The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has kept the FY25 inflation forecast at 4.5% and left the repo rate steady at 6.5%. Explore the detailed implications of the latest Monetary Policy of RBI in our blog.

Understanding Monetary Policy

The RBI’s monetary policy acts as a key mechanism to shape the economy. It involves adjusting the flow of money and determining benchmark interest rates , such as repo rates.

The central bank aim is to regulate inflation, oversee credit distribution, and influence overall economic conditions. These actions directly affect borrowing costs and credit availability, ensuring that financial stability is upheld while maintaining sustainable growth.

The role of the RBI Monetary Policy Committee

The MPC, formed under the RBI Act-1934, is tasked with determining the benchmark interest rates to manage inflation and economic growth. Chaired by the Governor (RBI), the committee brings together diverse expertise to evaluate the economic landscape.

These meetings result in key decisions that influence the country’s financial direction. The detailed outcomes are then made public, helping stakeholders understand the rationale behind these critical choices.

The committee meets at least four times a year on a bi-monthly basis. The recent meeting was held on August 08,2024.

RBI Monetary Policy 2024 highlights

The committee decided to maintain the RBI Monetary Policy repo rate at 6.50% for the ninth straight year. Here are the key rates from the MPC announcement:

| Rate | Percentage |

| Repo rate | 6.50% |

| Standing Deposit Facility (SDF) rate | 6.25% |

| Marginal Standing Facility (MSF) rate | 6.75% |

| Bank rate | 6.75% |

RBI Governor Shaktikanta Das, delivering the results of the latest bi-monthly policy meeting, highlighted that the MPC reached its conclusion with a 4:2 vote. The committee also decided to maintain its approach of withdrawal of accommodation stance.

For previous MPC highlights: RBI keeps repo rate unchanged: What does it mean for you

Inflation forecast for FY25

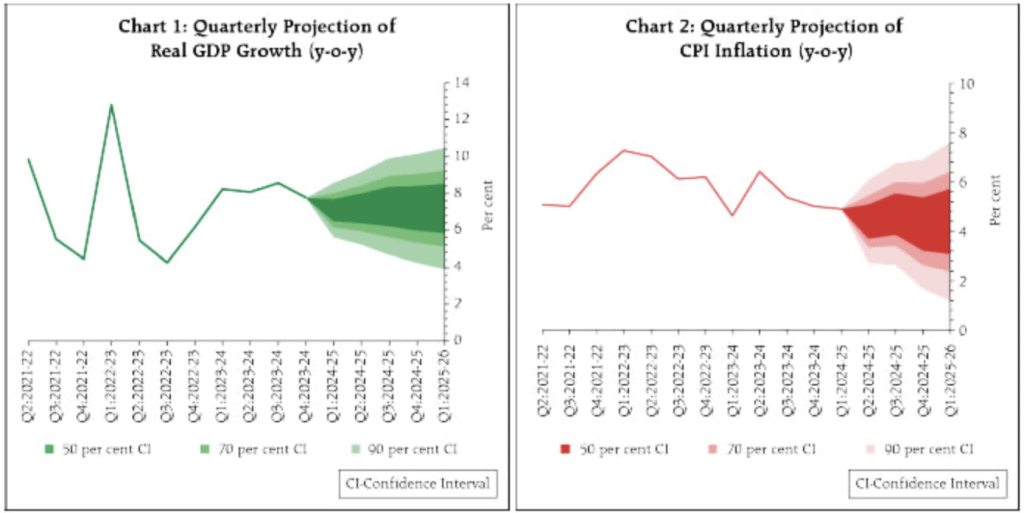

For FY25, the central bank has projected a consumer price index or CPI of 4.5%, with fluctuations expected over the year. The second quarter may see a rate of 4.4%, rising to 4.7% in the third, before settling at 4.3% in the fourth. Early expectations for Q1FY26 hold steady at 4.4%.

