Introduction

In the last decade, India’s telecom industry has seen a dramatic shift. Since its launch on October 1, 2022, the 5G network has spread its wings across 700 districts and over 200,000 sites.

Mobile broadband (MBB) users in India have seen a slight growth of 7.2% over the past year, totalling 839 million. This surge is mainly due to the popularity of Reliance Jio’s affordable 4G-enabled internet phone since August.

However, the number of non-MBB or ‘2G’ users has dropped by about 16% to 309 million in the year ending August, according to data from the Telecom Regulatory Authority of India (TRAI).

The slight increase in India’s mobile broadband user base (mainly 4G) from August 2022 to 2023 suggests that telecom companies are still struggling to persuade feature phone users to switch to 4G.

At a time when digital transformation is at its peak, it will be significant to watch out how mobile broadband providers play an essential role in connecting communities.

You may also like: Beyond the paycheck: Exploring compensation meaning through equity

Overview of telecom industry

India holds the position of the second-largest market in the world for telecommunications. As of June 2023, the teledensity of the country was recorded at 84.43%.

When looking at internet subscribers, India ranks second globally. The country is a significant consumer of data on a global scale.

According to TRAI, the average wireless data usage per subscriber increased significantly from 61.66 MB in March 2014 to 17.11 GB per month in December 2022.

The telecom sector’s gross revenue for FY23 was ₹ 3.1 lakh crore, highlighting the industry’s substantial growth.

Telecom players in India

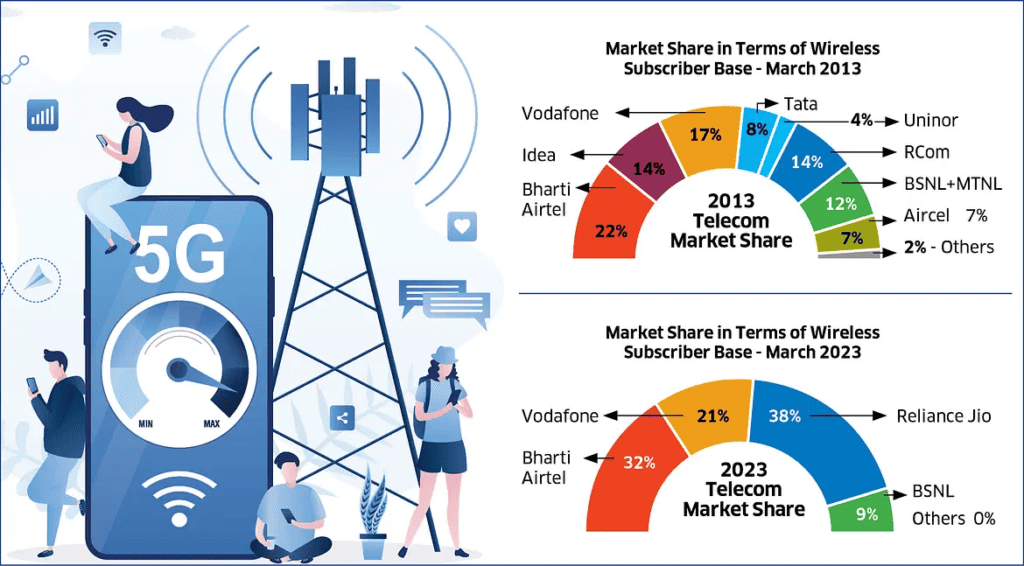

Back in March 2013, the telecom sector was bustling with over eight competitors, each striving to expand its market presence, with the main competition between Airtel vs Vodafone.

However, the landscape changed dramatically in 2016 when Reliance made its entry through Jio, sparking a fierce price war. This intense competition led many players to either reduce their prices or exit the market altogether.

Today, the Indian telecom market is dominated by four key players:

- Reliance Jio,

- Bharti Airtel,

- Vodafone Idea, and

- BSNL.

However, Vodafone Idea and BSNL are facing significant challenges, struggling to stay afloat due to continuous losses and the burden of servicing substantial debt.

As of August 2023, the top five service providers accounted for 98.35% of the total market share in terms of broadband subscribers. These providers included:

- Reliance Jio Infocomm Ltd, with 455.33 million subscribers,

- Bharti Airtel with 253.86 million,

- Vodafone Idea with 125.55 million,

- BSNL with 25.12 million, and

- Atria Convergence with 2.19 million subscribers.

The market share of these players is as follows:

| Company | Market Share |

| Reliance Jio Infocomm Ltd | 51.95% |

| Bharti Airtel | 28.96% |

| Vodafone Idea | 14.32% |

| BSNL | 2.87% |

| Atria Convergence | 0.25% |

| Others | 1.65% |

If talking about only wireless subscribers, Reliance Jio’s market share in India accounted for 38.81% as of August 2023, with Airtel’s market share being second.

Also Read: Sam Altman: Navigating the nexus of innovation and investments

Jio vs Airtel vs Vodafone vs BSNL

For the majority of the previous decade, Vodafone held the position of the second-largest player.

