PSU Bank Nifty today is making headlines as PSU stocks, particularly PSU banking stocks, have surged sharply. This spike in stock prices comes on the heels of the latest exit polls for the 2024 Lok Sabha elections.

Investor optimism has propelled the PSU Bank Nifty index to a historic high, with an over 5% increase. The anticipation surrounding these elections has significantly influenced market trends, especially within the PSU banking sector.

So, what did the exit polls indicate? Why are PSU banks seeing such a rise? Find the answers here as we delve into the factors and its implications for the financial market.

What is the Nifty PSU Bank index?

The Nifty PSU Bank index is a sectoral index that tracks the performance of PSU (Public Sector Undertaking) banks listed on the National Stock Exchange (NSE). Twelve well-known PSU banks, including Punjab National Bank, State Bank of India, and Bank of Baroda, are included in the Nifty PSU Bank stock list.

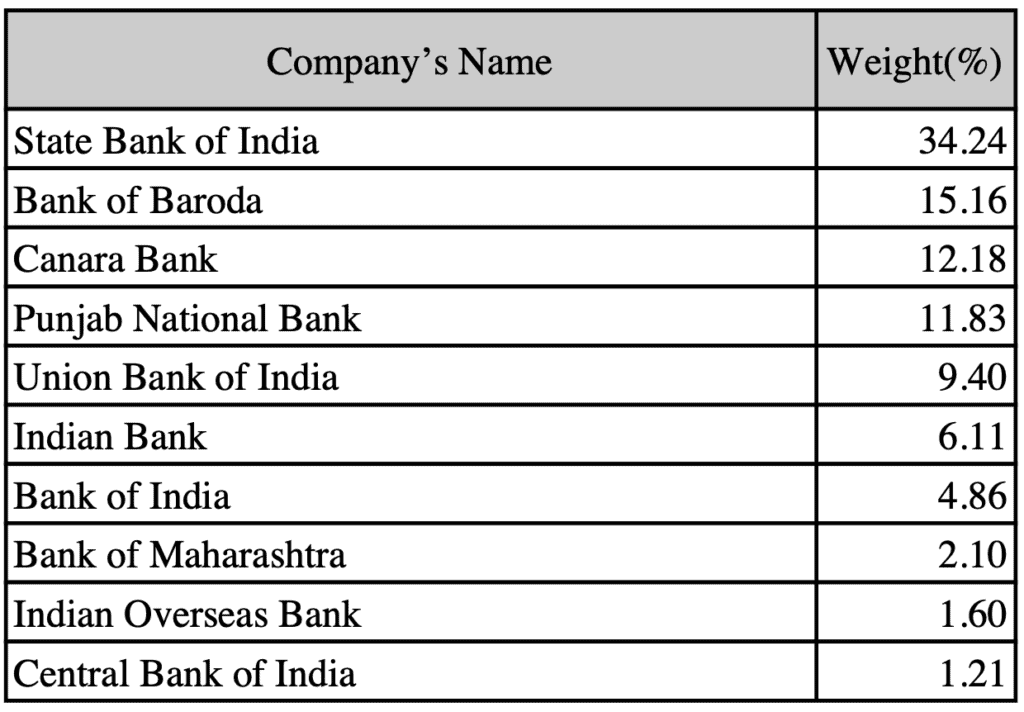

Here are the top Nifty PSU Bank stocks by weightage as of May 31, 2024.

Source: NSE PSU Bank Factsheet

These banks’ free-float market cap is the basis for the calculation of this index. Shares held by insiders or the government are not taken into account; only shares that are accessible for public trade are taken into account by the free-float market cap.

To be part of the index, a bank must meet specific criteria, including having at least 51% government ownership and a high trading frequency. The index represents the general state of the PSU banking industry and acts as a benchmark for investors.

Investors use it to gauge market trends and make informed decisions, often through financial products like ETFs that track the index’s performance.

Also read: Unravelling the power of public sector banks in India’s economic landscape

Exit poll results

In the 543-member Lok Sabha, a party or coalition needs 272 majority to establish the government. Overall, on June 1, 2024, exit polls for the 2024 elections suggest a victory for the Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA). Most exit polls indicate that the NDA will surpass the required majority.

The BJP is expected to increase its seat count compared to the previous election, with its allies also gaining a significant number of seats. The main opposition alliance, the Indian National Developmental Inclusive Alliance (INDIA), is projected to gain more seats than in the last election but still fall short of the NDA’s projected numbers.

