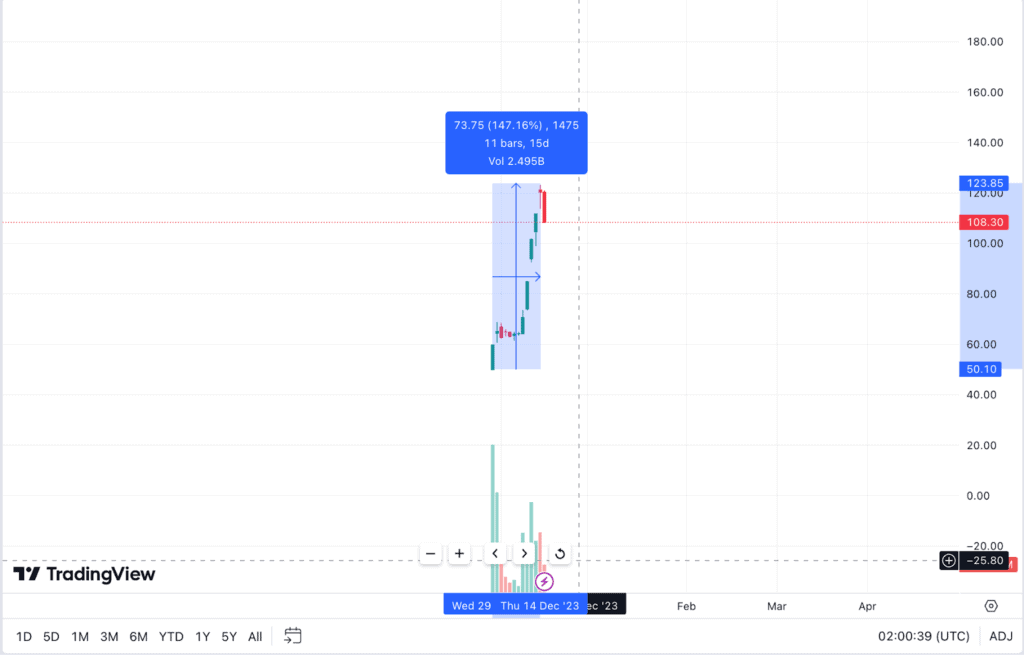

The sentiment remains high for PSUs and power stocks in India, and IREDA seems to have piggy-backed on a generally high-demand market to push its IPO price from ₹32 to over ₹100 in less than 2 weeks.

Technicals of IREDA

The stock was listed on the exchange on November 29 at ₹60 apiece, an 87.5% premium over the issue price of ₹32. It continued the same upward trajectory for the next 11 sessions, achieving a record high of ₹123.30 apiece.

The IPO was heavily subscribed – 38.8 times in the three days of bidding (November 21–23).

The NSE sought clarification on the unusual rally from the company on December 14, and the company replied on the same day, noting that there’s no positive information they have that could influence trading like this. The company said, “the volatility in the price and volume in IREDA’s shares is completely market driven.”

You may also like: Here is everything you need to know about INOX India’s IPO!

After the incredible rally, the stock has since fallen 12% from the high.

IREDA fundamentals

Established in 1987 as India’s first dedicated renewable energy financier, IREDA is a public sector NBFC wholly owned by the government of India. It has been known to be pivotal in propelling the nation’s shift towards sustainable energy.

With a focus solely on renewable energy and energy efficiency/conservation projects, IREDA boasts the largest share of credit towards the RE sector among NBFCs, except for Power Finance Corporation (which has broader sectoral diversification).

The company’s asset book is mainly dominated by solar energy (30 %), followed by wind power (20.9 %), state utilities (19.2 %), and hydropower (11.5 %.

IREDA marked a significant milestone in May 2023 by becoming the first public sector company to hit the capital market since 2022, highlighting its financial strength. IREDA’s total income stood at ₹2,655 crore, ₹2,860 crore, and ₹3,482 crore for the fiscal years FY21, FY22, and FY23, respectively. It recorded net profit of ₹347 crore, ₹634 crore, and ₹865 crore in the same fiscal years.

Peer comparison

| Company | P/E | Dividend Yield | ROCE |

| Power Finance Corporation Ltd. | 7.58 | 2.57% | 9.08% |

| IRFC | 20.40 | 1.58% | 5.32% |

| REC Ltd. | 8.93 | 2.92% | 9.14% |

| IFCI | – | 0.00% | 5.38% |

| IREDA | 33.66 | 0.00% | 8.17% |

Future outlook on IREDA stock

In an interview with MoneyControl, chairman and managing director Pradip Kumar Das said, “We are a pure-play green finance company, with an established track record and have a very mature relationship with developers.

Also Read: The role of the energy sector in powering India’s growth.

In the renewable energy space, in the last 6-7 months, they (PFC and REC) have aggressively signed many MoUs and communicated to the developers that they are here.”

While IPO gains are astronomical, especially considering the time frame, analysts recommend keeping the stock in your portfolio for long-term appreciation, too.

While valuations have gone really high at this new price, analysts recommend entering at a slightly lower price and waiting for prices to gradually trend upward.