The agricultural sector in India is one of the major players globally. Wheat, rice, and cotton have the highest number of acres in India compared to anywhere else in the world; it also leads globally as a producer of milk, pulses, and spices. The second largest agricultural land globally belongs to India with about half of its population earning their living from it.

Three major rice stocks in NSE on agricultural and stock exchanges rose by 14.5% after reports emerged that India may relax the limit on rice exports. The news not only attracted investors’ attention but also had far-reaching consequences for the worldwide market regarding rice.

This article focuses on the current state of affairs; its effects on specific rice stocks; and wider economic and policy implications of such a prospective shift.

Also read: The past, present, and future of the Indian agriculture industry

Current scenario

The market for Indian rice is valued at $52.82 billion in 2024 and it’s estimated to reach $59.46 billion by 2029, at a CAGR of 2.40% as per research conducted by Mordor Intelligence.

As per S&P global commodity insights, India, the largest exporter of rice globally, enforced export curbs such as disallowing shipment of broken rice and additional duties on non-basmati white rice in August 2022.

The Indian government further barred non-basmati white rice exports by July 2023 and imposed a duty of 20% on parboiled rice outflows while setting a minimum export price for basmati at $950 per metric tonne.

However, according to people familiar with the matter, this move could be used by India as an opportunity to ease up restrictions on some varieties ahead of the arrival of new crops in October so that there is no oversupply in the country.

As reported by insiders who wished not to be named, the government was mulling allowing fixed-duty white rice shipments. They also mentioned that instead of levying a tax rate of 20% on parboiled rice exports, it could introduce a flat levy to curb under-invoicing on cargoes.

Such action would help cool down Asian benchmark prices for Rice which hit their highest levels in more than fifteen years last month after India announced that from 2023 it will gradually limit sales of its key varieties.

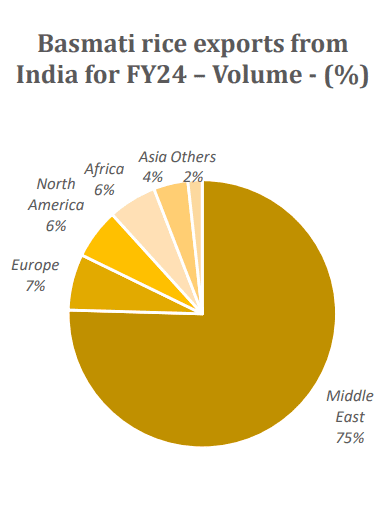

That would benefit some countries like West African and Middle Eastern nations whose bulk requirements are met through imports from this South Asian country.

Source: KRBL Ltd. Investor Presentation – Q4 FY2024

Impact on the rice stock market

There was high trading of shares in rice milling companies on Tuesday (July 9, 2024); it came about as a result of the probable easing of the 2023 government restrictions on the exportation of some rice varieties.

Exporting rice stock prices jumped during the session. Stocks for LT Foods Ltd rose to an intraday peak of 14.5%, and KRBL Ltd also climbed to 13%. Chaman Lal Setia Exports Ltd and GRM Overseas Ltd stock increased up to 15.3% and 9.4%, respectively.

This is how the companies compare in terms of stock (as of July 9, 2024):

