The textile industry in India is one of the oldest sectors of the Indian economy. It goes back several centuries. The Indian textiles and apparel market is projected to grow at a 10% compound annual growth rate (CAGR) to reach $350 billion by 2030.

Also, India is ranked as the third largest exporter of Textiles and Apparel worldwide. With exports expected to touch $100 billion, India is positioned as one of the top five global exporters across different textile segments.

Raymond Limited –a household name representing fashion and fabrics in India- became news recently when it announced a significant demerger plan. Raymond demerger news involves hiving off its real estate business into an independent entity from the company, known for its background in textiles and apparel.

Market analysts together with investors have given this strategic move attention regarding unlocking new value and streamlining operations. This article looks at the details of the Raymond demerger plan along with the Raymond’s share demerger date and the market’s reaction to it.

Also read: Textile industry in India – The foundation of fashionable clothing trends

About Raymond Limited

Raymond is a diversified group, which has the majority of business interests in the Textile & Apparel sectors and also has a presence across different segments like consumer care, realty and engineering both in national and international markets.

Raymond Limited was first incorporated as Raymond Woolen Mill in 1925 around Thane Creek. In 1944, Lala Kailashpat Singhania took over The Raymond Woolen Mill. Since then they have been known for class, elegance and individualism which is displayed in their men’s fashion.

For 97 years now, Raymond has been a textile behemoth with state-of-the-art infrastructure and strong fibre-to-fabric manufacturing capacities. Being highly reputed as well as the fastest-growing fashion fabric brand it offers an exquisite range of shirting and suiting fabrics across a variety of options such as worsted fabrics, cotton, wool blends, linen to denim.

Raymond and its brands have a presence in tier IV and V cities with more than 1500 outlets spread over 600 towns along with a vast network of over 20,000 points of sale available in India. Raymond is the world’s largest integrated textile company exporting suits to over 60+ countries including the USA, Canada Europe Japan Middle East etc.

Here’s a quick snapshot of the operational details of the company:

Source: Raymond Limited

Raymond lifestyle demerger plan

An exchange filing by the company revealed that its board had sanctioned the spin-off of its real estate operations into an entirely new entity called Raymond Realty Ltd. As per the demerger plan, each shareholder of Raymond Ltd will be entitled to one share in Raymond Realty for every share held in the textile business.

BSE and NSE will display the listing for Raymond Realty. The Raymond demerger record date is July 11, 2024.

This Raymond demerger date was announced on Thursday, 4th July 2024. The corporate board approved the demerger of the real estate business into a wholly-owned subsidiary Raymond Realty Limited (RRL), and the automatic listing of such a new company. To its existing shareholders in Raymonds Ltd., RRL would issue 6,65,73,731 shares having a face value of ₹10 per share issued.

After the Raymond share demerger, Raymond Realty would be a pure play-listed real estate organisation while Raymond Ltd is more like a firm with investments in engineering business and denim joint venture.

Raymond Ltd explained that this strategic demerger happened when the real estate business became large enough to stand alone and chart its own growth path as an independent firm.

