Do you love keeping up with your favourite TV shows, movies, and celebrities?

Then don’t be surprised if these shows & celebrities influence your investments too!

If, after watching a TV show or movie that mentions a particular product or company, you find yourself suddenly interested in buying that stock/crypto, you’re not alone!

Pop culture has always been intertwined with the stock market, and with the rise of social media and the internet, that connection has become even stronger. From fashion trends to political views, celebrities and influencers have a way of shaping the way we think and behave.

Be it Amitabh Bachchan endorsing Cadbury chocolates or Virat Kohli promoting Puma shoes, celebrities have a significant impact on consumer behaviour. But their influence doesn’t stop there. Celebrities are also known for swaying investment trends through endorsements and business ventures.

Social media, online television, podcasts, and YouTube have provided investors with more access to information, and celebrities or experts can reach a broader audience than ever before.

The rise of armchair investing

Nowadays, anyone with a smartphone can keep track of the stock market and buy and sell shares using various apps. As a result, many people track social media to know what’s happening in the world of finance. This means that rumours and gossip spread faster than ever before and can impact a company’s stock price.

That’s why effective communication from companies is more important now. If a company wants to stay ahead of the stock market game, they need to be proactive in their messaging.

You may also like: Pump-and-dump: Why is it illegal in the stock market?

Social media platforms and the stock market

Platforms like Twitter, Facebook, Instagram and Reddit have made it easier for celebrities and influencers to share their opinions, easily swaying the stock market and wiping off millions of dollars or conversely inflating a company’s value with just a single message.

Social media has created an environment in which information travels at lightning speed. Let’s look at one of the most sensational impacts of social media:

The GameStop saga

In January 2021, an army of Reddit users took to Wall Street, driving up the stock prices of GameStop and other companies that the big institutional investors had bet would fall.

The Reddit users drove up the stock prices so high that they actually caused hedge funds who were short-selling to lose billions of dollars. This unprecedented online buying frenzy turned the stock market on its head and forced a halt in trading.

Social media platforms like Reddit and Twitter were the primary means of communication for the group of amateur investors. With apps like Robinhood offering commission-free trades and fractional shares, it’s easy for new investors to access the stock market.

In the past few years, social media platforms have become a force to be reckoned with in the stock market. From Elon Musk’s tweets to Kylie Jenner’s Snapchat post, a single social media post can drastically impact a company’s stock price. Here are some instances that shook the stock price with one TWEET.

How one single tweet can affect the share price?

When it comes to tweets, no one can beat the Market Mover : Elon Musk, who is known for his prolific tweeting and the impact that his tweets can have on the stock market. Here are some examples of his market-moving tweets:

Tesla

In May 2020, Musk wiped nearly $14 billion off the value of his own company after tweeting that its share price was “too high”, and the company’s stock price closed 10% lower that day. This caused Musk’s stake in Tesla to fall in value by $3 billion.

Bitcoin

In February 2021, Musk announced that Tesla had bought $1.5 billion in Bitcoin to enable the company to facilitate payments in the cryptocurrency. However, in May, Musk announced that Tesla would no longer accept Bitcoin payments due to the environmental costs. This caused Bitcoin’s value to fall by more than 10%.

Musk later confirmed on June 21st that Tesla would resume allowing transactions made in the digital currency once crypto mining becomes greener. This announcement caused Bitcoin to hit a three-week high, climbing above $40,000.

Signal Advance Inc

One of Musk’s most impactful tweets was when he tweeted, “Use Signal.”

The tweet likely referred to the messaging app in light of privacy concerns over WhatsApp. However, it ended up boosting the wrong company’s stock as the Signal app isn’t publicly listed. Medical device company Signal Advance’s stock surged more than six-fold after the tweet, and many investors jumped on board without realising their mistake.

Dogecoin

How can we forget the famous MEME coin, which recently even became the logo of the bird app for a week or so? Musk’s support of Dogecoin has caused its price to skyrocket. The coin’s price has risen from just fractions of a cent to around $0.30. Thanks to Musk, the coin hit a total market capitalisation of over $70 billion in May 2021.