| Chaman Lal Setia Exports Ltd | KRBL Ltd | LT Foods Ltd | |

| Market cap (₹ crores) | 1,158.83 | 7,565.96 | 9,514.73 |

| Stock price to earnings | 9.88 | 12.8 | 16.0 |

| Return on equity | 17.5% | 12.5% | 19.4% |

| Earnings yield | 14.0% | 10.8% | 8.97% |

| Price / Earnings to growth ratio | 0.35 | 3.60 | 0.45 |

Must read: Understanding stock valuations using PEG ratio analysis

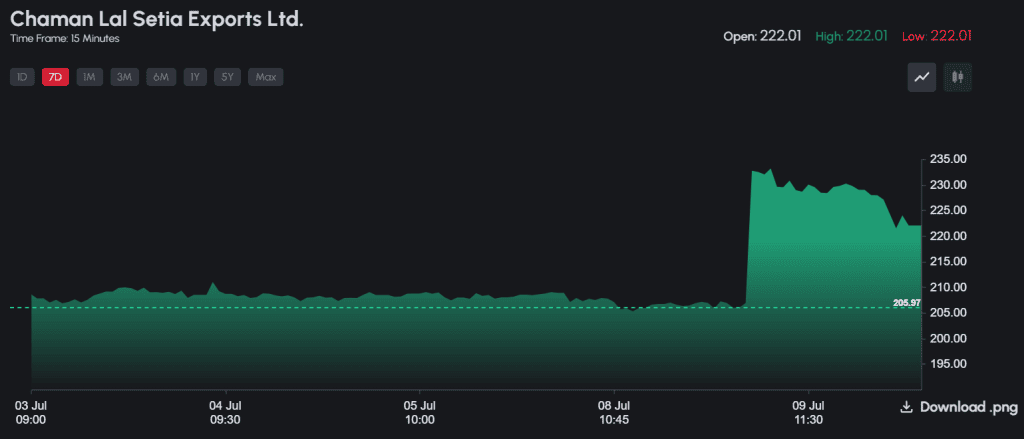

Chaman Lal Setia Exports Ltd

Chaman Lal Setia Exports Ltd’s leading trademark “Maharani” rice is the most reliable basmati company in all of India because they are honest and fair in their business dealings. It was formed in Amritsar Punjab back in 1974 and has since grown to be one of the biggest producer-exporter of basmati rice.

Here are a few financial highlights of the company’s performance for FY2024:

- The financial year was marked by remarkable resilience in the face of regulatory, cyclone and supply chain disruptions.

- EBITDA was at an all-time high at ₹162 crore.

- Operating leverage and improved cost efficiency saw the EBITDA margin increase steadily over the last three years.

- The dividend payout proposed by the board at ₹2.25 per share (10% of FY2024 profits).

This chart indicates the recent surge in the stock price of the company:

Source: NSE

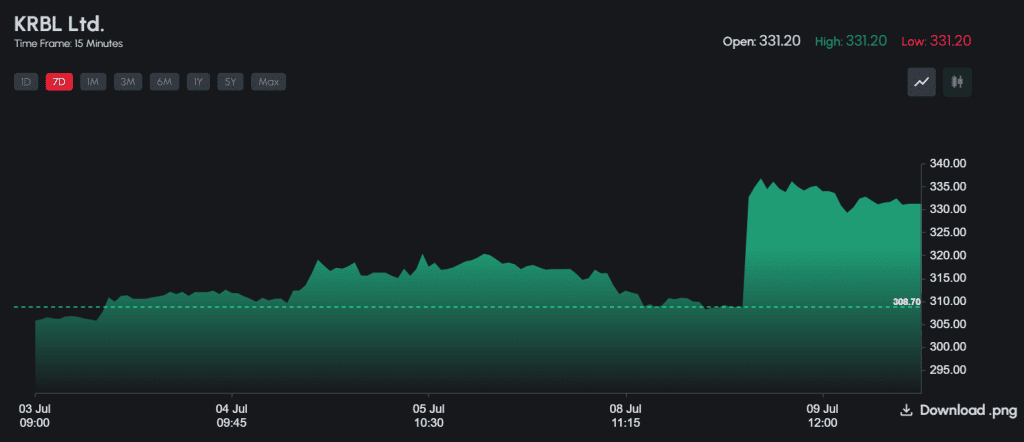

KRBL Ltd

With more than a century of experience in the industry, KRBL Limited is now one of the leading players in the Indian rice industry and India’s first integrated rice company. The business primarily deals with the manufacturing and marketing of rice products; hence, its achievements are a result of acting responsibly, executing well, producing creatively, and taking advantage of new possibilities.

