The world has scarce resources and unlimited wants to fulfil them. Over the years, money has grown to become the most crucial resource for humans. It becomes the medium of exchange for almost all other resources. However, it is highly unequally divided.

Similar is the case with India, where income inequality is increasing with the population. Nearly 129 million people are living in conditions of extreme poverty in the country as of 2024. The government seeks to curb this issue by launching various schemes.

In 2020, one such scheme was launched to support street vendors during the pandemic lockdown period. It is known as ‘PM Street Vendor AtmaNirbhar Nidhi Yojana’. It aims to provide microfinance aid to street vendors to improve their living conditions. Let’s understand this PM SVAnidhi loan and its facets in detail.

Explore more: Addressing the racial wealth gap through financial literacy initiatives

What is PM SVANidhi yojana?

It is a microfinance loan provided under the scheme of the ‘Ministry of Housing and Urban Affairs’ to the street vendors in the urban areas. During the pandemic, lockdown shut down the business of many street vendors. Due to this, they had to move from urban to rural areas, and their living standard depleted in the process.

However, the government started this PM SVANidhi Yojana to provide a collateral-free loan to these vendors. It is a working capital loan to re-establish the affected business.

How does it work?

In the PM SVANidhi loan, a street vendor like barbers, cobblers, thelewala, etc., are extended credit for 1 year to purchase related goods and raw materials or set up the service. The scheme is divided into three trances based on the loan amount:

- 1st trance: ₹10,000

- 2nd trance: ₹20,000

- 3rd trance: ₹50,000

After the successful and timely repayment of the first stance, the second can be provided, and consecutively, the third.

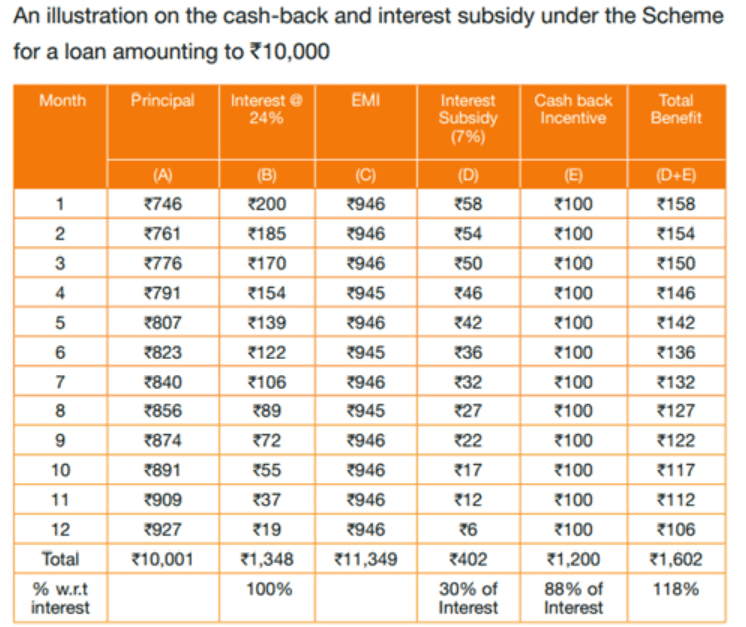

Apart from this, the scheme extends different facilities such as a 7% subsidy on interest, cashback up to ₹1,200 for digital transactions and seamless access with Aadhar card.

Source: PM SVANidhi

Investors can avail of this loan through online portals, Common Service Centres, banks, municipal bodies, etc. 66,79,361 street vendors benefited from this scheme as of Jan 9, 2024. The highest share of nearly 20% of these beneficiaries belong to Uttar Pradesh.

Eligibility

Street vendors should have at least one of the following documents provided by Urban Local Bodies or Local Vending Committees:

- Certificate of Vending

- Identity card

- Identification in a survey on the online platform.

- Letter of Recommendation

Apart from these documents, the Aadhar card and its mobile linking are the basic necessities for street vendors. These documents can be submitted online on the PM SVANidhi Yojana portal. Moreover, banks, Non-Banking Finance Companies (NBFCs), post offices, and municipal offices also help avail this scheme.

Check this: The UIDAI has released new rules for Aadhaar updates. Check them out here!

Process to apply for PM SVAnidhi Yojana

Street vendors can follow these easy steps to apply for the scheme:

Step 1: First, check whether your mobile number is linked to the Aadhar card. It is a basic and compulsory requirement. Individuals can visit the nearest post office, ward office or authorised bank for the same.

Step 2: Download the loan application form from the official PM SVANidhi yojana portal or visit the nearest centre to avail the same.

Step 3: Check the eligibility with the Survey Reference Number (SRN). There would be four categories based on available documents such as certificate of vending and letter of recommendation.

Step 4: Fill out the form details and submit documents for ‘Know Your Customer’(KYC).

Step 5: After checking this form, the loan will be disbursed within some days.

Individuals processing like this for the first time need can avail loans up to ₹10,000 only. One should plan timely repayment to be eligible for the next loans of ₹20,000 and ₹50,000.

Benefits

The scheme has potentially supported several lives during the tough times of covid-19 pandemic. It helps street vendors get financial support without a difficult registration process and is based on a simple Aadhar card document. Moreover, it incentivises the discipline repayment by interest subsidies. It also encourages digital payment by providing cashback. Overall, the scheme aims to uplift the living standards of vendors affected by lockdown.

Bottomline

The PM SVANidhi loan assistance provided by the government can provide a potential start for street vendors. ₹10,000 working capital can help them set up their goods, services or raw materials. Individuals should link their mobile to their Aadhar card, and have suitable documents to avail the loan. The growing reach of this scheme indicates that it can be a positive step towards combating the income inequality issue.

Also, read Empowering small businesses: A dive into government loan schemes in India

FAQs

- What benefits are covered under PM SVAnidhi Yojana?

It is a micro finance scheme, focusing specifically on street vendors. It provides loans which do not require collateral and at comparatively low interest rates. Being a government scheme, benefits like medical expense waivers, timely payment incentives, etc., are available.

- How much of a loan can be obtained under PM SVAnidhi Yojana?

It is a working capital loan. When the borrower avails this loan for the first time, it can be a maximum ₹10,000. On its timely payment, he/she can avail ₹20,000 loan and post this loan can be of ₹50,000.

- What is microfinance credit?

There are facilities that provide advance to individuals with low-income stature. Their income is usually unstable, and they require assistance. Microfinance helps them avail small amounts of loan with ease.

- How can microcredit schemes affect income inequality in India?

India is home to a large population and has a high income gap problem. If the people below the poverty line are assisted with micro-credit schemes, they can gradually manage their income sources. It can help reduce inequality in the country.

- How many street vendors have benefited from PM SVAnidhi yojana?

As of January 2024, the scheme has disbursed nearly 95 lakh loans to approx 66.8 lakh beneficiaries. The ease of processing and access has helped widespread acceptance of the scheme.