Stock overview

| Ticker | PAYTM |

| Sector | Fintech/Digital Payments |

| Market Cap | ₹ 52,115 Cr |

| CMP (Current Market Price) | ₹ 810 |

| 52-Week High/Low | ₹ 1,063 / 310 |

| Beta | 1.6 (High volatility) |

About Paytm

Paytm, operated by One 97 Communications Ltd., is a leading fintech platform in India with operations across:

- Digital Wallet & UPI Services

- Merchant Acquiring & QR Payments

- Financial Services (Lending, Insurance, Investments)

- Commerce and Cloud (Ticketing, Advertising, CRM, etc.)

Founded in 2010, Paytm has built one of the largest digital ecosystems in India. However, recent regulatory actions by the RBI and market pressure have put the company under intense scrutiny.

Primary growth factors for Paytm

1. Expanding merchant network

- Paytm has over 3.5 crore merchant partners, with robust traction in Tier 2/3 cities. Subscription-based Soundbox services have gained significant momentum.

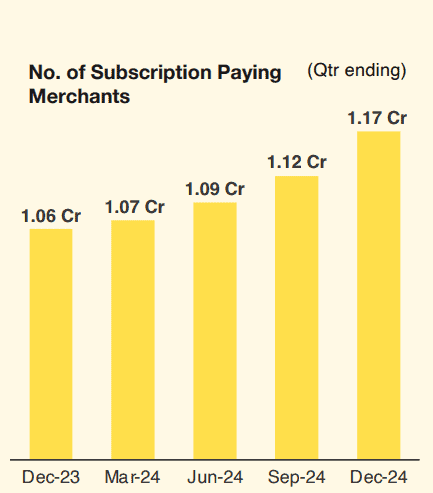

- The number of merchants paying subscription revenue to Paytm is also on the rise as indicated in the table below :

2. Credit & Lending services

- Paytm partners with NBFCs to offer personal and merchant loans. However, post-RBI restrictions on Paytm Payments Bank, this segment is under re-evaluation.

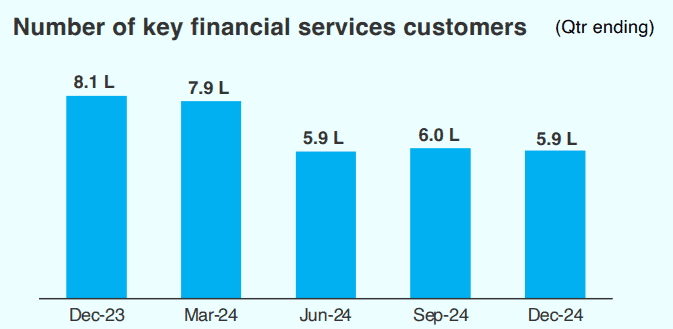

- Below is the trend of number of key financial service customers on a QoQ basis :

3. UPI leadership

- While NPCI data places Paytm behind PhonePe and Google Pay, it retains a significant market share, especially in offline QR-based payments.

- Payment processing margin was above 3bps guidance and is expected to be 5-6 bps (including UPI incentives) for FY 2025

- New device sign ups comfortably above January 2024 run-rate.

- Continuing strategy of picking up inactive devices and redeploying them after refurbishment for next 1-2 quarters. Refurbishment costs are much lower than capex for new device

4. Data monetisation & Cross-Selling

With access to a massive user base and transaction data, Paytm cross-sells insurance, mutual funds, and loans through its platform.

Loan distribution

- Strong interest of lenders in DLG model, which will help to increase disbursements with existing and new partners.

- DLG portfolio outstanding AUM of ₹4,244 Cr versus ₹1,651 Cr in last quarter Merchant Loan:

- Continue to see better collection efficiencies as they distributed ₹3,831 Cr, versus ₹3,303 Cr in Q2 FY 2025 with a significant portion under DLG Model Personal Loan.

- Reduction in disbursements (₹1,746 Cr versus ₹ ₹1,977 Cr in Q2 FY 2025) on account of tightening risk policies by lenders.

