Throughout the world, there is no doubt that the Indian banking industry is one of the most stable systems among global economies even with worldwide tremors. By 2050, it is expected that this country will have the third-largest domestic banking sector.

In this ever-changing financial services field, two institutions are particularly noticeable: Axis Bank and Kotak Mahindra Bank. Each has established its unique segment while demonstrating strong expansion, creative products and services and a client-oriented attitude.

Thus it is important to know what they excel at, their methods for achieving success and how well they perform in comparison with each other while contending for leadership in this market.

Company profiles

Axis Bank

Axis Bank Limited, one of the largest private sector banks in India today, was established in 1994. It started as UTI Bank Ltd; it was one of the first privately owned financial institutions set up under the RBI guidelines of 1993. Dr Manmohan Singh inaugurated its first branch in Ahmedabad.

Presently, Axis Bank has a presence across 2,963 cities in India with a network of over 5,377 branches and 16,026 ATMs and Cash Deposit/Withdrawal Machines. The bank also has overseas offices located at key centres for global finance such as Singapore and Dubai.

The overall is 11.4% in Q1 FY25.

It is the largest player in merchant acquisition, holding a Axis Bank market share of 19.8% and achieving an incremental share of 28% over the past year.

Axis Bank shares news

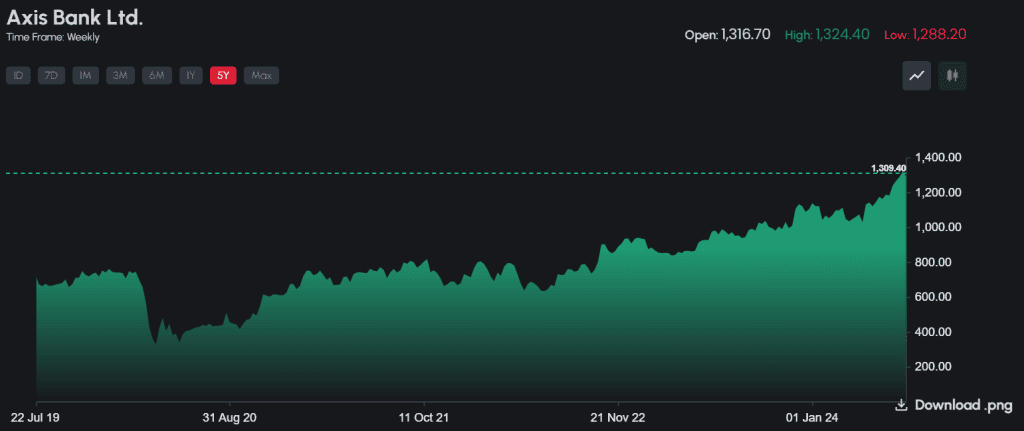

As of July 20, 2024, the Axis Bank share price is ₹1,293.80. Looking at the Axis Bank share price history, the return given by the stock for the past five years is 74.55%. The recent 52-week high of the Axis Bank share price NSE is ₹1,339.65 on July 12, 2024.

IDBI Capital recommends buying Axis Bank within the price range of ₹1170-₹1145. The Axis Bank share price target is set at ₹1350, with a stop loss at ₹1068.

Kotak Mahindra Bank

Kotak Mahindra Bank Limited is a banking institution situated in Mumbai, Maharashtra, India. It became one of India’s biggest banks because it has grown significantly since its establishment in 1985. The Kotak Mahindra Bank does many different things. Some examples include retail banking services, corporate banking services as well as treasury operations.

The bank offers a wide range of financial products and services to cater for all its clients’ needs too. Retail banking products provided comprise savings accounts like checking accounts or term deposits. Personal loans can be obtained from this bank; home loans are also available through them together with commercial vehicle finance being offered among other channels.

The overall Kotak Mahindra market share is 11.4% in Q1 FY25.

Kotak Mahindra share price news

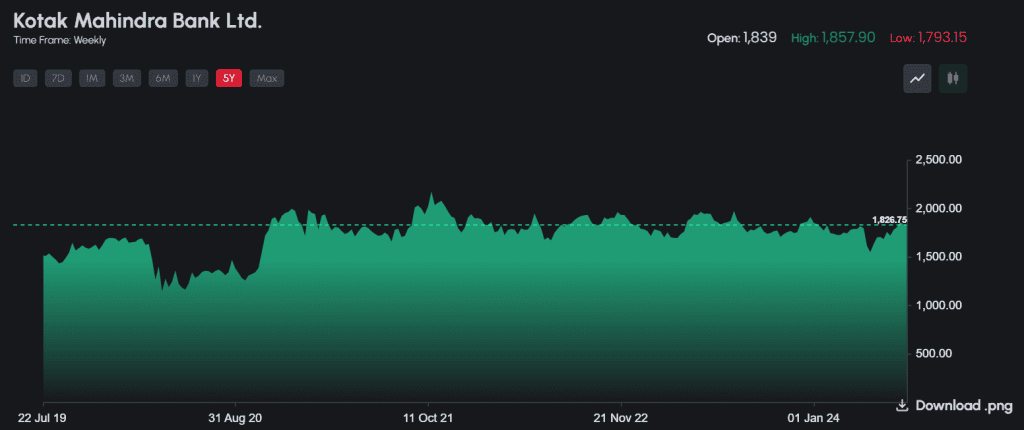

As of July 20, 2024, Kotak Mahindra’s share price stood at ₹1,812.00 per share. The recent 52-week high of the Kotak Mahindra share price NSE is ₹1,870.00 on July 9, 2024.