Raymond’s real estate business

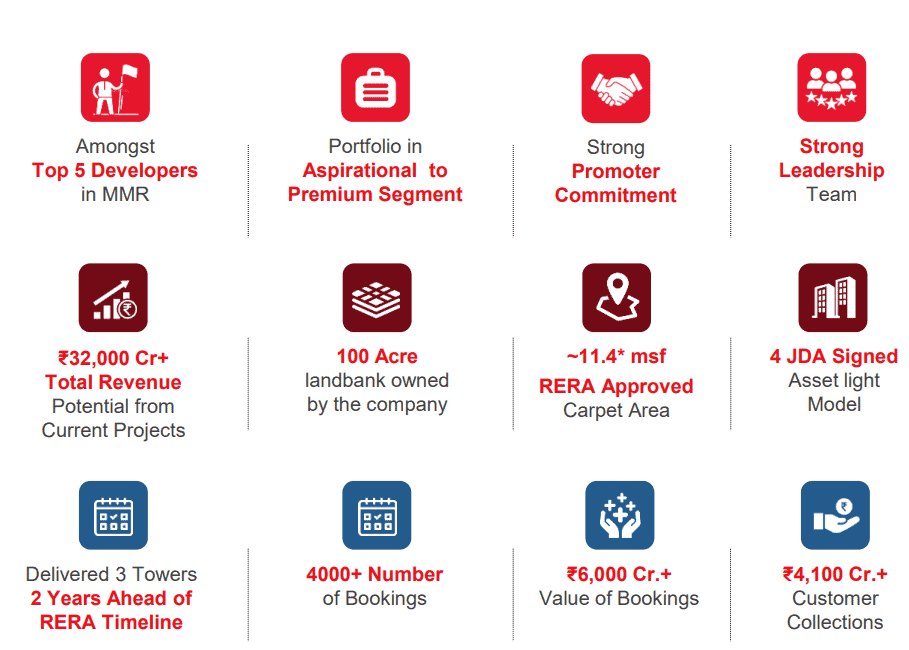

Raymond Realty has a broad stretch of land totalling around 100 acres in Thane. The total sanctioned FSI for this plot is about 11.4 million sq ft. Presently, however, only approximately 40 acres are under active development on the same land. Five real estate projects worth ₹9,000 crore in total are currently being developed on Raymond’s land in Thane.

In addition to these ongoing projects, the remaining land can yield over ₹16,000 crore. This would therefore imply that the entire revenue potential from their Thane lands is well over ₹25,000 crore.

Raymond Realty takes an asset-light approach and recently launched its first JDA project in Bandra, Mumbai. In addition to Mahim and Sion, they have also signed a new joint development agreement (JDA) with Bandra East bringing together all three of them into one whole picture. These JDAs alone can translate to more than ₹7,000 crore of revenue within Mumbai Metropolitan Region.

Combining both the Thane land development and JDA projects gives the possibility of generating ₹32,000 crore for Raymond. As such, it suffices to say that Raymond’s real estate business is indeed thriving; there are ongoing projects as well as greenfield sites and strategic alliances through JDAs.

You may also like: Is real estate growth in India sustainable? Opportunities vs Challenges!

Market reaction and share performance

There has been a lot of attention on shares of Raymond on Dalal Street as this multi-bagger counter extended its gains after announcing that it would demerge its real estate. The stock prices have gone up to and above what most analysts had predicted.

Raymond Limited’s shares, on Friday, 5th July 2024, the day after the Raymond demerger announcement, rose by 18% to reach an all-time high of ₹3,484 during intra-day trade but finally ended the day at ₹3,226.70 per share. On Monday it further gained to ₹3417.45 or about 6% higher from the last close.

The stock has given a return of 341.11% over the last five years. This chart shows the share price movements of Raymond Ltd’s stock for this period:

Strategic advantages and challenges of the demerger

Strategic advantages

- Focused business strategies

- Tailored strategies for lifestyle/apparel and real estate.

- Enhanced market alignment and growth opportunities.

- Enhanced value creation

- Direct shareholder ownership in both entities.

- Increased market valuations and better performance assessment.

- Operational efficiency

- Streamlined operations and resource allocation.

- Improved decision-making and productivity.

- Targeted investments

- Attract industry-specific investments for faster growth.

- Specialised funding for innovation and development.

- Market competitiveness

- Greater agility to respond to market changes.

- Stronger market positions within respective sectors.

You may also like: Enterprise value: What does it tell you about a company’s worth?

Strategic disadvantages

- Regulatory and operational hurdles

- Complex, costly, and time-consuming regulatory approvals.

- Disruptions due to restructuring and realignment.

- Market uncertainties

- Performance risks due to market volatility.

- Investor caution during the transition period.

- Initial financial strain

- High costs of the demerger process.

- Short-term financial strain and investment needs.

- Internal organisational challenges

- Potential employee morale and productivity issues.

- Inefficiencies during role and responsibility realignment.

- Dependency risks

- Loss of shared synergies increases operational costs.

- Real estate entity’s reliance on Raymond’s brand reputation initially.

Bottomline

The demerger of Raymond is a forward-looking step that aims to capitalise on the individual strengths of Raymond’s textile and real estate businesses. By fostering a more focused and efficient operational structure, Raymond Limited and Raymond Realty Ltd are well-positioned to navigate future opportunities and challenges, driving sustained growth and value creation for their stakeholders.