India’s beauty and personal care industry is undergoing rapid development, driven by increased consumer focus on health and wellness. The rise of digital platforms has significantly influenced purchasing behaviours, reshaping how people discover and buy products.

This sector’s ongoing growth is marked by new entrants and intensifying competition, reflecting the shift towards online shopping and heightened demand for convenience. Since its inception in 2012, Nykaa has been instrumental in leading this transformation.

In its Q1 FY25 report, the company revealed crucial financial updates, showing how it continues to progress within this evolving industry. For a deeper dive into Nykaa’s quarterly performance and the company’s forward-looking strategies, read on for a comprehensive analysis.

You may also like: The Indian fashion industry: A booming sector with huge potential

About Nykaa

FSN E-Commerce Ventures, better recognised as Nykaa, was founded by Falguni Nayar in 2012. It introduced a new approach to India’s beauty retail landscape. Beginning as a digital platform, the brand concentrated on personal care and cosmetics, rapidly establishing a strong foothold in the industry with over 6,700 brands. Its early success online quickly translated into wider expansion.

- Strategic expansion: With a network exceeding 200 outlets across India, the brand now provides an integrated shopping experience across various channels.

- Diversification: Extending beyond cosmetics, Nykaa ventured into fashion and wellness categories. Platforms like Nykaa Fashion and Nykaa Man allowed the company to attract a varied audience. By the first quarter of FY25, Nykaa had amassed a dedicated user base exceeding 35 million.

- Developing in-house lines: Nykaa created several proprietary brands, including Nykaa Naturals and Wanderlust. These offerings, shaped by market trends and customer insights, highlight the company’s relevance in the industry.

- International connections: The brand didn’t stop at domestic success. It introduced high-end international names to Indian shoppers, providing access to exclusive and premium selections. This expansion further supported Nykaa’s stature as a leader in lifestyle retail.

- Consumer-centric approach: Nykaa’s shopper-focused strategy is evident across its operations. From ensuring genuine products to offering personalised advice and thoughtful recommendations, the brand consistently strives to enhance each customer interaction.

Also read: A guide to investing in the Indian retail sector: Trends and opportunities

Nykaa Q1 performance

Nykaa’s Q1 FY25 results revealed consistent progress across its core segments. The company reported a 25% boost in consolidated gross merchandise value or GMV, largely propelled by the beauty division, which climbed 28% year-over-year (YoY). Despite a more subdued demand environment, the fashion arm showed strength, achieving a 15% rise during the same timeframe. Revenue from operations advanced by 23%, reaching ₹17,461 million.

Profitability saw marked improvement. Earnings before interest, taxes, depreciation & amortisation or the EBITDA increased 31% to ₹961 million, with margins expanding to 5.5%. Excluding expenses like new business and corporate restructuring expenses costs, adjusted EBITDA rose by 44%, underscoring a more efficient cost structure. Net profit for the quarter hit ₹136 million, showing an impressive 150% surge.

Beauty remains a focal point for Nykaa’s business. Home brands such as Kay Beauty posted a 47% jump in GMV. On the retail side, the company added 11 new stores, bringing its physical presence to 200 locations. The Superstore by Nykaa platform, catering to business clients, expanded its reach to over 1,000 cities, reflecting a 72% upswing in GMV.

Though the fashion segment encountered some headwinds, it outpaced expectations in terms of revenue, growing by 21%. This was driven by fewer returns and higher income from services. Improved operational efficiencies within fashion led to EBITDA margins narrowing from -14.1% to -9.2%, signalling a clear trajectory towards profitability.

| Particulars (₹ Million) | Q1FY25 | Q1FY24 | YoY | Q4FY24 | QoQ |

| Revenue from Operations | 17,461 | 14,218 | 23% | 16,680 | 5% |

| EBITDA | 961 | 735 | 31% | 933 | 3% |

| PBT | 221 | 97 | 127% | 196 | 12% |

| PAT | 136 | 54 | 150% | 91 | 49% |

Source: Nykaa Investor Presentation (Q1FY25)

Here are some of the strategic moves by the logo in this quarter:

- Increased investment in Dot & Key: The company raised its ownership in Dot & Key by 39%, investing ₹265 crores to hold a 90% share.

- Majority control of Earth Rhythm: Nykaa now holds a controlling interest in Earth Rhythm after a ₹44.5 crores investment. Previously holding 18.57%, this additional share shows strong belief in the clean beauty venture’s sustainability-driven model.

- Streamlining fashion operations: The transfer of the Western Wear and Accessories segment from Nykaa Fashion Limited to FSN E-Commerce Ventures Limited was completed, building on the earlier consolidation of athleisure and lingerie lines. This restructuring centralises operations, mirroring how the retailer has aligned its beauty brands under one roof for more cohesive management and streamlined growth.

