Paytm, one of India’s leading digital payment platforms, has been making headlines recently, but not for the reasons investors might have hoped. The company’s shares took a significant hit following the resignation of its Chief Operating Officer and President, Bhavesh Gupta, just days before the release of its highly anticipated Q4 results.

As the company gears up to release its Q4 financial results, investors are closely watching for any signs of turbulence or potential opportunities amidst the uncertainty.

In today’s article, we have analysed Paytm’s current financial position, competitors, and investment prospects in detail. Let’s get started!

About Paytm

Paytm or “pay through mobile,” was founded under the organisation One 97 Communications Ltd. Among India’s most prominent consumer and business-facing digital ecosystems, One 97 Communications Ltd. has been around since the 2000s.

The business facilitates mobile payment processing for both customers and businesses using a variety of channels, including internet payment gateways, QR code payment, Payment Soundbox, and Android-based payment terminals. Paytm also provides businesses and customers with financial services, including pay later via partnerships with financial institutions.

Ticketing, retail brokerage goods, and online gaming are some of the other services offered by the organisation.

More than 20 million companies and merchants use Paytm to accept digital payments. Why? Because over 300 million Indians have already used Paytm to make in-store purchases. Beyond that, the Paytm app is used to pay bills, recharge, send payments to friends and family, book cinema tickets and trips, and more.

Also read: Telecom industry in India: An overview of growth and opportunities

Paytm share news: Paytm share price drops after President’s resignation before Q4 results

Following the resignation of Bhavesh Gupta, the Chief Operating Officer and President of digital payments and financial services startup Paytm, the company’s stock dropped more than 4.5% on May 6 in a regulatory filing.

As per the document, Gupta announced in a letter that his resignation would take effect on May 31, 2024, at the latest, after working hours. But he did say that he plans to keep helping out the business in an advisory role for the CEO.

At the same time, Paytm has promoted Varun Sridhar to the position of Chief Executive Officer of Paytm Services Private Limited (PSPL) and Rakesh Singh to the position of Chief Executive Officer of Paytm Money.

Paytm Money and PSPL, which are both owned by One97 Communications, the parent company of Paytm, provide their consumers with a range of wealth management options, including stock brokerage and mutual fund investing.

Bhavesh Gupta’s step-down announcement came just days before releasing Paytm’s Q4 results for FY24. Moreover, the affiliated entity, Paytm Payments Bank Ltd. (PPBL), was subject to regulatory constraints imposed by the Reserve Bank of India (RBI), which is generally believed to have affected the quarterly earnings.

The mobile wallet business of the company has come to a complete standstill due to the regulatory action against Paytm Payments Bank.

The platform has seen a sharp drop in transactions over the past three months as users gradually exit the Paytm Payments Bank wallet ecosystem, even though it cannot add new members per RBI’s regulation. This has also impacted the company’s share price.

According to Paytm’s share price history, the stock has dropped 60.42% in the last 6 months and 77.65% in the last 5 years.

Current financials

| Metric | Value (as of 06 May 2024) |

| Market cap (₹ Cr.) | 22,321 |

| Net profit (₹ Cr.) | -1,113 |

| Book value (₹) | 196 |

| ROCE | -13.5 % |

| ROE | -13.9 % |

Also read: Why is Paytm’s share price falling? How will this impact you?

Investing in Paytm

Pros

- Strong growth momentum in financials till 2023:

While one will see a slump in the numbers in Q4 and ongoing numbers, one needs to see the business model and shift it aims to achieve.

The signals from past financial performance have been positive as below:

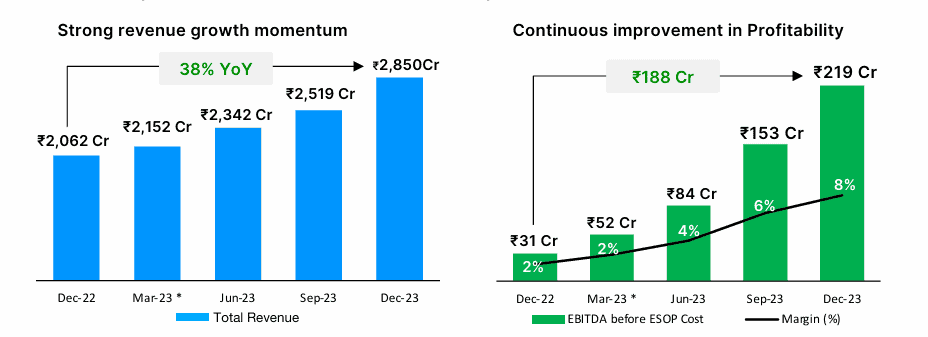

In Q3 FY24, Paytm reported revenue of ₹2,850 crore, marking 38% year-over-year (YoY) growth mainly because of faster GMV growth, more devices being introduced, and the financial services sector expansion.

The revenue from payment services increased by 45% year-on-year to ₹1,730 Cr, while the revenue from financial services and others increased by 36% to ₹607 Cr. It seems that PAT has reduced losses, as it reported an improvement of ₹170 Cr YoY to ₹222 Crore.

With an increase of 6% year-on-year, EBITDA before ESOP expenses increased from ₹188 Cr to ₹219 Cr, resulting in an 8% margin. The rise in merchant subscription earnings and improvement in payment processing margin have contributed to a 63% year-on-year increase in net payment margin, reaching ₹748 Cr.

Also read: EBITDA explained: Definition, calculation, significance, and more

- Brand recognition:

Inspite of the regulatory clampdown, recently when its wallet business has been hit, Paytm continues to survive on brand recognition among customers. For the general public, this reflects well on the Paytm brand and the services it offers.

Paytm will have to strongly consolidate its existing and surviving businesses such as cross-selling of investments, broking, movie tickets, mall services and cloud services.

This also presents an opportunity for Paytm for becoming a consolidated market player.

Cons

- There are questions about the stability and dependability of Paytm due to the regulatory inspections from the RBI. Investors need to be concerned with future compliance of Paytm and how it handles the loss of wallet and payments bank businesses.

- The recent directive from the RBI might have a significant effect on Paytm’s lending business as well if partners decide to scale down their business activities because of concerns about governance and operations. More importantly, Paytm has not had a strong relationship with the regulator, and moving ahead, their lending partners may also reconsider.

- Seasonal variables, such as stronger promotions over the holiday season, a higher mix of business activities, and somewhat lower payment processing margins normally observed during the festive season, contributed to a 7% quarter-on-quarter growth in contribution earnings but a 3% reduction in margin.

- The RBI clampdown has resulted in a decline in the previous two years in book value per share, which might impact investor trust. The stock has significantly declined from its 52-week high, which may indicate future volatility and risk for buyers.

It would be wise for investors to keep a close eye on Paytm to see how the business handles the RBI’s mandate and how it affects its lending operations and financial health in general.

Conclusion

The recent developments at Paytm have undoubtedly added an element of uncertainty to the company’s prospects. In such a scenario, should Paytm shareholders view this as a temporary setback or a warning sign of deeper issues? Only time will tell how the company handles the woes.

While Paytm’s Q4 results and the resignation of its president have added to the speculation, it is essential to remember that the company remains a significant player in India’s digital payments sector.