The hotel industry in India is experiencing growth, driven by a booming economy and an expanding middle class with increasing leisure spending. The country’s allure as a travel destination, bolstered by various government tourism initiatives, sets a favourable backdrop for businesses within this sector.

In this optimistic context, Kamat Hotels India Ltd., with its strong foothold in the hospitality industry, has just announced its Q4 results. For a detailed analysis of Kamat Hotels’ Q4 earnings and their implications for investors and the market, continue reading the blog.

Also read: Economics of the tourism and hospitality industry in India

About Kamat Hotels India Ltd.

Kamat Hotels, part of the Kamats Group, was established in 1986. The company specialises in the hospitality sector, offering a range of services from hotel operations to consultancy.

Kamat Hotels operates under five distinct brands, managing 16 properties across six states in India, including major cities like Mumbai, Pune, and Bhubaneswar. These brands include The Orchid, Fort Jadhav Gadh, Mahodadhi Palace, Lotus Resorts, and the recently launched IRA. The properties predominantly fall within the 4-star and 5-star categories, totalling approximately 1600 rooms with an average room rate of ₹6,500 as of March 2024.

The company’s flagship brand contributing 66% of the revenue, The Orchid, is recognised for being Asia’s first eco-friendly, 5-star hotel chain. The Orchid hotels are located in prime urban locations and cater to both business and leisure travellers.

In addition to managing its own and leased hotels, Kamat Hotels engages in contract management and operates the Orchid Loyalty program, diversifying its revenue streams.

The Kamat family, as the primary promoters, holds a significant stake of 63.34% in Kamat Hotels as of March 2024. The company was founded by the late Mr. Venkatesh Krishna Kamat and later led by Dr. Vithal Venkatesh Kamat. Today, the third generation, under the leadership of Mr. Vishal Kamat.

You may also like: Indian Hotels Company Ltd.

Kamat Hotels India Q4 results

Kamat Hotels India Ltd reported its financial results for the fourth quarter ending March 2024, showing a year-over-year revenue increase of 5.05% to ₹84.51 crore. Although this represents a slight decline of 1.82% compared to the previous quarter, revenue has surpassed pre-pandemic levels by 32%.

This notable recovery occurs in the context of the significant downturn experienced by the hotel industry during the COVID-19 pandemic.

Profit for the quarter was significantly lower, with a 99.21% decrease compared to the same period last year, resulting in a net profit of ₹2.13 crore. This represents a sharp contrast from the profit reported in the previous year’s same quarter.

Additionally, the company has achieved a substantial reduction in debt, decreasing by 39% from ₹327.3 crore in FY23 to ₹172.5 crore in FY24, significantly strengthening its financial position.

Operating income also declined substantially, down by 92.42% year-over-year. Similarly, earnings per share (EPS) for the quarter stood at ₹0.74, reflecting a decrease of 98.57% from the previous year.

This quarter saw an increase in selling, general, and administrative expenses by 29.07% year-over-year, reflecting higher operational costs. Additionally, finance costs rose due to expenses related to refinancing with Axis Finance, including one-time charges for processing and registration.

As of the end of the quarter, Kamat Hotels holds a total debt of ₹172.50 crores. Despite these challenges, the company inaugurated a new property, The Ira by Orchid, in Ayodhya on April 17, 2024, as part of its expansion strategy.

Looking forward, Kamat Hotels plans to increase its property count to 25 and the number of keys to over 2200 by FY 2025, aiming for a revenue target of ₹400 crore. The company is optimistic about improving occupancy rates and maintaining growth with the addition of upcoming properties in cities like Bhavnagar, Chandigarh, Dehradun, Noida, and Varave BK.

