Metropolis Healthcare, one of India’s leading diagnostics companies, has seen a significant surge in its share price. The stock jumped over 7.5% in today’s intraday session, hitting a 52-week high of ₹1,935 per share.

Metropolis Healthcare specialises in providing a wide range of clinical laboratory tests and profiles for prediction, early detection, diagnostic screening, confirmation, and monitoring of diseases.

The company operates a chain of diagnostic centres across India, South Asia, Africa, and the Middle East, serving business-to-consumer (B2C) and business-to-business (B2B) sectors.

Recently, Metropolis Healthcare’s share price surged over 7.5% to a new 52-week high of ₹1,935 per share, following a strong Q4 business update.

Let’s dive into the factors driving this surge and what it means for investors.

You may also like: The pharmaceutical industry in India and its contribution to the world

Metropolis Healthcare revenue growth and business update

During the fourth quarter, Metropolis Healthcare reported a 10% year-on-year increase in overall revenue and a 15% YoY growth in core business revenue. The company’s B2C (business-to-consumer) revenues soared by 18% YoY, while volume growth increased by 8% and revenue per patient (RPP) grew by 7% YoY.

| Particulars (Rs. Crs.) | Q3FY23 | Q3FY24 | Y-o-Y | 9MFY23 | 9MFY24 | Y-o-Y |

| Revenue from Operations | 285.5 | 291.1 | 2.0% | 865.7 | 876.7 | 1.3% |

| Cost of Operations | 208.2 | 222.5 | 633.8 | 663.4 | ||

| Reported EBITDA | 72.7 | 65.5 | -10.0% | 223.6 | 204.8 | -8.4% |

| Reported EBITDA Margin | 25.5% | 22.5% | 25.8% | 23.4% | ||

| Profit Before Tax | 48.0 | 36.9 | -23.2% | 145.6 | 124.2 | -14.7% |

| Profit After Tax (PAT) | 35.9 | 27.3 | -23.9% | 109.9 | 91.9 | -16.4% |

Metropolis Healthcare’s focus on specialised tests and premium wellness segments, along with strategic price adjustments, has driven this impressive performance. The company has managed to navigate the competitive landscape by expanding its network, acquiring talent, and upgrading its information technology and processes.

Debt-free status and EBITDA margin improvement

Here’s some exciting news: Metropolis Healthcare is now officially debt-free! The company repaid its debt during the quarter, achieving this milestone as of March 31, 2024. This financial health is a positive indicator for investors, as it suggests a strong and sustainable business model.

The company also saw an upward trajectory in EBITDA margins for Q4 FY24, both quarter-over-quarter and year-over-year. This improvement can be attributed to increased volumes and successful price adjustments.

Also Read: Torrent Pharmaceuticals Ltd.

Competition easing and market expansion

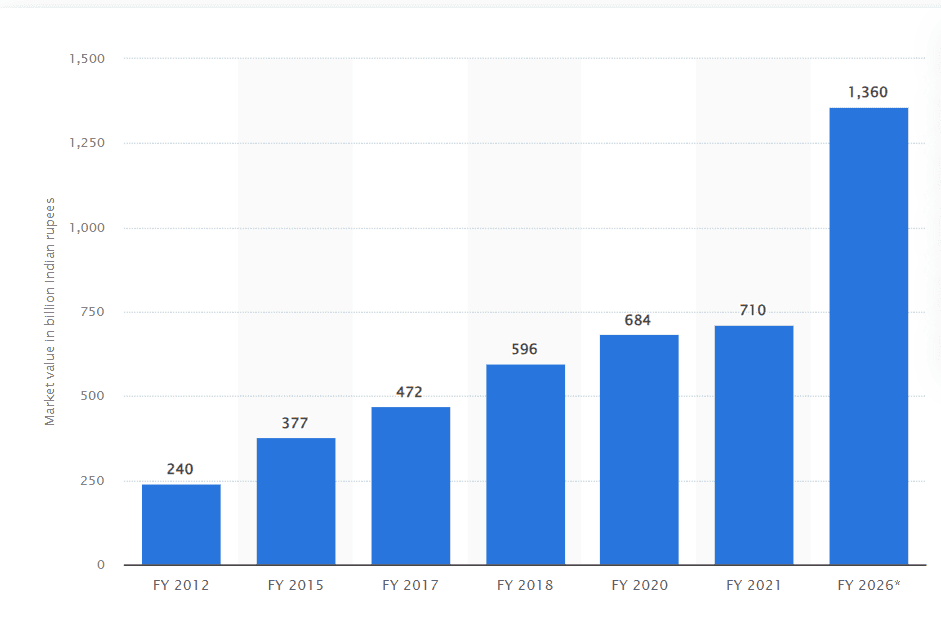

Value of the diagnostic market in India from the financial year 2012 to 2021, with an estimate for 2026*

Metropolis Healthcare has experienced a shift in the competitive landscape. Over the past 6 to 12 months, competition has eased as new entrants focus more on unit economics and profitability rather than deep discounting strategies.

This change has allowed Metropolis Healthcare to strengthen its market share in key regions and expand its presence into new territories.

Looking ahead: Stock performance and technical outlook

The Metropolis Healthcare stock has been on an upward trend for some time. Over the last six months, it has gained over 25% and has surged by 13% in the current fiscal year alone. The stock has outperformed the benchmark Nifty 50, which has gained over 27% in the last year.

In terms of the technical setup, the weekly chart patterns suggest a continued bullish outlook for the near term. Analysts predict the stock could reach a target of ₹2,000 soon, making it an exciting prospect for investors.

What this means for investors

For those looking to invest in the healthcare sector, Metropolis Healthcare’s strong performance and promising future make it an attractive option. The company’s focus on speciality tests and premium wellness, along with its aggressive lab and network expansion strategy, positions it well for further growth.

Given the stock’s recent surge and the company’s healthy financial standing, it might be worth keeping an eye on Metropolis Healthcare for potential investment opportunities. Just remember, as with any investment, do your research and consider your own risk tolerance before making any decisions.

Also Read: Indian elections & stock market volatility

Conclusion

Metropolis Healthcare’s recent 52-week high is a testament to its strong Q4 performance and strategic business approach. With solid revenue growth, a debt-free status, and improved margins, the company is set for a promising future.

For investors and market enthusiasts alike, this is one company to watch closely in the coming months. Keep an eye on Metropolis Healthcare for further updates and potential opportunities in the healthcare sector!