Here are a few financial highlights of the company’s performance for FY2024:

- The organisation’s earnings from exported goods depended on the policies adopted and geopolitical matters with a particular focus on the Middle East which led to the decrease in non-basmati exports.

- Driven by volume growth and strategic planning, KRBL has had a significant 18% increase in its domestic revenue.

- During the year under review, it had earned a total income of ₹5482 crores which is strong for its domestic business segment.

- KRBL registered an EBITDA of ₹899 crore and a PAT (Profit After Tax) of about ₹600 crore indicating that profitability margins were good.

This chart indicates the recent surge in the stock price of the company:

Source: NSE

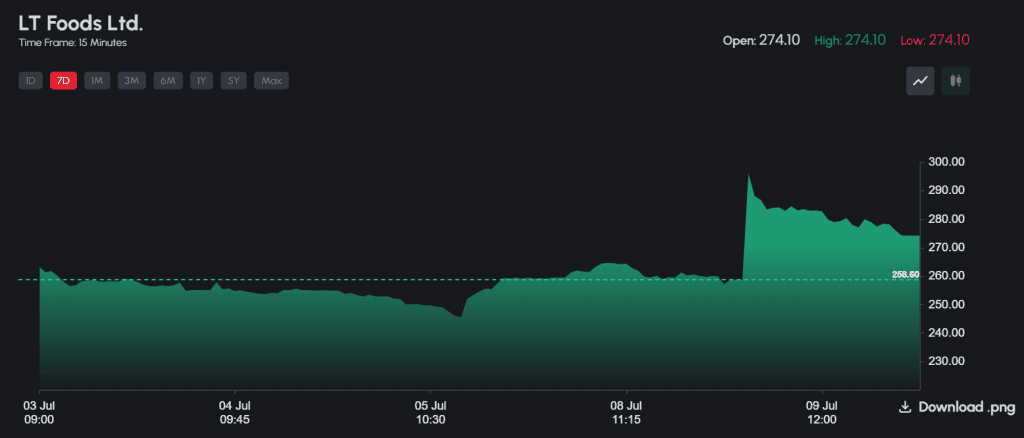

LT Foods Ltd

The company has been a major player in the consumer food industry for over 70 years since its inception. They are present in more than sixty-five countries where their trusted labels are known and valued internationally.

Here are a few financial highlights of the company’s performance for FY2024:

- The corporation’s overall revenue in which the Basmati and other niche rice, organic food and ingredients, as well as ready-to-eat and ready-to-cook categories of products have played a major role increased by 12% YoY.

- Basmati and other speciality rice segments of the company increased by 17%, while the ready-to-eat and ready-to-cook products saw a significant growth of 23%, contributing to global revenue growth.

- For India, there is a Company market share of 30.1% with an off-take volume growth rate of 11% for FY ’24 compared to other category’s growth rate which was at 8.9%.

This chart indicates the recent surge in the stock price of the company:

Source: NSE

Global market implications

Global rice supplies have been severely affected by the export restrictions, leading to rising prices and Asian benchmark rice prices reaching their highest point in fifteen years in January.

The statistics from the Indian government show that its rice exports for two months of the 2025 fiscal year decreased by 21% to 2.9 million tons while the consignment of non-basmati sank by 32% to 1.93 million tonnes.

Nevertheless, these proposed changes could help improve some of the pressures faced by global importers of rice.

According to reports, the government will introduce a minimum floor price of $500 per tonne for non-basmati rice exports. It is an attempt at keeping the pricing competitive whilst stabilising the domestic market.

Further reading: Agritech landscape in India: The amalgamation of agriculture and technology

Bottomline

India’s potential easing of rice export restrictions has significant implications. It affects not only the domestic agriculture sector but also global markets and policies. The rise in rice inventories suggests optimism for rice stocks in India and the overall industry, which plays a vital role in worldwide food distribution.