Paytm, once a titan in India’s digital payment sector, has faced a turbulent journey. Initially lauded for its innovative services, it has recently encountered several challenges.

Despite leading UPI transactions with 283.5 crore received and 41 crore remitted in December, recent RBI restrictions have raised serious concerns. The RBI’s order to stop accepting fresh deposits and credit transactions has raised concerns about Paytm’s long-term sustainability.

See the events that are affecting the unicorn’s existence in more detail.

The rise of Paytm

Paytm was launched in 2010 by Vijay Shekhar Sharma as a mobile-first digital payment platform. Initially, it aimed to facilitate prepaid mobile and DTH (direct-to-home) recharges.

The acronym for the business is “Pay Through Mobile.” Making cash payments easier to use and more accessible for people all over India was the aim. Over time, Paytm expanded its services significantly.

By 2013, Paytm introduced debit card and postpaid mobile payments. A significant breakthrough came in 2014 when the company launched its wallet system. This move attracted major services like Indian Railways and Uber to accept Paytm payments.

The user base grew rapidly. By 2015, this number had skyrocketed to 100 million. The launch of the Paytm wallet was a game-changer, making digital payments widely accessible.

In 2016, India’s demonetization of ₹500 and ₹1,000 notes provided an unexpected boost. With cash suddenly scarce, people turned to digital payments. Paytm quickly became a household name, capitalising on this shift.

Paytm’s reach extended to small merchants who adopted its QR code system. This allowed easy digital payments, linking directly to their bank accounts. The simplicity and convenience made it popular among businesses of all sizes.

With over 100 million app downloads by 2017, Paytm became the first payment app to accomplish this feat. The company continued to expand its offerings, including movie and flight tickets, gold purchases, insurance, and remittances.

Investors were enthusiastic. Alibaba’s Ant Group, Masayoshi Son’s Softbank, and Warren Buffett’s Berkshire Hathaway invested, pushing Paytm’s valuation to over $16 billion by 2019. These investments supported further growth and diversification of services.

Paytm Payments Bank (PPBL) was introduced by Paytm in 2017. This added another layer to its services, combining banking with digital payments. The bank aimed to reach unbanked populations and provide a seamless banking experience.

Also read: The rise of BharatPe: India’s leading fintech company

Paytm’s IPO: A turning point

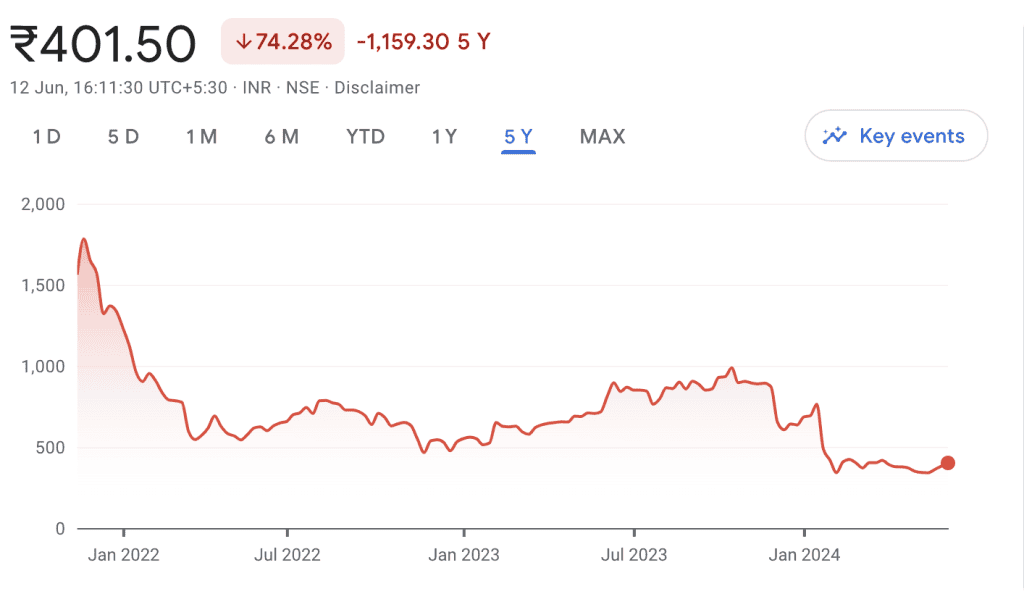

In November 2021, Paytm launched its Initial Public Offering (IPO), through its parent company One97 Communications, aiming to raise ₹18,300 crore. As far as IPOs go, this was the biggest in Indian history after Life Insurance Corporation. The stock was offered at ₹2,150 per share.

On its debut, the stock closed down over 28% from its issue price. This immediate drop wiped out significant investor wealth and raised concerns about the company’s valuation.

The IPO marked a major turning point for Paytm. It was intended to showcase the company’s strength and market potential. Instead, it highlighted underlying issues that worried investors.

The stock price continued to fall, and by March 2022, it had lost more than 75% of its value from the IPO price. This steep decline was alarming for shareholders and market analysts alike.

Investors were dismayed by the sharp drop. Many questioned the company’s ability to generate profits and sustain growth. The initial excitement around the IPO quickly turned into disappointment.

The aggressive pricing of the IPO was a significant factor. Paytm’s valuation appeared overly optimistic, leading to scepticism. Analysts argued that the stock was mispriced from the start.