Musk’s tweets have gained so much attention that some have called for them to be regulated. His influence on the financial markets is undeniable, and his followers take his tweets as the “golden rule.”

A study which analysed 17 tweets by Musk found that, on average, he caused an 84% average change to the share prices of the companies he mentioned.

That’s a massive impact! Investors are always on the lookout for any mention of a company by Musk, as it can cause the stock prices to soar or plummet in seconds.

Next in line, we have the Kylie Jenner Effect.

Kylie effect

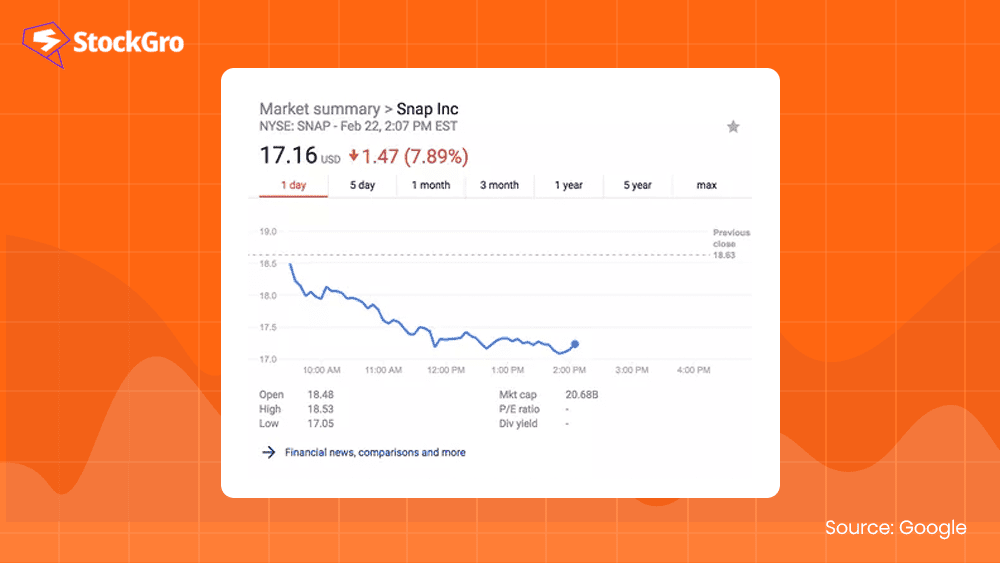

Kylie Jenner is one of the celebrities who has significantly impacted the stock market with her tweets. In February 2018, Jenner tweeted that she no longer used the Snapchat app, causing the company’s market capitalisation to drop by $1.3 billion.

Even though Jenner quickly followed up with another tweet saying how much she loved the app, it took until June 2020 for the share price to reach the same level it had pre-Jenner’s tweet.

Bieber’s boost for Crocs

Justin Bieber caused a stir on social media when he posted a photo of Crocs in a pool with the caption “soon” on his personal Instagram account. The post resulted in a 6% boost in the shoe company’s shares.

The power of influencers and celebrities

In recent years, new funds and individual celebrities have been stepping up to change the way startup capital is raised. Celebrities have been the face of companies for generations, with some stars even venturing out and starting their own brands. What we are now seeing is celebrities taking on the role of venture capital firms and investing in startups themselves using private funds.

Companies have long known that celebrities can make or break their businesses. That’s why they pay big bucks to use their fame in advertisements. But now, the actions of influencers and celebrities can also affect the stock market.

When a celebrity or influencer invests in a company, it can cause speculators to go into overdrive. This is what we call “Celebrity stocks”. On the other hand, when a celebrity shows negative feelings towards a company, it can send the markets reeling.

You may also like: How did actor Suniel Shetty become a business tycoon?

The rise of celebrity stocks

These are companies whose share prices are influenced by famous individuals like actors, well-known CEOs, or lauded investors. So, if you’re considering investing in a company, you might want to keep an eye on what your favourite celebrity is doing or saying about it.

Some companies are so closely associated with particular celebrities that their stock prices can rise or fall based on what those celebrities are doing. This phenomenon has led to significant growth for many companies, and it demonstrates the impact of social media influencers in the world of capital investments.