Significant challenges stem from rising costs in essential goods. During May and June 2024, surging vegetable costs heavily influenced the overall rate, making up nearly 35% of June’s increase alone. Other staples also contributed, leading to a broader impact on the economy.

Meanwhile, core metrics—excluding the more volatile sectors—have seen a reduction to historic lows. However, the MPC remains cautious, fully aware that the persistent increase in specific commodities could influence the broader economic landscape. The committee remains committed to steering inflation towards the 4% target to ensure a stable financial environment.

You may also like: What is Consumer Price Index (CPI)? How does it shape your finances?

GDP growth forecast

The recent monetary policy of RBI anticipates the economy to expand by 7.2% in FY25. While the annual outlook remains optimistic, projections for the first quarter have been slightly reduced to 7.1%. The economy is expected to regain momentum in the following months, with the second quarter projected at 7.2%, a slight rise to 7.3% in the third, and stabilisation at 7.2% in the final quarter.

Urban demand is supported by ongoing strength in the manufacturing and services sectors. Meanwhile, rural consumption is poised to benefit from a favourable monsoon and robust kharif sowing. Indicators such as rising industrial production and government-led infrastructure projects suggest a strong economic environment.

Nevertheless, challenges are on the horizon. Global geopolitical tensions, volatile commodity prices, and uncertainties in international markets present potential risks.

Market dynamics

The Governor highlighted that, in recent months, the Reserve Bank managed a significant shift in the liquidity environment, transitioning from a deficit in June to a surplus by July. This shift was achieved through careful adjustments in operations under the Liquidity Adjustment Facility, which helped align overnight interbank lending rates with the policy repo rate.

During this period, the weighted average call rate remained balanced within the LAF corridor. While short-term instruments like certificates of deposit or CDs and treasury bills saw minor changes, commercial paper rates stayed stable. A slight dip in the 10-year government bond yield reflected a stable financial environment.

Current account and capital flows

Shaktikanta Das, during his announcement, conveyed that India’s economic outlook for FY25 has been boosted by a significant reduction in the current account deficit (CAD) to 0.7% of GDP, a notable improvement from 2% in the previous year. This shift can be attributed to a smaller gap in trade and strong income from services and remittances. However, the first quarter of FY25 saw a widening trade gap due to faster growth in imports compared to exports.

June 2024 marked a turnaround in capital inflows, with portfolio investments returning to positive figures and continuing through August. The period also witnessed a sharp increase in direct investments, with the first two months of FY25 recording a substantial rise in these figures compared to the previous year.

Debt inflows showed moderation, while deposits from non-residents grew significantly. By August 2024, India’s forex reserves had reached a record $675 billion. Despite ongoing volatility in global markets, India’s external sector remains well-positioned to meet its financial obligations.

Also Read: How Global Economic Events Affect Personal Finances

Additional measures

- Repository for digital lending platforms: The RBI is introducing a database for approved digital lending platforms. This initiative will allow users to verify the legitimacy of these platforms, minimising risks associated with unregulated services.

- Increased frequency of credit updates: Financial institutions must now update borrower information biweekly. This change ensures that both lenders and consumers have access to more current financial data, enabling more informed decisions.

- Enhanced UPI transaction limits for taxes: The RBI has raised the transaction cap for tax-related payments via UPI, increasing the limit from ₹1 lakh to ₹5 lakh. This move supports more seamless, higher-value transactions in the digital space.

- Introducing delegated transactions on UPI: A new feature, “Delegated Payments,” will allow one user to permit another individual to conduct transactions from their account. This addition broadens the scope and functionality of UPI.

- Faster cheque settlement: The RBI plans to overhaul the cheque settlement system by transitioning to continuous processing. This adjustment will reduce the time required for cheque clearances, improving efficiency for all parties involved.

Bottomline

The latest monetary policy of RBI balances growth with inflation control, maintaining the repo rate at 6.5%. The RBI and MPC remains vigilant, aiming for stability amidst global uncertainties to support India’s economic trajectory in FY25.