Good news for stock market enthusiasts. Here is an opportunity to invest in a unique sector. RK Swamy is one of the few companies in the marketing and advertising space to be announcing an IPO.

With AI and digital marketing taking over the world, it may definitely be worth exploring the pros and cons of investing in this IPO. Today’s article helps you analyse RK Swamy’s operations, financials and more from the IPO’s perspective.

Who is RK Swamy?

Offering varied marketing and advertising services like creatives, media solutions, data analytics and market research, RK Swamy is one of the top integrated marketing service providers in the country.

Also read: From print to digital: The story of India’s media and entertainment sector

History

Founded in 1973 and named after the founder himself, the company is the brainchild of Mr RK Swamy. It was initially called RK Swamy Advertising Associates and was headquartered in Chennai, Tamil Nadu.

The founder also started Hansa Vision, a television programming firm. Today, both firms are merged and operate as RK Swamy Hansa Group.

RK Swamy today

Today, RK Swamy stands as one of the top marketing companies in India. With more than five decades of experience in the industry, RK Swamy has worked with premium brands like NTPC, Hatsun, Shriram Transport Finance, Bank of India, UNICEF, L&T, Nilkamal, LIC, State Bank of India, the Government of India and more.

Srinivasan K Swamy is currently heading the group as the chairman and managing director. The company has offices in 12 cities across the country and has a global network across four countries – Singapore, the USA, the Middle East and Bangladesh.

RK Swamy operates under different divisions as follows, catering to different demands of clients:

- R K SWAMY — Creative Services

- R K SWAMY — Media Services

- R K SWAMY — Integrated Digital

- R K SWAMY — Healthcare Content & Digital

- R K SWAMY — Social Rural Direction

Shareholding pattern before IPO

Following is the list of shareholders holding more than 1% on the date of filing the red herring prospectus.

- Srinivasan K Swamy – 38.80%

- Narasimhan Krishnaswamy – 39.93%

- Evanston Pioneer Fund L.P – 14.04%

- Prem Marketing Ventures LLP – 1.52%

Also read: Here’s everything you need to know about Credo Brands IPO

Fund utilisation plan

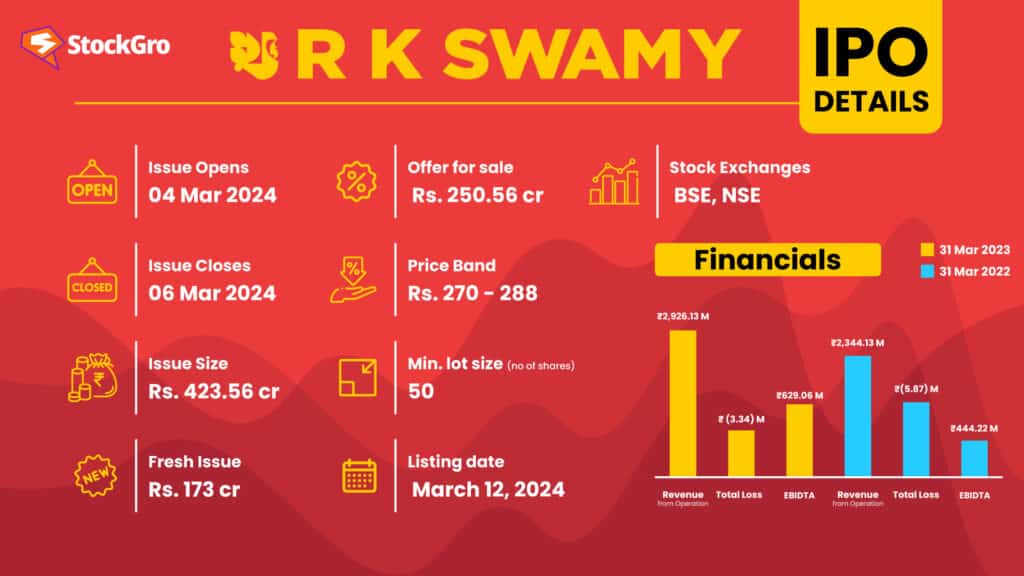

- ₹250.56 crores raised from the offer for sale will proportionately be distributed among selling shareholders after deducting the IPO’s expenses.