In September 2016, the Indian telecom market experienced a significant shakeup with the launch of Reliance Jio’s mobile and data services. Jio quickly gained the reputation of a game-changer in the industry thanks to its affordable data rates and the elimination of charges for domestic calls.

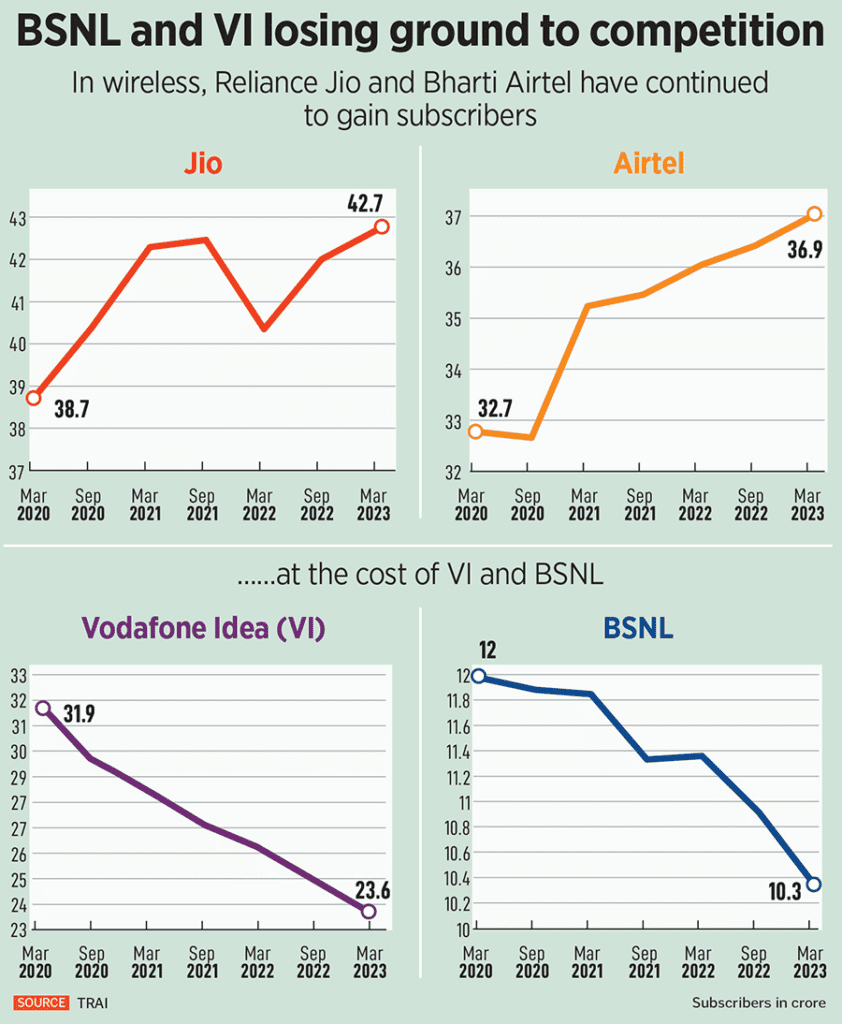

After that, Vodafone India struggled to match the pace of Jio and Airtel 4G network expansion, because of which Vodafone Idea’s share price also fell dramatically.

Similarly, BSNL has been reliant on the government’s equity infusion to maintain its operations.

Vodafone India and BSNL’s financial woes can be observed in the fall in their subscribers.

In August, Vodafone Idea experienced a decline in its customer base, losing approximately 49,782 subscribers. Similarly, BSNL also saw a reduction in its customer numbers, with a loss of around 22.02 lakh subscribers.

However, Airtel users in India and Jio users in India are constantly increasing.

Financial woes of Indian telecoms

BSNL and Vodafone Idea have been grappling with mounting losses due to AGR-related dues, delays in the 4G services rollout, and fierce competition. AGR, or adjusted gross revenue, pertains to the dues that operators are required to pay to the central government. These dues are based on the revenues that the operators generate and include charges related to licences and spectrum.

Here’s the total revenue, net profit/loss and total debt of BSNL and VI:

| BSNL | VI | |||||

| Total revenue (₹) | Net profit/loss (₹) | Total debt (₹) | Total revenue (₹) | Net profit/loss (₹) | Total debt (₹) | |

| FY18 | 25,070 | -7,995 | 16,543 | 28,279 | -4,168 | 57,985 |

| FY19 | 19,320 | -14,904 | 20,050 | 37,092 | -14,604 | 125,940 |

| FY20 | 18,906 | -15,499 | 24,285 | 44,958 | -73,878 | 27,343 |

| FY21 | 18,595 | -7,441 | 29,733 | 41,952 | -44,233 | 50,789 |

| FY22 | 19,054 | -6,981 | 23,239 | 38,516 | -28,245 | 40,647 |

| FY23 | 20,701 | -8,161 | 16,091 | 42,177 | -29,301 | 49,411 |

Since 2019, the government has announced three revival packages for BSNL, the most recent one being in June.