You may also like: Honasa Consumer Q1 2024 results

Nykaa share price performance

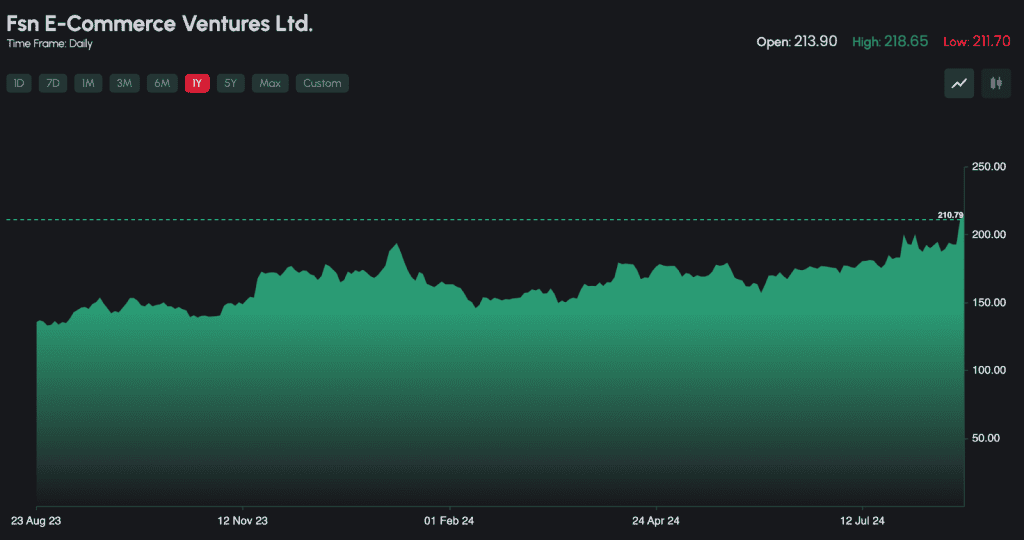

Recently, FSN E-Commerce Ventures experienced a significant boost in market activity. On Wednesday August 21-2024, its stock soared by 18.6%, climbing to ₹228.30, marking its highest value since late 2022. By the session’s close, the company’s shares had settled at ₹210.79.

This performance sharply outpaced the modest 0.13% rise in the BSE Sensex and 0.38% of the Nifty 50. Though still far from the record peak of ₹429 reached in November 2021, recent market momentum suggests a renewed sense of confidence. It appears stakeholders are responding positively to the company’s strategic focus on expanding its beauty portfolio and strengthening its position in fashion and wellness.

Nykaa’s share price has seen a substantial 61.23% rise over the past year as of August 22, 2024.

Source: Cogencis iInvest

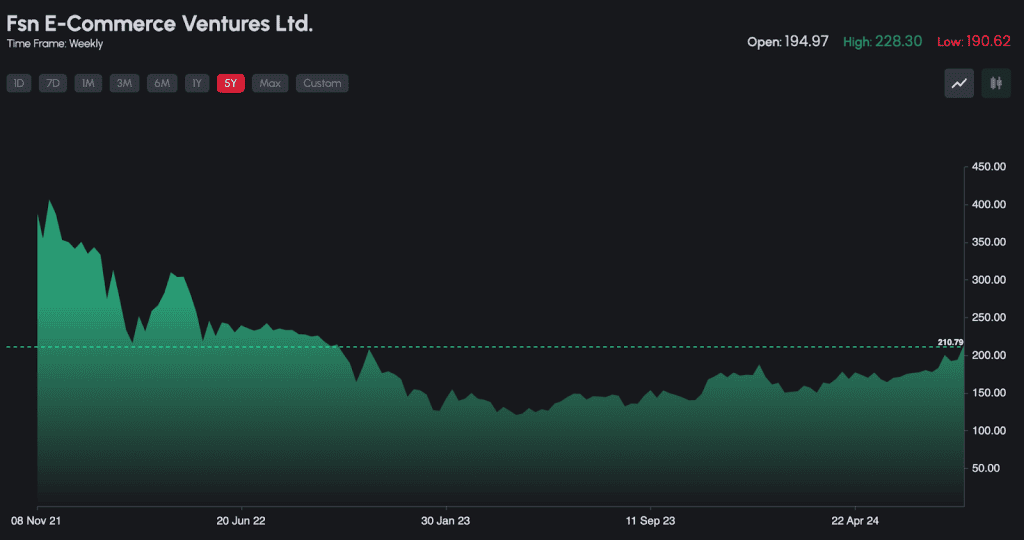

Over a five-year period, the stock has gained 13.33%.

Source: Cogencis iInvest

Bottomline

Nykaa’s Q1 FY25 results showcase strong advancements across its key areas, propelled by strategic investments and focused growth plans. The stock has seen a marked recovery, signalling potential for further upside. Yet, future performance will depend on how well the firm adapts to shifting market conditions and maintains its operational strength.