- ₹54 crores will be spent in FY 2024 towards the working capital requirements of RK Swamy.

- ₹10.9 crores will be spent across 2024 and 2026 towards capital expenses of the company’s project towards setting up a DVCP (Digital Video Content Production) studio.

- ₹33.3 crores will be used between 2024 and 2026 towards the infrastructure development of RK Swamy and its subsidiaries.

- ₹21.7 crores will be spent in 2025 and 2026 towards setting up client engagement and customer experience centres.

- The remaining funds so received will be used for the regular operations and other corporate issues of RK Swamy.

Is RK Swamy’s stocks for you?

| Peer comparison | ||||||

Company | Market cap | Total income (₹ million) | EPS (Basic) (In ₹) | NAV ₹ per share | P/E | RoNW % |

| RK Swamy Limited | – | 2,999.13 | 7.03 | 31.67 | – | 22.20% |

| Affle (India) Limited | 172,410.40 | 14,882.80 | 18.43 | 109.98 | 66.74 | 16.73% |

| Latent View Analytics Limited | 100,069.32 | 5,945.28 | 7.71 | 58.93 | 63.70 | 12.87% |

| Vertoz Advertising Limited | 11,426.68 | 837.62 | 9.22 | 85.59 | 78.07 | 10.77% |

You should invest because:

- The advertising market’s size in India is rapidly growing. The market size grew at 8.3% to reach ₹93,166 crores in 2023. Given the latest trends around digital marketing and advertising, holding a stock in this space can be beneficial for investors. RK Swamy also has the advantage of being one of the few listed stocks in this sector.

- The company has been in the market for 50 years now, offering a one-stop solution for all advertising needs to clients from varied sectors. The long experience in the industry has consistently helped the firm grow.

- Through its subsidiary, Hansa Customer Equity, the company has been offering services around data analytics. With more than 15% years of experience and revenue growth in this segment, RK Swamy stands as an industry leader in the market research space, with over 200 clients.

- RK Swamy has served more than 4,000 clients in its journey. The company has customers from different sectors, maintaining strong relationships with the brand. In 2022 and 2023, repeat customers have contributed to over 80% of the revenue.

- Besides the above, the firm has an experienced management team and efficient internal infrastructure to provide the best service to its clients.

Watch out for:

- The revenue of RK Swamy is concentrated around top clients. The top 10 clients contribute to over 40% of the revenue, while the top 50 clients contribute to over 70% of the revenue. Any disturbance in the firm’s relationship with these clients can adversely impact the revenue.

- The demand for R K’s marketing and advertising services is highly dependent on the client’s business and the related industries. RK Swamy gets more than 65% of business from the BFSI, automotive and FMCG industries. Any drop in demand for these industries can directly bring the firm’s business down.

- More than 75% of RK Swamy’s revenue in the previous year, came from digital operations. A change in the trend, such as decreasing demand for digital services, will have a negative effect on RK’s business.

- Data analytics is a significant offering of the firm. Any inaccuracies in the research and reports can affect the firm’s goodwill to a large extent.

- Many businesses prefer having in-house teams for marketing and advertising. This approach affects marketing firms like RK Swamy and narrows down their customer base.

Also read: Reddit’s IPO and AI ambitions: A game-changer for social media?

Bottomline

The advertising industry is currently going through a digital revolution. With AI, social media, voice and video advertising, etc., the marketing space is witnessing new trends every day.

While it may seem like a lucrative option to buy stocks in this sector, it is essential for investors to thoroughly assess the performance of RK Swamy in the last few years, before making their investment decisions.