| (₹ crore) | Q4 FY24 | Q3 FY24 | QoQ % | Q4 FY23 | YoY % |

| Revenue | 84.51 | 86.13 | -1.9% | 80.49 | 5% |

| EBITDA | 23.32 | 26.16 | -10.9% | 30.07 | -22.5% |

| PAT | 2.13 | 41.57 | -94.9% | 271.16 | -99.2% |

Source: Kamat Hotels India Investor Presentation Q4FY24

Also read: Insights and implications from Titan Q4 results

Kamat Hotels India share price performance

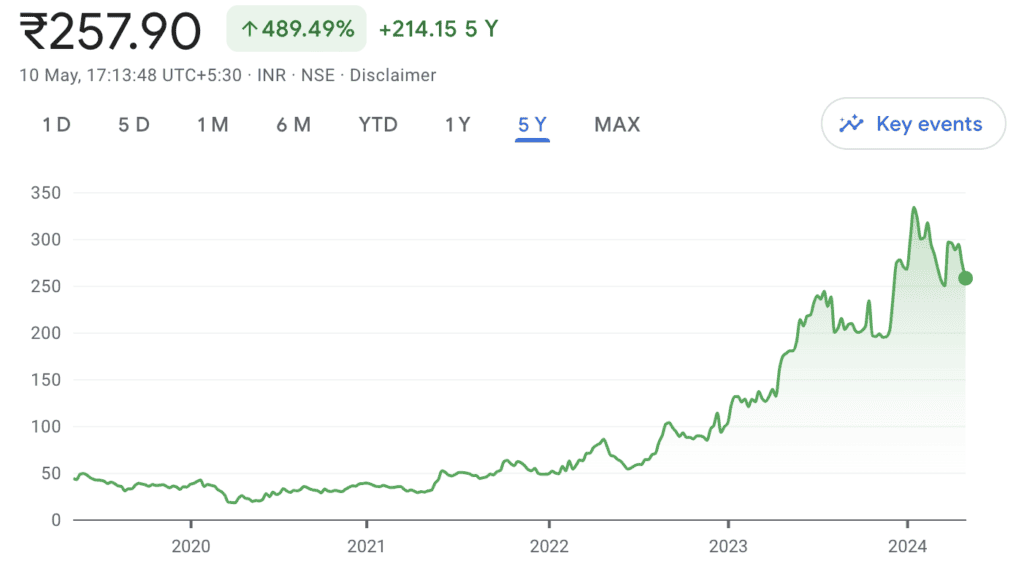

As of May 10, 2024, Kamat Hotels India share price stands at ₹257.90. Over the past year, the stock has delivered a return of 48.69%, influenced by shifts in the company’s financial health and broader market conditions.

Over a five-year period, the shares have seen a significant return of 489.49%, reflecting long-term growth. The company’s market capitalisation is ₹682.38 crore, with a 52-week high of ₹372 and a low of ₹169.

Investing pros & cons

Pros

- Improved operational metrics: According to Kamat Hotels India ltd annual report, post-COVID, the company has seen significant improvement in operational metrics such as revenue and EBITDA margins. For instance, Kamat Hotels has shown a robust recovery, with a 32% increase in revenue over pre-pandemic levels in the last quarter.

- Debt reduction: The company significantly reduced its debt by 39% from ₹327.3 crore in FY23 to ₹172.5 crore in FY24, enhancing its financial stability.

Cons

- Significant profit decline: Despite revenue growth, the company’s profit fell dramatically by 99.21% year-over-year in the fourth quarter, highlighting volatility and potential risk factors in profitability.

- Intense competition: The Indian hotel market is highly competitive, with many international chains vying for market share. This could pressure pricing, occupancy rates, and overall profitability, demanding continuous innovation and strategic positioning from Kamat Hotels.

Bottomline

Kamat Hotels India Ltd. faces a mixed landscape. The company has demonstrated resilience by rebounding in revenue and significantly reducing its debt, setting a strong foundation for future stability and growth. However, the sharp decline in profits and the competitive pressures of the Indian hospitality market present ongoing challenges.

As Kamat Hotels continues to expand and enhance its offerings, the strategic moves it makes in response to these challenges will be critical in sustaining its growth trajectory and maintaining its position in the market. Investors and stakeholders should closely monitor these developments as the company progresses towards its future goals.