Not many people know, but the alcohol and cigarette industry in India is an essential contributor to the country’s economy. In fact, according to a recent report, the alcohol industry alone contributed around INR 2.5 lakh crore to the economy in 2020.

That’s right, every time you light up or pop open a bottle, you’re doing your patriotic duty by contributing to the country’s finances. And with over a billion people, you can bet that’s a lot of dough.

But here’s the kicker: even with these heavy taxes, the stock price and revenue of companies like ITC, which produce cigarettes, have still increased. How is that possible, you ask? Well, my friend, it’s all about knowing how to capitalise on the government’s revenue stream.

Well, for this article, we suggest you stay sober for a while to wrap your head around the interesting facts that are coming your way. Let’s start!

How much revenue does “sin tax” generate in India?

Excise tax is a flat tax rate imposed on every unit of the product sold. In the case of socially harmful goods like alcohol, cigarettes, gambling, and pornography, the excise tax is also called the sin tax. It is collected from the producer or wholesaler, ultimately driving up the retail price for consumers.

The alcohol and cigarette industry is often referred to as “sin stocks” because these products are seen as vices that have negative health effects and are heavily taxed.

Heavy taxes are levied on the alcohol and cigarette industry in India. In the case of alcohol, the tax rate is as high as 250%, while cigarettes are taxed at around 60%. These taxes account for a significant portion of the cost of production, which ultimately affects the pricing of these products.

Finance Minister Nirmala Sitharaman, in Budget 2023, announced a 16% increase in National Calamity Contingent Duty (NCCD) on cigarettes.

Also Read: Old vs. New – Which Tax Regime is Better For FY 2023-24?

The liquor and cigarette market overall

The Indian cigarette and liquor industry has witnessed steady growth over the years. According to industry experts, the alcohol industry is expected to grow at a CAGR of 7.7% between 2021 and 2026. The cigarette industry, on the other hand, is expected to grow at a CAGR of 6.7% during the same period.

One of the main reasons for this growth is the addictive nature of these products. Additionally, people consider them discretionary expenses, meaning they will continue to purchase them even during a weak economy.

Despite heavy taxation and government efforts to reduce consumption, these industries continue to thrive. With a staggering 160 million smokers and growing alcohol consumers, it’s important to understand how and why these industries persist.

Read Also: Indians Had To Pay 97.75% As Tax – Shocking Story Of India’s Marginal Tax Rate

As a result, the industry players have to find ways to cope with the heavy taxation, such as increasing efficiency in production and distribution or passing on the cost to consumers. Heavy taxation affects everyone in the industry, including manufacturers, retailers, and consumers.

For manufacturers, it can result in lower profit margins or even loss, while retailers may struggle to sell products due to high prices. Conversely, consumers may turn to cheaper alternatives or black market products to avoid the high prices, which can have negative health and safety consequences. What a bummer!

Despite these challenges, the alcohol and cigarette industry in India continues to thrive, leaving us asking – WHY? – as we chug the last sip of our favorite drinks (Gin and tonic, is it?).

Three things that define the alcohol and cigarette industry? RESILIENCE! RESILIENCE! RESILIENCE!

Factors contributing to the industry’s resilience

Well, one thing good came out of your drinking and smoking habits, you might have single-handedly saved the entire industry! Just kidding! The alcohol and cigarette industry in India continues to thrive despite heavy taxation due to a combination of factors.

By investing in the alcohol and cigarette industry, you’re essentially betting on the fact that people will continue to indulge in these vices despite the high prices. And let’s face it, when it comes to alcohol and cigarettes, people are willing to pay a premium for their fix.

Let’s look at some numbers, shall we? The Indian tobacco industry alone is estimated to be worth over 11 billion dollars, with ITC being one of the major players. And with a growing middle class and changing lifestyles, the demand for these products is only going to increase.

Alcohol and tobacco contain chemicals that create a physical dependency, making it difficult for consumers to quit. Additionally, these products have long been socially acceptable, further contributing to their popularity.

Another important factor is the availability of these products. Despite regulations, they are widely available in India. Thanks to the liquor shop down the street, you can get your hands on all new flavours of vodka whenever you want!