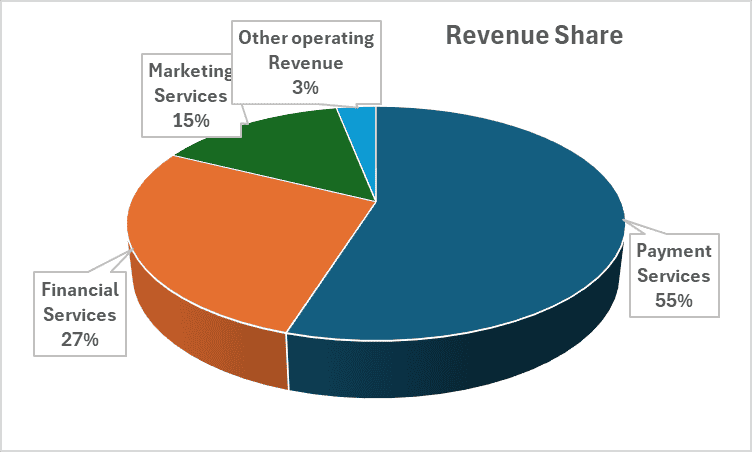

5. Diversified revenue streams

- Commerce (event ticketing, travel bookings)

- Enterprise services (CRM, advertising, AI-driven tools)

- Here are the revenue streams of Paytm :

Q3 FY25 Financial Performance

| Metric | Q3 FY 25 | YoY Growth | QoQ Growth |

| Revenue | 1,828 cr | -36% | 10% |

| Direct Expenses | 869 cr | -35% | 13% |

| EBITDA | -41 cr | -119% | -78% |

| Registered Merchants | 4.3 cr | 10% | 2% |

| Payment Devices | 1.17 cr | 10% | 4% |

| Loans Distributed | 5,577 cr | -31% | 6% |

- Revenues grew strongly due to increased merchant payments and financial services.

- Despite topline growth, profitability remains elusive due to regulatory constraints and higher costs.

Detailed competition analysis for Paytm

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Paytm | 52,115 Cr | ₹ 1,828 cr | NA | -9% |

| PB Fintech | 67.470 Cr | ₹ 1,291 cr | 28x | 39% |

| InfoEdge | 82,889 cr | ₹ 722 cr | 129x | 4% |

| One Mobikwik | 2,205 cr | ₹ 269 cr | 157x | 9% |

- Despite Paytm’s leadership in payments, profitability and valuation concerns keep it at a discount to tech peers like Zomato.

Company valuation insights: Paytm

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Paytm shares based on expected future cash flows:

- Intrinsic Value Estimate: 870 per share

- Upside Potential: 13%

- WACC: 8.7%

- Terminal Growth Rate: 3.9%

Given the company’s lack of profits and high volatility, valuation remains speculative.

Major risk factors affecting Paytm

1. Regulatory overhang: The RBI has banned Paytm Payments Bank from onboarding new customers and mandated a stop to most operations by March 15, 2025. This severely impacts the fintech backbone of Paytm.

2. Profitability concerns: Despite strong revenue growth, Paytm continues to post significant losses. The path to sustainable profit remains uncertain.

3. Market share loss: Competitors like PhonePe, Google Pay, and BharatPe are aggressively acquiring both users and merchants.

4. Dependency on lending partners: Regulatory clampdown or credit quality issues in lending partners can negatively impact loan distribution volumes.

5. Investor sentiment: Volatility due to news flow and regulatory issues may keep institutional investors cautious in the near term.

Technical analysis of Paytm

- Resistance: ₹845

- Support: ₹750

- Momentum: Neutral, Bullish

- RSI (Relative Strength Index): 50 (Neutral)

- 50-Day Moving Average: ₹785

- 200-Day Moving Average: ₹660

The stock has shown signs of accumulation post regulatory dip and is trying to stabilize above ₹800. A breakout above ₹880 could see a rally toward ₹950–970.

Paytm stock recommendation by Ketan Mittal

Price Target: ₹870 (12–15 months)

Outlook: Cautiously optimistic

Recommended Action: Speculative Buy (for high-risk, long-term investors)

Rationale:

Paytm is pivoting toward profitable segments such as merchant subscriptions, soundbox deployments, and financial services distribution

Rationalising of costs post-RBI clampdown on its Payments Bank.

Cash-rich balance sheet (~₹8,650 crore as of Q3 FY25), strong brand recall, growing merchant base, and positive contribution margins in core businesses.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Paytm remains a high-risk, high-reward play in India’s digital financial ecosystem. While short-term volatility due to regulatory issues is inevitable, the core business remains intact, and the shift toward profitability is encouraging.

Investors with a high-risk appetite and long-term vision may consider accumulating gradually, especially on further dips, as the business stabilises post-Payments Bank phase-out. Clarity on regulatory compliance and consistent execution will be key triggers going forward.