Quess Corp. is an Indian business services giant undergoing an exciting transformation as the company plans to split into 3 separately listed entities. With a strong position in the market, Quess Corp. boasted revenues of ₹4841.8 crores and profits of ₹63.65 crores last quarter, ending December 2023.

Is this the right time to invest in Quess Corp.?

Learn about Quess Corp.’s history, financials, competitive position, growth prospects, and more in today’s article. Find out if this leading staffing and facility management firm can continue its success story as it splits up its business.

About Quess Corp

Since its founding in 2007, Quess Corp. Ltd. has become India’s dominant supplier of integrated business services. The organisation’s core competencies include offering services in Internet business, integrated facilities management, personnel and services, and global technological solutions.

The organisation, which has its headquarters in Bengaluru, has 83 locations spread over the whole country of India and also has activities in the Americas, the Middle East, and Southeast Asia, among other places. Quess has more than 1,700 clients all around the globe.

The Indian branch of Fairfax Financial Holdings, Thomas Cook India Ltd. (TCIL), and its chairman and managing director, Ajit Isaac, helped Quess Corp. grow.

When Quess Corp. bought Avon Facility Management Services Ltd. in 2008, it opened up a new opportunity in the facility management sector.

A significant investment was made by Fairfax Financial Holdings in Quess Corp. in 2013.

In 2016, Quess Corp. went public with an IPO and its equity shares were listed on the National Stock Exchange and the Bombay Stock Exchange. There have been 13 domestic subsidiaries, 20 overseas affiliates, 2 domestic associates, and 3 foreign associates working under the umbrella of this corporation as of 2020.

Quess Corp. was 48th among the top 100 most prominent global staffing organisations in 2021, according to SIA, and 137th on the Fortune India 500.

In the third quarter ending December 2023, Quess Corp. announced a combined net profit of ₹63.65 crore. The third quarter’s revenue was ₹4841.8 crores rupees, up from ₹4465.6 crores a year before.

Also read: Rail Vikas Nigam Ltd (RVNL) rides high with ₹ 65,000 crore order book

Quess Corp.’s share price surged over 15%: Board supports Quess Corp demerger

In comparison to ₹4465.6 crore in the same period last year, Quess Corp’s revenue for the third quarter was ₹4841.8 crore. Quess Corp. shares have increased by more than 49% in a year, compared to the Nifty 50’s increase of more than 23%.

In the morning session on February 19, Quess Corp. shares jumped more than 15% and reached a 52-week high on the BSE at ₹580 apiece. Stocks have now climbed for five consecutive trading sessions, according to the Quess Corp. share price history.

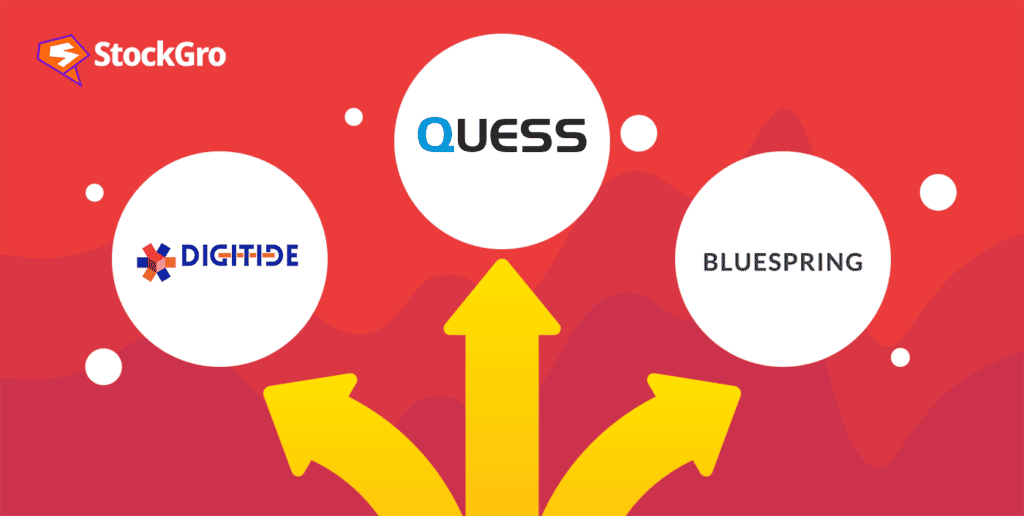

The price jump occurred after the company’s board of directors agreed to split its different business areas into three separate companies. The corporation’s board of directors accepted the demerger proposal during their meeting on February 16.

