In the high-voltage world of energy production, JSW Energy has been a powerhouse. It is a significant player in India’s power sector, which boasts an installed power capacity of 426.13 GW as of November 30, 2023, making India the third-largest producer and consumer of electricity worldwide.

But recently, it’s not just their power plants that are generating sparks. Their share prices are on fire too! The company’s Q4 results were out on May 7, 2024, and they were nothing short of a blockbuster. The result? A surge in JSW Energy’s share price by nearly 6%.

The article aims to provide an in-depth analysis of the recent surge in JSW Energy’s share price following its Q4 results.

About JSW Energy

JSW Energy holds a significant position in India’s power sector, functioning as a comprehensive power company engaged in the production, distribution, and commerce of electricity. The company operates under the umbrella of the JSW Group, a multifaceted conglomerate with a presence in a variety of sectors such as steel, power, cement, and infrastructure.

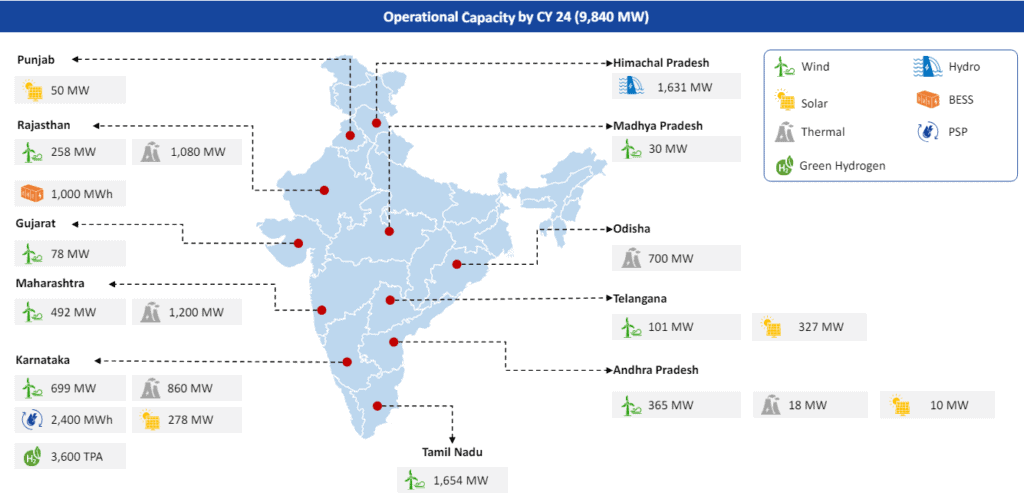

JSW Energy Limited has experienced consistent and robust growth over the years, prioritising the effective utilisation of all available resources. JSW Energy has a wide range of operations in various Indian states, as well as investments in natural resource companies in South Africa.

This chart provides a detailed overview of the company’s operational capacity, both in terms of location and sector.

The company has established a goal to reach a state of zero carbon emissions by the year 2050. It is excelling with its strong values and sustainable business practices. JSW Energy is establishing itself as a leader in the power sector through its transparent operations, strict corporate governance norms, and clear vision.

JSW Energy has made strategic investments in its business operations, as evident from its capital expenditure (capex) details. For capital expenditures, the corporation has set aside a substantial sum of ₹19,360 Cr.

A substantial portion of this total, around ₹18,652 Cr, has already been allocated to different projects and initiatives. In addition, JSW Energy has shown its dedication to these investments by already investing approximately ₹15,046 Cr. The figures highlight the company’s commitment to expanding and innovating in the power industry.

