According to a forecast by the Automobile Component Manufacturers Association (ACMA), India’s auto component exports are anticipated to hit a staggering $30 billion by 2026. Furthermore, the revenue of the auto component industry is projected to reach an impressive $200 billion by the same year.

Amidst the vibrant and ever-evolving landscape of auto components, Minda Corporation emerges as a distinctive entity. Not only has it stood the test of time since its inception in 1958, but it has also consistently demonstrated an innovative approach to cater to the demands of the industry. Minda Corporation has carved a niche for itself as a pioneer in delivering all-encompassing solutions in the realm of automotive components.

Recently, on May 22, Minda Corporation unveiled its much-anticipated Q4 results, causing ripples in the financial world. This article aims to dissect these results, providing an in-depth analysis of the figures and the market reaction upon the release of the results.

About Minda Corporation Ltd

Minda Corporation, a key player in the automotive component manufacturing sector, has been making remarkable progress for more than six decades. Established in 1958, the company boasts a storied past and has consistently showcased its innovative prowess in meeting industry needs.

The company is the principal entity of Spark Minda, which was previously a part of the Minda Group. The inception of Minda Corporation was a consequence of a division among the Minda brothers’ businesses in 2012. Presently, it has established itself as a top-tier manufacturer of automotive components for Original Equipment Manufacturers (OEMs) and Tier-I suppliers, both domestically and internationally.

The product range of Minda Corporation is varied and extensive. It encompasses die-casting components, sensors, junction boxes, bearings, cables, plastics, and interiors among others. The company also produces electronic and mechanical security systems and provides systems and electronic controllers for electric vehicles.

Minda Corporation, with its widespread presence across India and overseas, operates in numerous countries with over 34 plants and offices. It employs a strong workforce of over 16,000, including more than 600 engineers. The company’s dedication to innovation and technology is apparent in its collaborations with several international entities, thereby fortifying its market position.

The market capitalisation of Minda Corporation Ltd is ₹10,038.95 crore, as of May 25, 2024.

Minda Corporation Ltd’s quarterly performance

Here are some of the principal financial indicators of Minda Corporation’s Q4 results performance in comparison to the preceding quarter:

| Q4 FY24(₹ crores) | Q3 FY24(₹ crores) | Change(%) | |

| Revenue | 1,215 | 1,166 | 4.20 |

| Operating profit | 139 | 130 | 6.92 |

| Profit before tax | 92 | 76 | 21.05 |

| Net profit | 71 | 52 | 36.54 |

| EPS | 2.96 | 2.20 | 34.54 |

The board of directors at Minda Corporation Ltd have proposed a final dividend of 45%, which translates to ₹0.90 per share based on the face value. This recommendation brings the cumulative dividend for the year to 70% or ₹1.40 per equity share.

Minda Corporation Ltd’s annual performance

Here are the principal financial metrics of the company, in comparison with the figures from the previous year:

| FY2024(₹ crores) | FY2023(₹ crores) | Change(%) | |

| Revenue | 4,651 | 4,300 | 8.16 |

| Operating profit | 514 | 463 | 11.02 |

| Profit before tax | 308 | 298 | 3.36 |

| Net profit | 227 | 284 | -20.07 |

| EPS | 9.50 | 11.90 | -20.17 |

The company’s top line, represented by its revenue, has shown an encouraging growth of 8.16%. However, the bottom line, which is depicted by the net profit, tells a different story. Despite the increase in revenue, the net profit has seen a decline of 20.07%.