Paytm case study: Key factors for downfall

Regulatory non-compliance issues

Paytm faced significant regulatory challenges starting in 2018. The Reserve Bank of India (RBI) flagged the company for multiple violations, including non-compliance with KYC (Know Your Customer) norms.

In June 2018, the RBI halted the opening of new accounts due to compliance issues. By 2021, the bank was fined ₹1 crore for submitting false information. Despite an external audit, further lapses were found in technology and cybersecurity. In October 2023, another fine of ₹5.39 crore was imposed.

These persistent operational shortcomings resulted in repeated regulatory interventions, including bans on onboarding new customers and other banking activities. This constant pressure hindered Paytm’s ability to function smoothly and grow.

The RBI’s final crackdown on PPBL was severe. On January 31, 2024, the bank was instructed to cease accepting deposits, top-ups, and offering certain banking services by February 29, 2024.

The directive to halt new deposits and top-ups in PPBL disrupted its core operations. This forced the company to shift its banking activities to other financial institutions, significantly impacting its business model and revenue streams.

Strategic missteps

Paytm’s strategy to diversify into various financial services, such as credit, insurance, wealth management, and FASTag, did not yield the expected results. The Indian stock market and public shareholders found it challenging to understand and value this business model, further complicating Paytm’s post-IPO journey.

Market competition

The company was up against fierce competition from other online payment services like PhonePe and Google Pay. These competitors offered similar services, often with fewer regulatory hurdles and more straightforward business models. This increased competition further eroded Paytm’s market share and profitability.

Technological and operational lapses

PPBL also struggled with technological and operational issues. The RBI identified lapses in cybersecurity and IT infrastructure, which posed significant risks to customer data and transaction security. These deficiencies undermined user trust and added to the company’s operational challenges.

Political and economic climate

The broader political and economic environment also played a role. Regulatory crackdowns on financial institutions, particularly those with ties to Chinese investors, created additional pressure. Antfin, an Alibaba affiliate, held a significant stake in One97 Communications, raising concerns amid strained India-China relations.

You may also like: India’s UPI expansion and the call for local fintech empowerment

Paytm share news

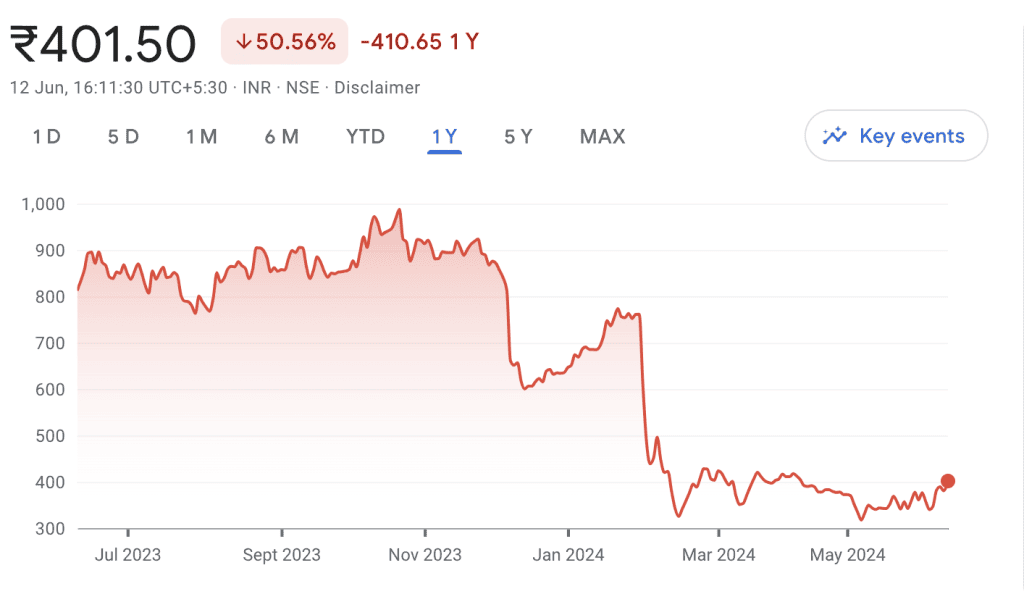

Paytm shares experienced significant volatility, dropping 9% on February 6 to a record low of ₹395.50 before rebounding 19%. The RBI’s regulatory actions severely impacted the parent company, One97 Communications Ltd., causing a 36% decline from January 31 to February 2, 2024. This resulted in a ₹17,378.41 crore market cap loss.

When we look at Paytm’s share price history, continuous declines saw shares hit a 10% lower circuit on February 5, 80% below the IPO price. Major investors like Softbank, Ant Group, and Berkshire exited their stakes, reflecting waning investor confidence amidst ongoing regulatory challenges.

As of June 12, Paytm share price stands at ₹401.50. Over the past year, the Paytm share has had a negative return of 50.56%.

And Paytm’s share gave a 74.28% negative return over five years.

To know more: Why is Paytm’s share price falling? How will this impact you?

Bottomline

The cumulative effect of regulatory fines, bans, and operational challenges led to a significant loss of trust among users and partners. This erosion of trust, coupled with negative media coverage and ongoing regulatory scrutiny, weakened Paytm’s market position.

The company’s future course will be decided by how well it handles these problems and regains the trust of its stakeholders.