Initial public offerings (IPOs) are landmark moments in the ever-changing world of finance because they signal the beginning of a company’s journey from private to public ownership.

IPOs give investors a chance to be a part of a company’s success story. In 2023, India surpassed all other countries in terms of IPOs, taking the lead globally. An additional indicator of strong market activity was the 72% surge in initial public offerings IPOs during Q4 2023, as compared to the corresponding quarter in 2022.

The approaching IPO of retail industry powerhouse Naman in-store (India) limited is one such notable event. This article will explore the details of the Naman in-store IPO in detail.

Naman in-store (India) limited – Overview

A provider of retail solutions to a wide range of industries and retail outlets, Naman in-store (India) limited has been in business since 2010. In addition to shelving solutions for supermarkets, the company manufactures space-saving modular furniture for use in classrooms, salons, and offices.

Using a business-to-business model, this company has a presence across India. Naman has catered to approximately 32 retail clients and their franchisees, along with 4 industrial clients, as of September 30, 2023. The firm has built a solid reputation in the market despite working in a very cutthroat and dispersed industry. The company has an immense customer base. In FY23, the top 10 customers accounted for 92% of the revenue, compared to 83% in FY22.

Naman in-store IPO details

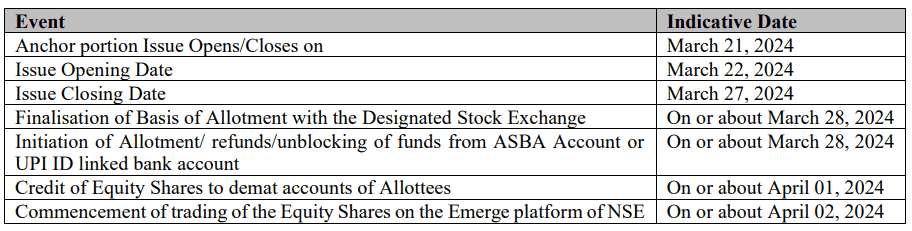

Through the IPO, Naman in-store (India) wants to raise ₹25.35 crores. Naman in-store (India) IPO opens for subscription on March 22, 2024 and closes on March 27, 2024.

Source: NSE

Each equity share of Naman in-store (India) with a face value of ₹10 will be priced between ₹84 and ₹89 in the IPO. Naman in-store IPO lot size is 1,600 shares. The minimum bid is 1,600 shares, and bids can be placed in multiples of 1,600 shares. The equity shares have a floor price of 8.4 times their face value and a cap price of 8.9 times their face value.

Naman in-store IPO reservation

| Investor Category | Shares Offered |

| QIB Sharess | Not more than 50% of the Net Issue |

| Retail Shares | Not less than 35% of the Net Issue |

| NII (HNI) Shares | Not less than 15% of the Net Issue |

Source: NSE

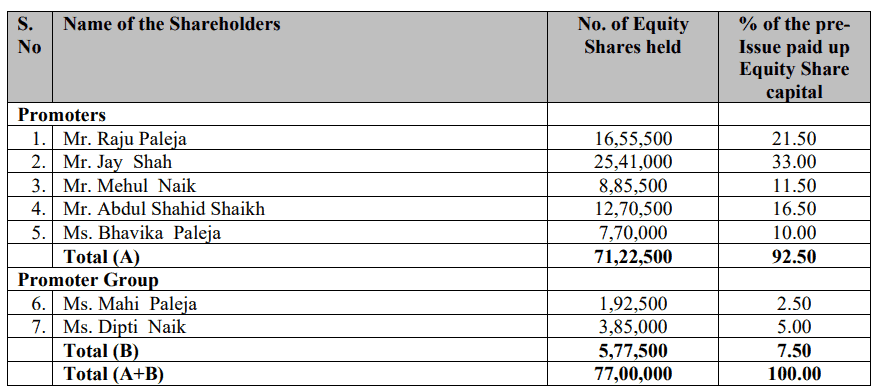

Naman in-store IPO promoter holding

The total amount of shares held by the company’s promoters and promoter group before they were issued is:

Source: NSE

Also read: What is an IPO valuation

Naman in-store limited financial information

Naman in-store (India) limited has shown a remarkable financial performance. The company’s revenue increased by 193.48% and its profit after tax (PAT) increased by 1696.28% between the fiscal years ending on March 31, 2022 and March 31, 2023. Effective cost management and enhanced operational performance are evident from this data.

Financial key ratios

| Particulars | Mar 2023 | Mar 2022 |

| Gross profit margin (%) | 7.43 | 6.13 |

| Net profit margin (%) | 2.90 | 0.45 |

| EPS (₹) | 31.10 | 1.67 |

| Return on networth / Equity (%) | 69.23 | 12.10 |

| ROCE (%) | 32.20 | 10.06 |

| Return on assets (%) | 7.77 | 0.76 |

| Debt to equity (x) | 4.69 | 9.77 |

Source: Money control

When analysed in conjunction with other financial data, these ratios provide a complete picture of the company’s financial performance.

Also read: What do you mean by EPS

IPO objectives

There are well-defined goals behind Naman in-store (India) Limited’s IPO. The capital expenditure is the intended purpose of the company’s fund-raising efforts. Land at Butibori, MIDC will be acquired on a leasehold basis with a substantial portion of the funds that are raised.

The corporation intends to relocate its current production facilities to this site. Expectations are high that this change will boost operational efficiency and scalability, allowing the growth trend to persist.

Beyond this, the newly acquired property will also serve as the site of a new factory for the company. The corporation will be able to better manage its production processes and meet the rising demand as a result.

The remaining funds will be used for general corporate purposes, with a cap of 25% of the gross proceeds, under SEBI ICDR Regulation.

Strengths and risks

Strengths of Naman in-store (India) limited:

When it comes to retail furniture and fittings, Naman in-store (India) limited stands out for a number of reasons:

- In addition to a UK compliance certificate for quality systems, the company’s products have been certified by ISO 9001, 14001, and OHSAS 18001.

- More than 25, 45, 50, and 35 customers were served for the years ending March 31, 2021, 2022, and 2023, respectively, demonstrating a strong and lasting client relationship.

- With 491 employees as of September 30, 2023, the company boasts competent leadership and a motivated team.

- Vasai, Maharashtra is home to its extensive manufacturing facilities, which span over 1,41,687 sq. ft.

Risks associated with Naman in-store (India) limited:

There are, however, potential downsides to Naman in-store (India) limited:

- Loans from banks and other financial institutions have been secured for specific borrowings by the company through the creation of a charge over the directors’ immovable and movable properties.

- Services provided to clients in Maharashtra account for a considerable chunk of the business’s income.

- When it comes to sourcing and transporting raw materials and finished goods, the business depends on outside transportation companies.

- The reputation and operational outcomes of the company could be affected by any disturbance to its operations or a decrease in service quality.

Also read: Service sector in India

Bottomline

Naman in-store (India) limited initial public offering is a fascinating chance to invest. The firm is well-established in the retail furniture and fittings market and has demonstrated remarkable financial success. Strategic initiatives to improve operational efficiency and scalability are the intended beneficiaries of the capital raised through the initial public offering.

On the other hand, there are risks involved, as with any investment. Some things that could go wrong for the business include its heavy use of outside transport services and the fact that most of its customers live in Maharashtra.

Initial investigations into the company’s finances, business strategy, and risk factors should come before any investment in an initial public offering.