The country’s fourth-largest auto giant, Mahindra & Mahindra, also known as M&M has a capital infusion plan to supercharge its business across multiple segments for the next three years.

The lion’s share of this capital plan will be directed toward boosting its auto division. And their shares are racing to new record highs. What is the plan? Why is the Mahindra and Mahindra share rising? Let’s look into it.

Company overview

The M&M conglomerate had its origin in 1945. It was started by Ghulam Mohammad and the Mahindra brothers. Now, it’s a dominant force in our nation’s automotive and various other sectors.

What started as a steel trading company soon got into assembling Willys Jeeps. Later, it grew over the years and has a footprint in many businesses. It now has three main business segments in its portfolio: Auto, farm and services.

The auto business, which is responsible for M&M’s top-line growth, is known for its vast range of vehicles. They include sports utility vehicles or SUVs, light commercial vehicles, last-mile mobility solutions, iconic motorcycles, trucks, and buses.

Next, the farm segment. They are in the business of manufacturing tractors and also in farm machinery. The third segment is services. Here, Mahindra functions in financial services, technology, hospitality, real estate, logistics, auto components, auto recycling, renewable energy, advanced platforms, and aerospace through its number of subsidiaries.

Let’s have a look at its market position, to better understand it impact in Indian economy. In the auto and farm segments, they are kingpin as the number one manufacturer of SUVs (18% market share in FY24), light commercial vehicles (LCVs), and tractors globally by volume.

In finance and technology, they are the top non-banking financial companies (NBFC) in rural and semi-urban areas and rank among the top five IT services firms. Among their growth sectors, M&M is #1 in electric three-wheelers, vacation ownership, auto recycling, and used car services.

Also read: Automobile industry in India

Mahindra and Mahindra numbers

| Mar 2023 | Mar 2024 | |

| Sales | 121,269 | 139,078 |

| Operating profit | 20,285 | 24,892 |

| Profit before tax | 14,060 | 15,978 |

| Net profit | 11,374 | 12,270 |

The recent Mahindra and Mahindra news

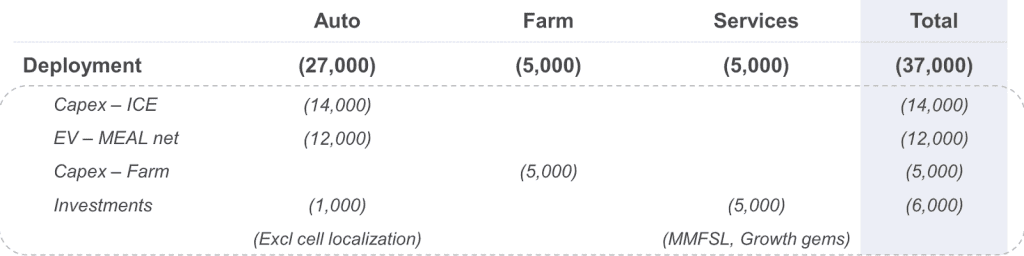

The company is getting investor’s attention with its turbocharge capital infusion plan. The company is planning to put in ₹37k crore for the next three years. This investment will span various business segments, but the major gainer is the auto sector.

M&M plans to debut 23 new vehicles by the end of this decade. It intends to introduce:

- 9 ICE i.e., internal combustion engine SUVs,

- 7 battery electric vehicles and

- 7 LCVs.

Since electric vehicles are in the nascent stage in our market, for the next 5 – 7 years, ICE models will continue to be a priority. ₹14,000 crore will be allocated for the development of new models and refreshing existing ones. ₹12k crore will be invested in the electric vehicle segment in parallel. That’s for the auto segment.

The rest ₹5,000 crore each in its farm and services businesses. In the farm sector, the focus will be on upgrading tractors and the sector’s machinery offerings. The services sector will see investments aimed for further expansion.

Source: Mahindra & Mahindra Q4FY24 Investor Presentation

M&M is also set to increase its SUV manufacturing capacity from 49,000 units per month to 64,000 units per month by next year, with a target of reaching 72k units per month by the end of FY26. This expansion aims to address the current backlog of 2.2 lakh vehicles and reduce customer waiting periods.

To address the increasing demand for electric vehicles, Mahindra is exploring partnerships with global players for the local production of battery cells. New electric vehicle models are set to launch starting January 2025. However, the listing of Mahindra Electric Automobile Ltd (MEAL) is not anticipated within the next three to five years, allowing time for the electric segment to gain traction.

Also read: Fundamentally analysing Mahindra Holidays and Resorts India Ltd.

Market reaction

The market has reacted positively to M&M’s new capex plan.

- Jefferies finds the new electric SUVs compelling and expects significant auto volume growth, raising their target price.

- Emkay Global and Nuvama Institutional Equities have both slightly increased their EPS estimates, maintaining positive outlooks and higher share price targets.

- JM Financial upgraded its target multiple, citing strong auto demand, farm segment recovery, and EV readiness, while maintaining a ‘Buy’ rating and higher target price.