On the other hand, Vodafone Idea (VI) faces its own set of challenges. While it is still striving to establish a nationwide 4G presence, competitors like Jio and Airtel are rapidly progressing towards one of the world’s fastest 5G rollouts in the country.

Analysts express concern that without a significant capital infusion into VI, the company’s 5G capex may not materialise.

Both BSNL and VI are racing against time to compete with their larger, well-funded rivals, Reliance’s Jio Platforms and Bharti Airtel, who are aggressively expanding their 5G services across India.

Also read: The Complete Guide to NFO – New Fund Offer

Telecom duopoly

The consistent tariff hikes in 2021 and 2022 by Bharti Airtel and Reliance Jio significantly bolstered the profit margins of both companies. It appears that their hesitation to further increase tariffs stems from a desire to first extend the 5G rollout to a broader customer base, thereby securing an early adopter advantage.

The sector’s high capital intensity poses a significant barrier to entry, deterring the emergence of new players. With no new entrants and two existing operators facing substantial financial difficulties, Reliance Jio and Bharti Airtel still have the potential to expand their subscriber base. Their approach to future tariff hikes will be a fascinating development to observe.

Financial and stock performance

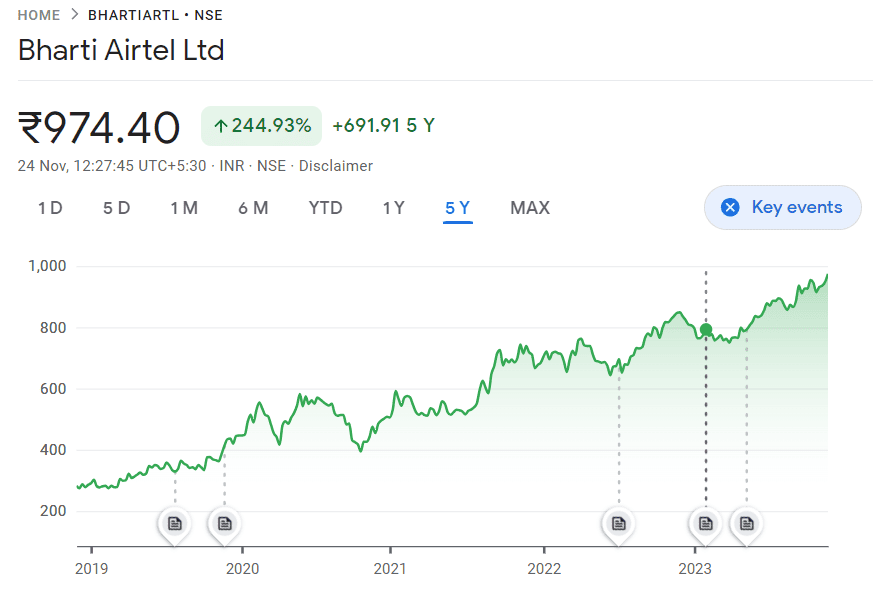

Among the top 4 players only 2 are listed: Bharti Airtel and Vodafone Idea. BSNL and Jio are not listed on the stock exchange.

Let’s see the key financial ratios of Bharti Airtel and Vodafone Idea:

| Stock | PE Ratio | PB Ratio | Dividend Yield |

| Bharti Airtel Ltd | 68.49 | 5.37 | 0.42% |

| Vodafone Idea Ltd | -2.26 | -0.89 | — |

From the above table, it is quite clear that Bharti Airtel is providing a dividend to its investors, whereas Vodafone Idea is not providing any dividend. Bharti Airtel has a good dividend yield of 0.42%.

Here, the P/E ratio or price to earnings ratio shows whether a company’s stock is overvalued or undervalued or that investors are expecting high growth rates in the future. Vodafone Idea Ltd has a negative PE ratio signifying that the company is not profitable.

The P/B ratio or price to book ratio also shows whether the stock is undervalued or overvalued. Usually, a ratio higher than 1 shows the stock is overvalued. Here, Bharti Airtel has a higher P/B and Vodafone Idea has a negative P/B signifying that the net book value of the company is negative.

Looking at the company’s 5-year stock performance,

Bharti Airtel has generated an absolute return of 244.93% as on 24th November 2023.

Vodafone Idea has generated a negative return of 36.91% as on 24th November 2023.

Bottomline

To wrap up, the last ten years have seen a dramatic transformation in India’s telecom sector, marked by the introduction of 4G and the recent emergence of 5G. The industry, which was once characterised by a multitude of participants, is now controlled by a select few major providers.

Despite numerous obstacles, the sector continues to expand, fueled by a surge in data usage and the ongoing shift towards digitalisation. Nevertheless, the financial difficulties faced by some providers underscore the importance of strategic planning and investment.

The trajectory of India’s telecom industry will be determined by how these issues are tackled and how providers adjust to the fast-paced changes in the digital world.