This is the shareholding pattern of the company:

| Type | Percentage |

| Promoters | 74.66% |

| FII | 5.36% |

| DII | 10.16% |

| Public | 9.82% |

Also read: A comparative study of FIIs and DIIs in financial markets

JSW Energy’s Q4 results

Here are some of the key financial metrics of the recent quarter results as compared to the same quarter previous year:

| Q4 FY24 | Q4 FY23 | |

| Total revenue (₹ crores) | 2,879 | 2,806 |

| EBITDA (₹ crores) | 1,292 | 881 |

| EBITDA Margin (%) | 45% | 31% |

| Depreciation (₹ crores) | 427 | 291 |

| Finance cost (₹ crores) | 533 | 233 |

| Profit before tax (₹ crores) | 332 | 357 |

| Profit after tax (₹ crores) | 351 | 272 |

| EPS (₹) | 2.09 | 1.53 |

Also read: EBITDA explained: Definition, calculation, significance, and more

JSW Energy’s FY24 results

Here are some of the key financial metrics of the annual results as compared to the previous year:

| FY24 | FY23 | |

| Total revenue (₹ crores) | 11,941 | 10,867 |

| EBITDA (₹ crores) | 5,837 | 3,817 |

| EBITDA Margin (%) | 49% | 35% |

| Depreciation (₹ crores) | 1,633 | 1,169 |

| Finance cost (₹ crores) | 2,053 | 844 |

| Profit before tax (₹ crores) | 2,150 | 1,924 |

| Profit after tax (₹ crores) | 1,723 | 1,478 |

| EPS (₹) | 5.79 | 4.33 |

JSW Energy share news

On Wednesday, May 8, JSW Energy’s share price experienced a significant uptick of nearly 6% in early trading on the BSE. This surge came on the heels of the company’s announcement of its Q4 results, which showcased a robust year-on-year increase in both revenue and profit.

Following the initial surge, the stock experienced some fluctuations and quickly trimmed its substantial gains.

When looking at JSW Energy’s share price history, the return generated is 696.95% over the last 5 years.

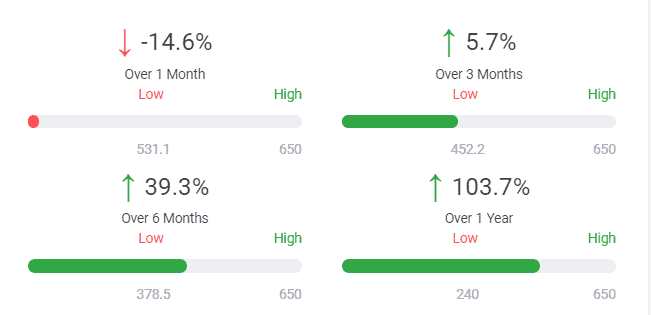

This is the price change analysis of JSW Energy’s share rate:

Must read: The concept of rate of return is the key to making investments. Know how.

Brokerages’ take on JSW Energy’s performance

The performance of the company has caught the attention of various brokerages, and their take on the company’s performance is quite insightful. Let’s look at a couple of the JSW Energy share price targets:

Following the release of the March quarter results, JM Financial has reiterated its ‘buy’ recommendation for the stock, raising the target price from ₹555 to ₹648. The firm expresses confidence in JSW Energy’s potential for growth and anticipates that the company is on a steady path to reach its renewable energy capacity goals of 10GW by 2025 and 20GW by 2030.

JM Financial underscored JSW Energy’s expansion of greenfield RE capacity by 681MW/3.4GW during FY24, which has increased the total committed RE capacity to 13.2 GW. Moreover, the firm praised JSW Energy’s tactical decision to strengthen the wind energy supply chain via a technology licensing agreement with SANY Renewable Energy, China.

Conversely, Kotak Institutional Equities has held onto its ‘sell’ recommendation for the stock even after the Q4 results, albeit with an upward revision of the fair value from ₹235 to ₹275. Kotak acknowledges the aggressive expansion plans of JSW Energy, which have included investments in renewable and thermal resources and storage technologies.

However, the firm opines that the current market price, which is 31 times the projected EPS for FY26 and thrice the price-to-book value, already encapsulates all the positive aspects.

Bottomline

JSW Energy’s recent surge in share price following its Q4 results underscores its pivotal position in India’s power sector and investor confidence in its growth trajectory. The company’s strategic investments in renewable energy, coupled with its commitment to carbon neutrality by 2050, reflect a forward-looking approach aligned with global sustainability goals.

While brokerages offer differing perspectives on JSW Energy’s performance, ranging from optimistic growth projections to cautious evaluations of market valuations, the overall sentiment suggests recognition of the company’s strategic initiatives and potential for continued expansion in the renewable energy sector.