The business would demerge into three separate entities:

- Bluspring Enterprises Ltd.,

- Quess Corp Ltd., and

- Digitide Solutions Ltd.

Because of the demerger, Bluspring Enterprises, Quess Corp., and Digitide Solutions will all become separately listed companies.

After the demerger takes effect, every shareholder will get one extra share in Quess Corp. for each share held in the newly formed companies. Getting the necessary regulatory permits is anticipated to take 12 to 15 months. Management expects a 16–17% CAGR through the following three years.

According to the organisation, this allows management to target better and develop capital allocation strategies unique to that specific company, ultimately benefiting shareholders.

The plan of action as per the Quess Corp. demerger ratio:

- Workforce management will continue to be handled by Quess Corp.

- Digitide Solutions will oversee the insurtech, business process management, and human resource outsourcing companies.

- Investments, industrial services, and facility management are now Bluspring Enterprises’ areas of focus.

Also read: How is Tata Power leading the way in the PM rooftop solar scheme?

Quess Corp. competitors

Below are some of the competitors of Quess Corp. (as of February 20, 2024) based on market capitalisation (₹ cr.):

- Info Edge India Ltd. (69,095.65)

- Central Depository Services Ltd. (19,338.25)

- Jyoti CNC Automation Ltd. (14,914.41)

- Inox India Ltd. (10,487.72)

Investing in Quess Corp

Pros

- The plan to split the company into three listed companies with strong market positions, growth potential, unique strategies, and an appealing investment proposition is meant to bring out the value of each business segment, improve the capital allocation strategy, and bring in more investors.

- Quess Corp. has improved its profitability and revenue growth in the third quarter of 2023 compared to the same period in 2022. This means that Quess Corp. has increased its sales volume and market share in the business services industry. This reflects the company’s resilience and competitiveness in challenging market conditions.

- Acquisitions and strategic alliances have consistently strengthened Quess Corp.’s success, and the company has a solid plan for future expansion. Its market position is stable and serves a wide range of industries with a broad client base.

- Quess Corp.’s shareholders and board of directors have approved the demerger plan, which is in line with the company’s aim of becoming a world-class provider of business services.

Cons

- The demerger plan must be approved by regulators and meet other standard conditions. This process could take 12 to 15 months and may come with costs and risks as the business segments are split up and reorganised.

- International and domestic competitors significantly challenge Quess Corp.’s market share in the business services sector.

- Quess Corp. has a high valuation compared to its peers and the industry average. It trades at a P/E ratio of 37.65 and a P/B ratio of 3.09 as of February 20, 2023. This can mean that investors are putting a lot of confidence in the company’s future success or that it’s overpriced and might see price fluctuations.

Financials

| Metric | Value |

| Market capitalisation (₹ Cr.) | 7,947 |

| Book value per share (₹) | 173.02 |

| Dividend Yield | 1.50% |

| ROCE | 9.39 % |

| ROE | 8.73% |

| Face value (₹) | 10 |

Shareholding pattern of Quess Corp

The shareholding pattern (as of December 2023) of Quess Corp. is as follows:

Promoters: 56.65%

Foreign Institutional Investors (FIIs): 16.3%

Domestic Institutional Investors (DIIs): 10.67%

Public: 16.39%

Also read: Facilitating cross-border transactions: NPCI’s ambitious plans

Conclusion

As one of India’s top business services firms, Quess Corp. plans to demerge and expand. This transition brings opportunities but also uncertainty. With its strong position and diversified operations, Quess Corp. has potential for those with high-risk tolerance.

However, after any restructuring, investors should evaluate the competitive market scenario, financial metrics, and the company’s new corporate shape.