Product innovation and diversification

The industry also adapts to changes in taxation policies and market trends through product innovation and diversification. Furthermore, companies in the industry have been known to lobby government officials to advocate for policies that benefit their businesses.

For example, cigarette companies have introduced lower-priced alternatives to premium brands to cater to price-sensitive consumers. They have also diversified into other product categories, such as smokeless tobacco and e-cigarettes, which have gained popularity among younger consumers.

No wonder why everyone’s going bonkers over vape!

Similarly, the alcohol industry has introduced new products, such as flavored and craft beers, to cater to changing consumer preferences. To leverage their distribution networks, they have diversified into non-alcoholic beverages and bottled water.

Time to hydrate yourself now!

Government Policies and Regulations

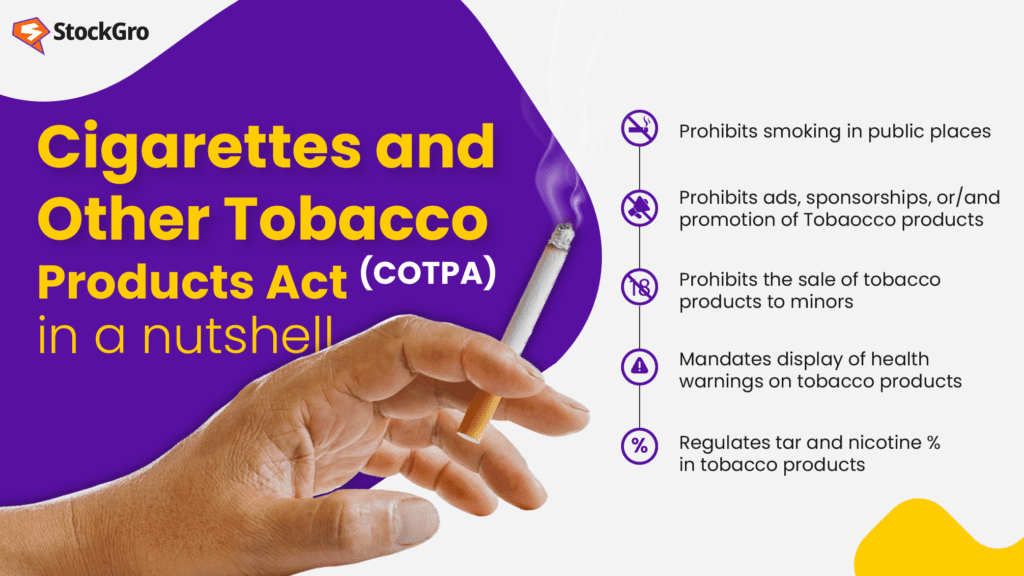

Besides heavy taxes, the government also regulates the advertising and marketing of these products to control their consumption. For example, the Cigarettes and Other Tobacco Products Act (COTPA) ban the advertising and promotion of tobacco products and restricts smoking in public places.

Similarly, the Food Safety and Standards Authority of India (FSSAI) regulates the labelling and advertising of alcoholic beverages.

Public education campaigns raise awareness about the negative health impacts of alcohol and tobacco consumption.

However, high taxes can also lead to black market sales and smuggling of these products. Therefore, the government has to strike a balance between generating revenue and preventing illegal activities.

Despite these regulations, the alcohol and cigarette industry in India continues to thrive. According to the National Family Health Survey (NFHS) conducted in India from 2019 to 2021, on average, men smoke about 12 cigarettes or bidis per day, while women smoke approximately 3 cigarettes or bidis per day.

How to invest in alcohol and cigarettes?

One way to invest in these industries is by purchasing individual stocks of companies that produce these products. Some of the top alcohol and cigarette companies in India include United Spirits Limited, ITC Limited, and Godfrey Phillips India Limited.

You can check out the top tobacco stocks in India and also explore the top alcohol stocks in India.

When investing in sin stocks, it is essential to remember that these companies face regulation and social stigma. As a result, it is important to do your research and consider the potential risks before investing.