Prestige Estate Projects Ltd announced its Q4 results on May 28, 2024. The results showed a mixed performance. While major metrics improved on a quarterly basis, they declined on a yearly basis.

A dividend was also recommended. In this blog, let’s discuss the key highlights of Prestige Estate’s Q4 results.

You may also like: Is real estate growth in India sustainable? Opportunities vs Challenges!

Company overview

Prestige Estate Projects Limited, part of the Prestige Group, is one of South India’s top real estate developers. Prestige Estates and Properties was its original name when it was founded in 1986. In 1997, it changed to a private limited company, and in 2009 it went public.

The company is run by Mr. Irfan Razack and his brothers, who together own 65.48% of the shares as of March 2024. Institutional investors, along with public shareholders, own the remaining shares.

With over 37 years of experience, the Group has established itself as a key player in the real estate sector. The company has completed 300 real estate projects, covering 190 million square feet (msf) of area.

It is currently developing 53 projects encompassing 92 msf as of March,2024. Retail, commercial, residential, and hospitality sectors are all part of their varied portfolio.

In terms of revenue distribution, the residential segment contributes 64.82% of the total revenue as of FY24. Services account for 12.05%, hospitality sector brings in 10.03% of the total revenue. Office properties contribute 3.78%, and retail properties make up 3.18% of the revenue mix.

Prestige maintains a strong presence in Bengaluru and has expanded its operations to Hyderabad, Chennai, Kochi, Mangalore, and several other cities. In addition, the business offers a range of services such as fit-out, subleasing, and property management. Their ongoing and upcoming projects ensure continuous growth and development in the real estate market.

Also read: Your guide to real estate investment trusts

Prestige Estates Q4 results

Prestige Estate reported its Q4 financial results, showcasing a mix of growth and challenges.

The consolidated revenue from operations stood at ₹2,164 crore, up 20.5% from ₹1,795.80 crore in the previous quarter. However, this was a 17.77% decrease compared to ₹2,631.80 crore in Q4 FY23.

The consolidated profit before tax (PBT) for Q4 was ₹314.50 crore, representing a 32.70% increase from the previous quarter. However, this was a 49.27% decrease from ₹620 crore in Q4 FY23.

The consolidated net profit for the period was ₹235.90 crore, up 43.23% from ₹164.70 crore in Q3 FY24 but down 53.32% from ₹505.40 crore in Q4 FY23.

| (₹ crore) | Q4 FY24 | Q3 FY24 | QoQ % | Q4 FY23 | YoY % |

| Revenue from operations | 2,164.00 | 1,795.80 | 20.50 | 2,631.80 | -17.77 |

| Total expense | 1,957.30 | 1,717.20 | 13.98 | 2,352.60 | -16.80 |

| Profit Before Tax | 314.50 | 237.00 | 32.70 | 620.00 | 49.27 |

| Profit After Tax | 235.90 | 164.70 | 43.23 | 505.40 | -53.32 |

Source: Prestige Estates Financial Results Q4FY24

Also read: Decoding GE Power India’s Q4 success: Share price surge & strategic moves

Full-year analysis

Revenue from operations for FY24 stood at ₹7,877 crore, which is a 5.27% decrease compared to ₹8,315 crore in FY23. Despite the decrease in revenue, profitability showed strong growth.

PBT increased by 50.06%, reaching ₹2,122.30 crore in FY24 compared to ₹1,414.30 crore in FY23. Similarly, PAT saw a substantial rise of 52.67%, amounting to ₹1,628.70 crore in FY24, up from ₹1,066.80 crore in the previous year. This improvement in PAT indicates a positive trend in the company’s bottom line.

A notable highlight of the year for the Group was signing a deal with ADIA Kotak AIF for ₹2,001 crore. This partnership is expected to support the company’s financial stability and expansion capabilities. Prestige acquired 62.5 acres of land at Indirapuram Extension NCR, with a development potential of 10 msf and an estimated sales potential of approximately ₹10,000 crore.

The Prestige City Hyderabad project achieved overall sales of ₹3,797 crore within just four months. This quick sales turnaround reflects the strong market response and the project’s attractiveness to buyers.

| (₹ crore) | FY24 | FY23 | YoY% |

| Revenue from operations | 7,877.00 | 8,315.00 | -5.27 |

| Total expense | 7,314.30 | 7,682.40 | -4.79 |

| Profit Before Tax | 2,122.30 | 1,414.30 | 50.06 |

| Profit After Tax | 1,628.70 | 1,066.80 | 52.67 |

Source: Prestige Estates Financial Results Q4FY24

Dividend details

Prestige Estate Projects Limited has announced a final dividend for the financial year 2023-2014. The company has recommended a dividend of 18%, equivalent to ₹1.8 per share on the equity shares of the company.

Approval by the shareholders is required for this dividend proposal. At the upcoming 27th annual general meeting of the firm, the decision will be confirmed.

Prestige Estate shares news

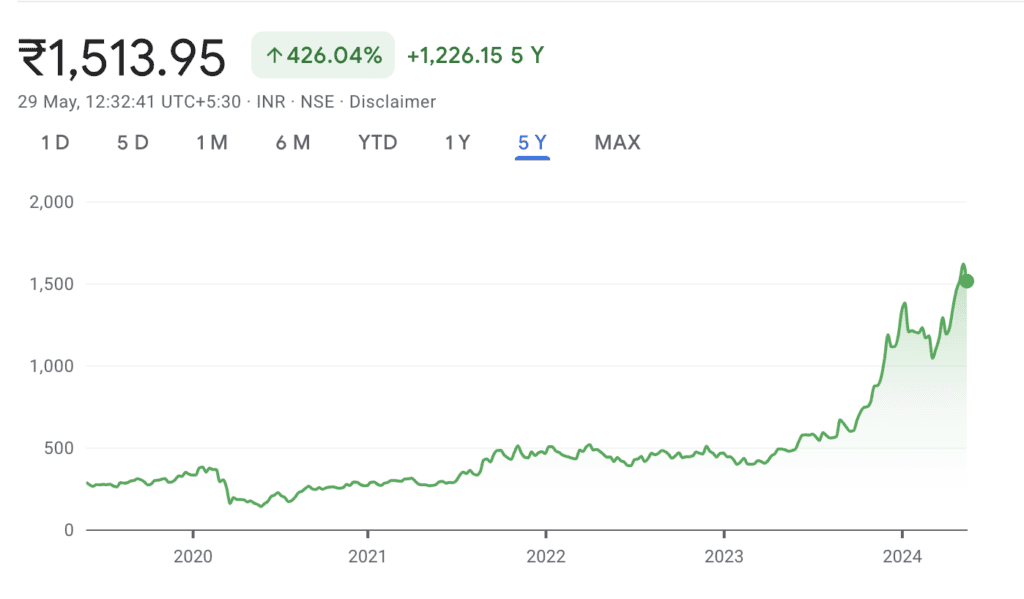

As of May 29, 2024, Prestige Estates share price stood at ₹1,516.

When examining the Prestige Estate share price history over the past year, the shares have shown remarkable growth. The Prestige real estate share price has delivered a return of 219.27% over this period.

Looking at a longer-term perspective, the performance remains robust. Over the past five years, Prestige Estate shares have provided a return of 426.04%.

Bottomline

Prestige Estates Q4 results present a nuanced picture. The quarterly improvements in revenue and profit indicate strong operational performance. However, the year-on-year declines highlight areas needing attention.

The recommended dividend underscores the company’s commitment to shareholder returns. Moving forward, investors should watch how Prestige addresses yearly declines and leverages its strong market position.