The stock has provided an 18.42% return over the last five years when you observe Kotak Mahindra’s share price history.

LKP Securities Limited suggests a “buy” rating with Kotak Mahindra’s share price target of ₹2,124 per share, implying a potential upside of 26% from today’s price level.

Axis Bank vs Kotak Mahindra financial profiles

Let’s compare the key financial metrics for both companies – Kotak Mahindra vs Axis Bank.

| Axis Bank(For the year ending March 2024) | Kotak Mahindra Bank(For the year ending March 2024) | |

| Revenue (₹ crores) | 112,759 | 56,237 |

| Operating profit (₹ crores) | 11,336 | -13,382 |

| Profit before tax (₹ crores) | 35,178 | 23,863 |

| Net profit (₹ crores) | 26,492 | 18,213 |

| Earnings per share (₹) | 85.49 | 91.62 |

| Market cap (₹ crores) | 3,99,452 | 3,62,125 |

| Price to earning | 15.1 | 19.9 |

| Debt to equity | 8.25 | 4.00 |

| ROCE (%) | 7.06 | 7.86 |

Reasons for growth

Axis Bank

- Strong financial growth: Balanced growth of savings as well as loans, and a sharp increase in net interest income and fee income helped the bank achieve a profit after tax that is 160% higher during FY24.

- Innovative digital initiatives: Customer experience and operational efficiency were improved after many digital banking solutions such as ‘open by Axis Bank’ and ‘NEO for Business’ were introduced.

- Expansion and market penetration: Rural and semi-urban areas received more branches from the bank which also managed to grow its market share in credit cards among other segments like merchant acquiring.

- Improved asset quality: Gross non-performing asset (fell by 59 basis points year-on-year) and net non-performing asset (fell by 8 basis points year-on-year) ratios have come down considerably indicating sound credit quality management with prudent risk controls being put in place.

Must read: NPA: The tipping point in banking and economy

Kotak Mahindra Bank

- Strong financial performance: The bank achieved a surge of 26% for its annual profit after tax (PAT) and posted a return on equity (ROE) of 15.08%. Net interest income grew rapidly, expenses were well managed and there were favourable tax credits.

- Subsidiary success: Kotak Securities and Kotak Mahindra Investments experienced strong growth with PAT up 42% YoY and 58% YoY respectively. This was due to strategic acquisitions (like Sonata Finance) and good market positioning.

- Asset quality and management: With a net non-performing assets (NNPA) ratio of only 0.34%, the bank’s asset quality can be considered healthy while its current and savings account (CASA) ratio stands at 45.5%, reflecting efficient risk management practices.

- Technological advancements: Investing in digital platforms together with IT infrastructure systems; has improved customer satisfaction levels as well as eased operational efficiencies thereby positioning the institution for sustainable growth even during periods marked with regulatory challenges.

Company strategies

Axis Bank

- Digital transformation: Axis Bank has laid more emphasis on digital banking hence it works towards improving its technological infrastructure while at the same time utilising advanced analytics for bettering customer experience as well as operational effectiveness.

- Customer centricity and innovation: Axis Bank wants to improve consumer satisfaction through unique services such as the Axis Bank app that brings simplicity and convenience to banking.

- Sustainable growth: It is committed to being environmentally responsible; thus, it integrates sustainable practices like monitoring emissions and setting targets for renewable energy acquisition.

- Employee empowerment: Creating an inclusive work culture where all staff feel valued is another priority area for the bank. In light of this, they foster innovation among employees through collaboration.

You may also like: Sustainable and Ethical Investing: Definition, importance and types

Kotak Mahindra Bank

- Digital transformation: The bank wants to maintain being the best when it comes to digital methods and interfaces, making use of technology for both running and changing the institution.

- Asset quality and risk management: Making sure that only the right assets are added in terms of quality at a risk-adjusted price and ensuring proper risk management.

- Efficiency and productivity: Prioritising efficiency improvement, productivity increase and capital optimisation.

- Customer-centric approach: Ensuring that customers are always served first so that the bank can make them have amazing experiences, to be loyal later on.

Further reading: The best banks in India: Leading the way in finance

Bottomline

Axis Bank and Kotak Mahindra Bank have strategies that can capitalise on changes happening within India’s banking sector. These different approaches, stable finances and a willingness to try new things while putting customers first – make them significant players in this space.

Whether through investment opportunities or contributing towards overall economic stability as India continues its journey towards becoming one of the biggest economies worldwide – Axis Bank & Kotak Mahindra will play key roles.