- Motilal Oswal highlighted M&M’s prudent capital allocation and strong response to new model launches, revising earnings estimates upward and reiterating a ‘Buy’ call with an increased target price.

You may also like: Mahindra Logistics Ltd.

Mahindra and Mahindra share price performance

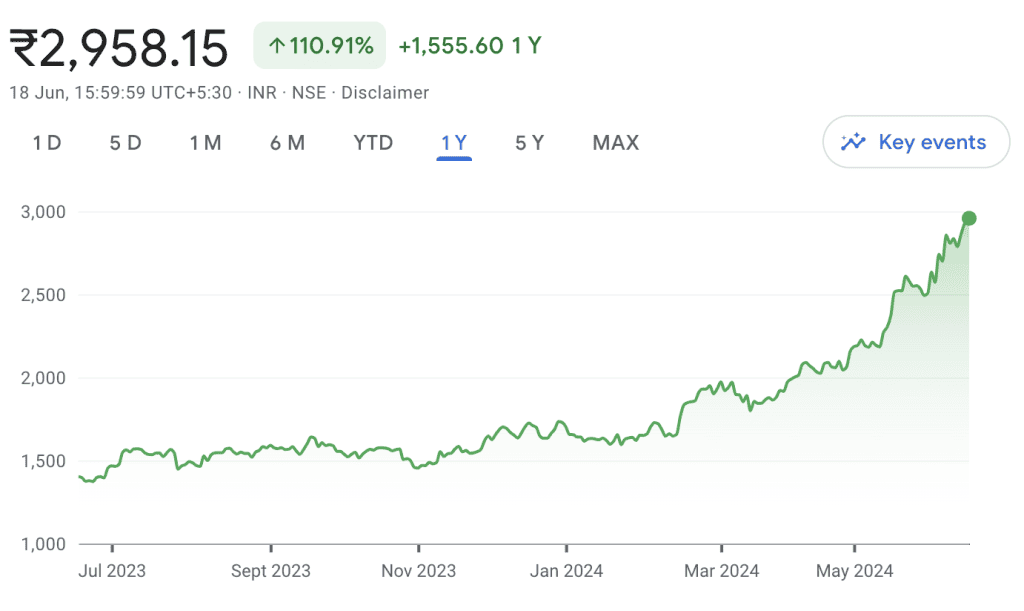

Mahindra & Mahindra shares have recently reached an all-time high. It is due to the positive response by the global brokerages to the new investment plan by the company for FY 25-27.

The stock gained nearly 3% on the NSE, hitting a record high of ₹3,013.5. On the BSE, the share price rallied 2.71% to ₹3,006.45.

Over the past year, Mahindra car market share has delivered multibagger returns, with a 110.9% increase.

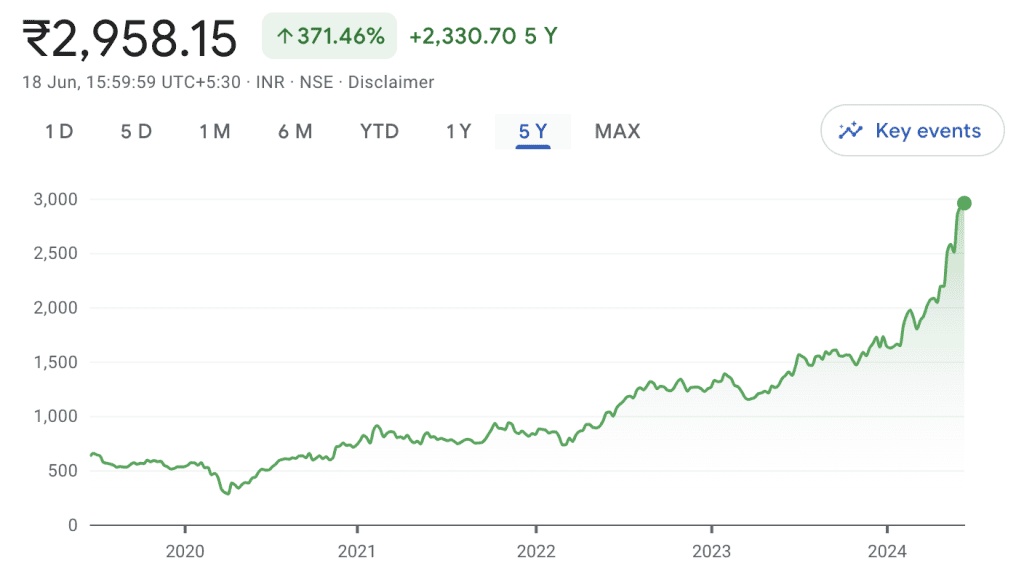

The Mahindra and Mahindra share price performance over the last five years has shown remarkable growth, achieving a 371.46% increase.

Bottomline

Record-high share prices have been achieved as a result of investor confidence bolstered by M&M’s ₹37,000 crore investment plan. The company’s dedication to electric vehicles (EVs) and its focus on growing its auto, farm, and services businesses point to a promising future. Investors recognise the potential for sustained growth in M&M’s strategic direction.