Market reaction to Minda Corporation’s results

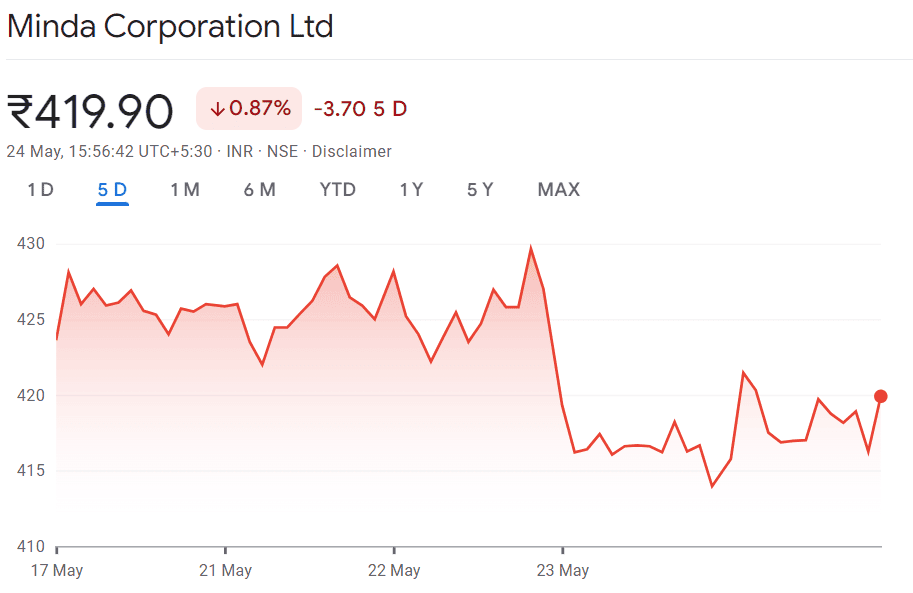

Minda Corporation Ltd released its quarterly results on May 22, 2024. On the previous day, the Minda Corporation Ltd’s share closed at ₹425.10 and had hit a 52-week high of ₹434.00. Post the results release the Minda Corporation’s share price fell from ₹426.05 to ₹421.25 and has been on a decline since, as can be seen by the trading pattern for the past 5 days.

According to Axis Securities analysts, the Minda Corporation’s share target is ₹475, with a recommendation to buy.

Peer analysis

Let’s compare the key financial ratios of Minda Corporation Ltd with that of its competitors:

| Company | CMP (₹) | Market cap(₹ crores) | P/E | Earnings Yield (%) |

| Minda Corporation | 419.90 | 9,998 | 44.0 | 3.52 |

| Endurance Technologies | 2,196 | 30,885 | 45.4 | 3.02 |

| Jupiter Wagons | 525 | 21,654 | 65.1 | 2.22 |

| Suprajit Engineering | 415 | 5,748 | 38.5 | 4.13 |

| Sansera Engineering | 1,026 | 5,503 | 29.6 | 5.27 |

| Lumax Auto Technologies | 482 | 3,286 | 29.8 | 6.68 |

Strategic pillars of growth

These pillars are designed to guide Minda Corporation’s growth trajectory and ensure its continued success in the competitive automotive industry.

- Bolstering core strengths: The first strategic pillar emphasises the reinforcement of Minda Corporation’s fundamental competencies. This involves a concentrated focus on areas such as safety security systems, wiring harnesses, instrument clusters, and die casting. The objective is to fortify Minda Corporation’s market standing and ensure the delivery of superior-quality products.

- Embracing technological innovation: The second pillar underscores Minda Corporation’s dedication to technological progression. The company is channelling investments into in-house research and development and forging alliances with global players. This approach is aimed at fostering innovation and keeping pace with industry advancements.

- Capitalising on the electric vehicle market: The third pillar mirrors Minda Corporation’s strategic orientation towards the rapidly growing electric vehicle sector. By creating products that are compatible with any electric vehicle (EV agnostic) and enhancing the content per vehicle, Minda Corporation is positioning itself to seize the growth opportunities offered by the electric mobility shift.

- Enhancing passenger vehicle portfolio: The fourth pillar highlights Minda Corporation’s initiatives to augment its product range for passenger vehicles. This includes the development of control systems, sensors, and interior solutions, catering to the changing needs of consumers.

Through the concentration on these strategic pillars, Minda Corporation aspires to evolve into a comprehensive solution provider and a trusted partner for Original Equipment Manufacturers (OEMs). The company is striving to attain a leadership position in cost-effective manufacturing while also maintaining a pioneering stance in technological advancements.

Furthermore, Minda Corporation is committed to outperforming industry growth rates and persistently enhancing its profit margins. This strategic blueprint underscores Minda Corporation’s dedication to fostering innovation, upholding quality standards, and ensuring customer satisfaction.

Bottomline

Minda Corporation Ltd. stands as a testament to resilience and innovation within the automotive component manufacturing industry.

The recent Q4 results highlight Minda Corporation’s consistent growth path. Despite a modest increase in quarterly revenue and substantial leaps in operating profit and net profit, the annual performance paints a varied picture. The company managed to achieve a rise in annual revenue, however, the net profit saw a decline. This reflects the challenges in sustaining profitability in the face of escalating costs and market pressures.

The market reaction to the quarterly results was muted, with the share price experiencing a slight decline. However, the overall outlook remains positive, with analysts from Axis Securities recommending a buy.