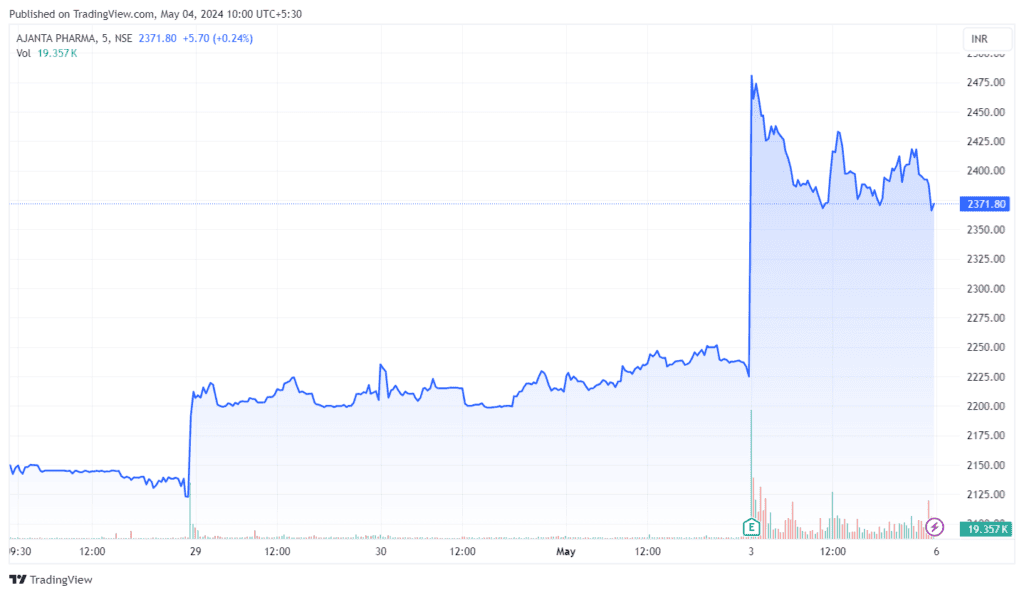

Ajanta Pharma share news: Ajanta Pharma’s share price rises over 13.5% after Q4 results

On May 3, 2024, Ajanta Pharma’s stock reached a 52-week high of ₹2,540, a 13.70% increase. The spike is a result of the company’s buyback goals and the outstanding results for the entire fiscal year and the latest Q4 quarter.

Along with its fourth-quarter results, the pharmaceutical company announced its fourth buyback plan in the past four years, allowing it to acquire up to 10.28 lakh equity shares.

Source: TradingView

Ajanta Pharma has analysts who have maintained a buy recommendation and a revised Ajanta Pharma share price target of ₹2,613, while other stock price targets vary from ₹2,560 to 2,613.

Ajanta Pharma Q4 results

The business announced its financial results for the fourth quarter of FY24 on Thursday, shortly after market hours, and revealed a ₹203 crore, or 66% year-on-year increase, in its consolidated net profit. The pharmaceutical company’s net profit for the fiscal quarter ending in March of the previous year was ₹122 crore.

The company’s financial results showed a 20% year-on-year growth to 1,054 crore in revenue from operations in the most recent quarter and an 86% rise to 278 crore in EBITDA compared to 149 crore in Q4 FY23. The EBITDA margin increased significantly to 26%.

Africa’s institutional sales expanded in Q4, with a 23% YoY increase, driving the quarter’s robust result. Quarterly sales in Asia, Africa, and India increased by 18%, 13%, and 14% year over year, respectively.

Factors such as favourable API pricing, reduced logistics costs, less price erosion, and reduced shortages of medicines contributed to the US market’s excellent growth this year.

The company’s sales performance in India was strong, thanks to higher volumes, pricing changes, and the launch of new items. This year, the business debuted fifteen new items, four of which were market pioneers.

