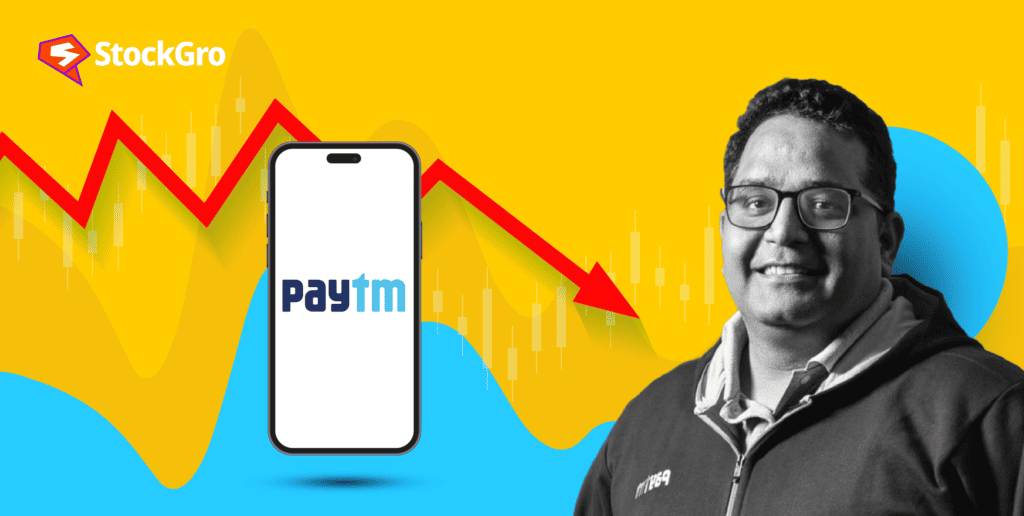

For the third consecutive day as on 5th February, One 97 Communications, the parent company of fintech behemoth Paytm, saw its shares plummet, hitting the lower circuit. On the BSE, shares dipped by 10% to ₹438.35, with only sellers in the market as the downward trend persisted.

Now, Paytm’s stock is down by 56% from its peak in the past year. As of 5th February 2024, it was about 80% less than its original IPO price of ₹2,150.

All this comes after the Reserve Bank of India (RBI) made an unexpected announcement regarding Paytm Payments Bank on the evening of 31st January.

But why did the RBI take such a bold step, and how will this impact Paytm users and investors? Let’s find out in this article.

About One 97 Communication

One97 Communications is an Indian tech company based in Noida. It was set up by Vijay Shekhar Sharma in 2000 as a service called Paytm, which stands for ‘pay through mobile,’ giving people a way to recharge their mobiles.

Coming from Aligarh district, Uttar Pradesh, Vijay Shekhar Sharma was inspired by Alibaba and its leader, Jack Ma, whose focus was on mobiles over desktops. This drove him to create a digital payment company allowing Indians to use their cell phones easily for many tasks. From buying veggies and handling utility bills to cinema tickets, it made transactions simple.

In 2011, he launched wallet services, but Paytm’s real growth happened in 2016. That’s when demonetisation happened in India.

The company offers financial and digital payment services through its subsidiaries and businesses to consumers and merchants. It also helps merchants with mobile advertising and marketing. Plus, it aids in mobile payments.

In 2018, Sharma secured a big investment for Paytm, $300 million from Warren Buffett’s company, Berkshire Hathaway.

Also read: What’s driving India’s no. 1 payment giant, Phonepe shift to stock broking?

Why is Paytm’s share price falling?

On the 31st of January, 2024, the RBI unexpectedly directed Paytm Payments Bank Ltd (PPBL) to immediately halt the enrollment of new customers. This move was seen as an unexpected blow to Paytm Payments Bank.

The RBI’s directive effectively barred the bank from conducting any banking activities, including deposits, wallet top-ups, credit transactions, bill payments, and FASTags, after February 29.

Further, the Paytm wallet customers will be able to use their money until February 29 or until their balance is depleted. This development follows the RBI’s observation of fabricated compliances, anomalies in adherence to Know Your Customer (KYC) standards, and intra-group transactions within PPBL.

Further, there were reports that there was an investigation by the Enforcement Directorate into One97 Communications Ltd. However, the company refuted these allegations.

All about Paytm Payments Bank

Paytm Payments Bank, which received its licence in 2015, is a specialised banking entity. It works as a key banking partner for Paytm, holding money in the popular Paytm digital wallets.

The bank has over 100 million verified KYC users and it has issued the most FASTags in India, i.e., more than 8 million.

One97 Communications owns 49% of Paytm Payments Bank, and the rest, 51%, belongs to the founder of Paytm, Vijay Shekhar Sharma.

Why did RBI take such a harsh action?

PPBL has been under the regulatory lens of the RBI since 2018. Despite its positive inception in the aftermath of the 2016 demonetisation, the bank encountered regulatory hurdles within a year of its operation.

The RBI was compelled to impose a temporary suspension on the initiation of new accounts in June 2018, triggered by non-adherence to Know Your Customer (KYC) guidelines, violations of licensing conditions, etc.

The RBI conducted an examination of PPBL and its parent company due to suspicions of inadequate information barriers within the group. This concern extended to data access by entities located in China, who indirectly held shares in the payments bank via their investment in the parent company.

During a recent audit, the RBI found that 31 crore of the 35 crore Paytm wallets were inactive.

The inspection also revealed several worrying issues such as:

- Multiple accounts linked to a single PAN card,

- Breaches of KYC-anti-money laundering regulations,

- Lack of KYC for hundreds of thousands of accounts, and

- The submission of inaccurate compliance reports by the bank, among other serious concerns.

These findings led the regulator to impose stringent restrictions on the bank, effectively bringing its operations to a halt.

Must read: Breaking the records: Netflix’s subscriber list has hit a new high!

How did the company respond?

Paytm is rapidly addressing RBI’s instructions and is collaborating with the regulator to resolve issues promptly.

Moving ahead, One97 Communications will not be working with Paytm Payments Bank but will partner with other banks. Paytm gave an assurance that services like insurance distribution, loan allotment, and equity broking are not linked to PPBL. They expect these services to remain unaffected.

In the worst scenario, RBI’s decision could cost the company ₹300-500 crore on its yearly EBITDA.

How will this impact customers and investors?

According to RBI, all the customers will be able to withdraw or utilise their balances from their Paytm accounts until February 29. After that, they will not be able to withdraw their balances including FASTags.

This action will also lead customers to switch to Paytm’s competitors like PhonePe, Mobikwik, ICICI Bank, SBI, Amazon Pay, etc.

Talking about investors, they are already severely impacted by the downfall of Paytm’s share price. Plus, many investors are only concerned about Paytm share price news.

Also read: Here’s everything you need to know about MobiKwik’s upcoming IPO

How did the action impact the stock’s price?

If we look at Paytm’s share price history, as of 5th February 2024, the share price was about 80% less than its original IPO price of ₹2,150.

Investors have seen the downfall of Paytm’s share price for the 3rd consecutive day. On 1st and 2nd February, the price of the share hit a lower circuit of 20%. On 5th February, the shares dipped further by 10% to ₹438.50, losing over 42% in 3 days.

Bottomline

So, will Paytm shares go up? What’s next? It goes without saying that Paytm, a massive fintech firm, is bracing for challenging times ahead. Its once-celebrated status in India’s digital payment landscape is not secure anymore.

Vijay Shekhar Sharma, the founder, is standing at a critical point which will set the direction of the company’s future. We’ll have to wait and watch if Paytm can become the symbolic figure of India’s digital payments story once again.