Let’s take a look at some examples of celeb factor:

The “Hathaway Effect” on Berkshire-Hathaway

Anne Hathaway, the Oscar-winning actress, is known for her performances in films like “The Devil Wears Prada” and “Les Misérables.” However, what many people don’t realise is that her name is also closely associated with Berkshire-Hathaway, the investment conglomerate led by Warren Buffett.

According to author Dan Mirvish, every time there’s a lot of news chatter about Anne Hathaway, Berkshire-Hathaway sees a jump in its stock prices. In fact, he coined the term “Hathaway Effect” to describe this phenomenon.

While there’s no direct correlation between the actress and the company, it’s thought that automated trading programs scour the internet for stories about “Hathaway” and apply that data to the stock market, regardless of whether it’s related to the actress or not.

One example of the Hathaway Effect occurred in 2011 when Anne Hathaway co-hosted the Academy Awards. The day after the awards show, Berkshire-Hathaway stock saw a nearly three-point rise. While this may seem like a coincidence, it’s worth noting that this isn’t an isolated incident.

The Hathaway Effect has been observed multiple times over the years, suggesting that there’s some truth to it. The evidence (BRK.A is Berkshire Hathaway’s trading name):

| Years | Event | |

| 3rd Oct 2008 | Rachel Getting Married opens BRK.A up 0.44% | |

| 5th Jan 2009 | Bride Wars opens BRK.A up 2.61% | |

| 8th Feb 2010 | Valentine’s Day opens BRK.A up 1.01% | |

| 5th March 2010 | Alice in Wonderland opens: BRK.A up 0.74% | |

| 24th Nov 2010 | Love and Other Drugs opens BRK.A up 1.62% | |

| 29th Nov 2010 | Anne announced as co-host of the Oscars: BRK.A up 0.25% |

So the next time you’re watching the news and see Anne Hathaway’s name come up, keep an eye on the stock prices for Berkshire-Hathaway!

The Kohli effect on Vedant Fashions

Indian cricketer Virat Kohli is known for his impressive performances on the field, but he’s also made a name for himself off the field as well. In addition to his various endorsements, Kohli is the brand ambassador for Vedant Fashions, a popular clothing retailer in India.

In 2017, Vedant Fashions released an ad featuring Kohli and Anushka Sharma, which gained immense popularity. Shortly thereafter, the company posted a profit of more than Rs 100 crore in FY17.

Their profit rose 23.4% to Rs 111.30 crore in FY17, according to filings with the Registrar of Companies (RoC). Net revenue grew 21% to Rs 610.24 crore compared to the previous year.

Weight Watchers winning strategy

Weight Watchers has a long history of partnering with famous faces to promote its products and services. And it’s a strategy that’s paid off big-time in the past. After all, who can forget the company’s high-profile partnership with Oprah Winfrey?

The company replicated that success with another A-list star: DJ Khaled. The plus-sized musician and producer served as a social media ambassador for Weight Watchers, sharing his weight-loss journey and progress with his massive following on various platforms.

The company’s announcement about its new partnership with DJ Khaled had a significant impact on its stock price. In fact, on the same day, the news broke – Weight Watchers’ stock soared, thanks to the hype surrounding the deal.

By associating themselves with a popular celebrity, companies can increase their brand visibility and attract new customers. But, they can be both a blessing and a curse for companies that are associated with them.

So, what’s the real cause behind all this impact?

The bandwagon effect

When it comes to investing, many of us follow the crowd rather than doing our own research. This tendency to follow the herd is known as the “bandwagon effect.” In the world of investing, the bandwagon effect can lead to buying stocks solely based on hype, which can ultimately result in a financial disaster.

As humans, we have a natural desire to belong and be accepted by others. This need for social validation is the driving force behind the bandwagon effect. When we see others investing in a particular stock, we assume that they must know something we don’t and follow suit.

While the bandwagon effect can lead to short-term gains, it can also lead to long-term losses. Blindly following the crowd without understanding the fundamentals of the stock can result in investing in overvalued or underperforming stocks.

Additionally, when the hype dies down, and everyone jumps off the bandwagon, the stock’s value can plummet, resulting in significant losses.

If you’re a wise investor, you know better than to get in to some hype or FOMO.