Ajanta Pharma’s FY24 quarterly performance

| CONSOLIDATED RESULTS | JUN ’23 -Q1 | Sept ‘23- Q2 | Dec ‘23- Q3 | Mar ‘24- Q4 |

| Sales (₹ cr.) | 1,021 | 1,028 | 1,105 | 1,054 |

| Net Profit (₹ Cr.) | 208 | 195 | 210 | 203 |

| EPS (₹) | 16.53 | 15.51 | 16.68 | 16.10 |

Source: Screener

Current financials

| Metric | Value (as of 04 May 2024) |

| Market cap (₹ Cr.) | 30,017 |

| Book value (₹) | 283 |

| ROCE | 31.9 % |

| ROE | 23.5 % |

| Stock PE | 36.8 |

Source: Screener

Competitors of Ajanta Pharma

| P/E | Market cap(₹ crores) | ROE (%) | Net profit last quarter (₹ crores) | |

| Torrent Pharmaceuticals | 64.62 | 92550.52 | 20.03 | 443.00 |

| Gland Pharma | 40.06 | 27777.61 | 10.86 | 191.86 |

| ERIS Lifescience | 31.23 | 11832.05 | 18.03 | 101.46 |

Source: Screener

Also read: Torrent Pharmaceuticals Ltd.

Shareholding pattern

The shareholding pattern (as of March 2024) of Ajanta Pharma is as follows:

| Promoters | 66.22% |

| Foreign Institutional Investors (FIIs) | 8.54% |

| Domestic Institutional Investors (DIIs) | 17.48% |

| Public | 7.76% |

Source: Screener

Investing in Ajanta Pharma

Pros

- Strong financial performance:

During fiscal year 2024, Ajanta Pharma had significant financial success. The company’s strong operational efficiency and market positioning are shown by its ability to continuously earn profits.

As we’ve seen in Q4, the company achieved a net profit of ₹203 crore, while the Revenue from Operations in FY24 grew 20% to ₹1,054 crore. Additionally, the company saw a 39% increase to ₹816 crore. in profit after tax from ₹588 crore.

The company’s incredible PAT growth rates indicate its strong profit momentum and its ability to maintain growth. Results from the fiscal year and the fourth quarter of that year show that Ajanta Pharma is in good financial shape and might be a worthwhile investment.

- Business with a strong specialist therapeutic focus:

From ophthalmology and dermatology to cardiology and other specific specialty areas, APL’s product line covers a wide range of therapeutic objectives. In India, the company’s ophthalmology division outperformed segment growth, achieving 12% in Q4 FY24.

In the same quarter, Ajanta Pharma’s dermatology products saw a remarkable growth of 17% and the pain management portfolio of Ajanta Pharma grew by 12%, reflecting strong market demand and effective product penetration.

- Well-equipped R&D and certified production facilities:

Two of APL’s seven production sites have received approval from the US Food and Drug Administration (FDA). Six of the seven factories make formulations, while one of them makes active pharmaceutical ingredients (APIs) for captive use. The USFDA and WHO Geneva have already given their stamp of approval to the Paithan and Dahej production plants.

The firm has been a pharmaceutical industry leader for almost 40 years, thanks to its experienced promoters. This can be reassuring for investors, as it reduces regulatory risks and positions the company for international market opportunities.

Cons

- Challenges from both local and international competitors:

Both at the domestic and international levels, APL is up against stiff competition and price pressure. On a global scale, the generic pharmaceutical industry is confronting several challenges, including rising pricing, more regulation, stricter product performance standards, fierce competition, and heavy government pressure to lower prices.

- Moderate EPS growth rate with high P/E:

While the company’s financial performance is strong, the EPS growth rate is considered mediocre. Investors typically look for a high EPS growth rate, as it often indicates a company’s profitability is increasing at a rapid pace.

Moreover, Ajanta Pharma’s PE ratio is significantly high, which could be a potential risk factor. For value-oriented investors, a high PE ratio might be a deterrent, as it suggests they are paying more for each unit of income.

Also read: Fundamentally analysing Solara Active Pharma Sciences Ltd.

Conclusion

Investors are excited about Ajanta Pharma’s record-breaking stock performance and strong Q4 results, but it’s important to keep a fair view of this opportunity. Before investing, it’s important to conduct an in-depth analysis of Ajanta Pharma’s potential for future expansion and risk factors.