Market reaction on exit polls

The stock market reacted strongly to the exit polls on June 3 2024, reflecting investor confidence in political stability. The Sensex surged over 2,000 points in early trading, reaching a new record high. Similarly, the Nifty saw its biggest jump in four years, climbing over 800 points.

Investor optimism was driven by expectations of policy continuity under the ruling party. BSE-listed equities now have a market capitalization of ₹12.48 lakh crore thanks to this rise. Both Sensex and Nifty had all their constituent stocks trading in the green.

The Sensex hit a record high of 76,739 points, while the Nifty soared past the 23,300 mark, reaching a new lifetime high of 23,339 points.

Nifty PSU Bank share price performance after exit polls

PSU stocks are rallying after the latest election exit polls projected hatrick for the current ruling party. This surge comes on top of a year-long rally driven by factors such as attractive valuations, clean balance sheets, and strong fundamentals. The government’s focus on leveraging the strength of public sector companies has also supported this upward trend.

Among these, PSU banking stocks stood out, reaching new record highs. The Nifty PSU Bank index on June 3, 2024 surged over 5.30% in a single trading session, reaching an all-time high.

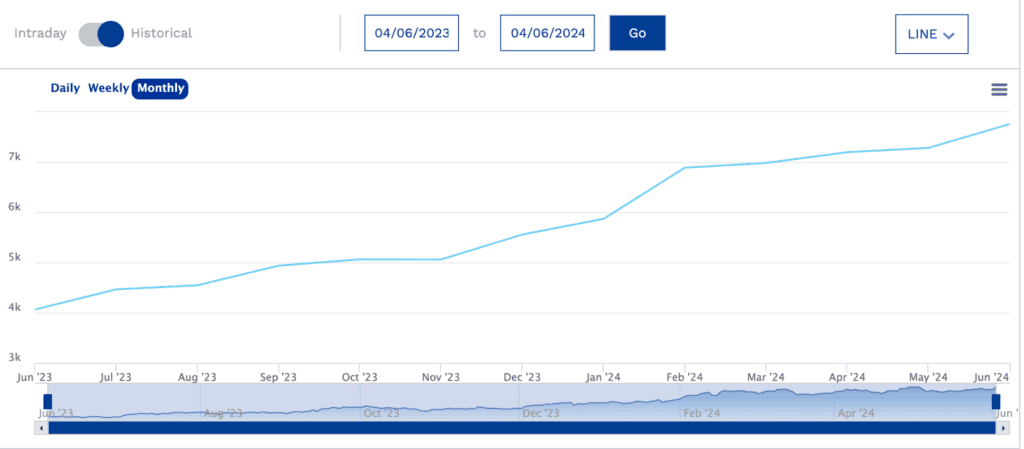

Below is the Nifty PSU Bank index chart, illustrating its performance over the past year leading up to today’s election June 4, 2024.

Source: NSE PSU Bank Index

You may also like: The best banks in India: Leading the way in finance

Analysis of PSU Bank Nifty surge

All 12 constituents of the Nifty PSU Bank list showed positive momentum. Bank of Baroda led the gains with a 7% increase, followed by Bank of India with a 4.7% rise. SBI also posted a 5% increase. Other banks, including Canara Bank, Indian Bank, and Punjab National Bank, reported gains ranging from 3% to 4.9%.

The rally pushed the Nifty PSU Bank index to a record high of 8,027.65 on June 3, 2024, surpassing its previous peak of 7,685.95 on April 30, 2024. This surge reflects investor confidence in the banking sector amidst strong economic indicators and corporate earnings forecasts.

Here is the Nifty PSU Bank chart from April 30 to June 4, 2024.

Source: NSE PSU Bank Index

The continuation of the current government is seen as supportive of the economy and capital markets. It provides stability and may continue the government’s economic agenda. This political stability is likely to support the ongoing growth momentum in India’s banking system.

S&P Global Ratings recently revised its outlook on six Indian banks, including SBI and Indian Bank, from stable to positive. This reflects confidence in the resilience and financial performance of Indian banks. The banking sector’s fundamentals are supported by recent structural improvements and economic growth.

Also read: What’s inside the RBI annual report 2023-24?

Bottomline

The recent surge in the Nifty PSU Bank index reflects investor confidence driven by exit poll results indicating potential political stability. This stability is expected to support the ongoing growth momentum in the banking sector. Positive outlooks from rating agencies and strong fundamentals further bolster this confidence.

Investors are likely to view the continuation of current economic policies as favourable for long-term growth. The resilience and improved financial performance of PSU banks suggest a promising future, encouraging investors to maintain a positive outlook on the sector.