The Sahara Group was one of the largest Indian conglomerates back in the day. With footprints across various industries and countries, Sahara was one of the leading companies in India. But, the last decade and a half have made the Sahara group famous for all the wrong reasons.

The latest news of Mr Subrata Roy’s death on 14th November 2023, takes us back to how he built the Sahara Group from scratch. So, join us as we walk down his journey and the latest news on Sahara Group.

Who is Subrata Roy?

Subrata Roy, Sahara Group’s founder and chairman was born in 1948 in Bihar.

With a capital of ₹2,000 in 1978, he tried his hands at entrepreneurship. The Sahara Group grew rapidly and soon, he was one of the most sought-after and influential businessmen in the country.

Subrata Roy’s net worth in 2013 was approximately ₹50 million, making him one of the richest businessmen at that time. However, the entrepreneur who was admired for his lavish lifestyle, could not remain in the public’s good books for too long. The infamous Sahara scam imprisoned Subrata Roy in 2014.

He then developed a chronic illness & lost his life in November 2023 due to the failure of his cardiac and respiratory organs.

You may also like: What’s driving India’s no. 1 payment giant, Phonepe shift to stock broking?

The birth of Sahara Group

Subrata Roy was a man of varied experiences. Before venturing into the Sahara Group, he did the usual things that everyone else at that time did, like loading sacks into trucks, selling snacks, etc.

But, a confident entrepreneur always believes he deserves better. So did Mr Roy.

In 1976, he began a chit-fund company. He made a few changes to the functioning of his business in 1978, which marked the actual beginning of the Sahara Group.

The upward trajectory of Sahara Group

There was no looking back for the Sahara Group after 1978. What began as a finance company expanded its presence into multiple sectors.

The main aim of the Sahara Group was to make financial services accessible to all classes of people, even those who could not afford them earlier. The attractive financial schemes pulled more people towards Sahara, making the brand more popular each day.

With more funds flowing in, Sahara expanded to create a business empire with companies in more than ten sectors.

Apart from businesses in real estate, infrastructure, hospitals, restaurants, FMCG, etc., the Sahara group was present in distinct industries like media, aviation, sports, etc.

Air Sahara was the airline owned by the Sahara group, which was later then taken over by Jet Airways.

Source: Facebook – Sahara Airlines

The group was also an active title sponsor for various national and international sports tournaments.

To add to its achievements in various sectors, the Aamby Valley project came as a feather on the cap. Sahara Group built Aamby Valley, a township which had luxury in every nook and corner.

Also Read: GoFirst Bankruptcy: Airline’s possibility of revival seems unlikely

Sahara India Financial Corp Ltd

The group’s venture in the non-banking industry was one of its most popular products. Sahara India Financial Corp Ltd, a non-banking financial corporation (NBFC) by the group, promised small customers like cart pullers and rickshaw drivers attractive returns on deposits.

By 2008, the NBFC had a deposit of ₹20,000 crores, which was more than the deposits of new private banks at that time.

As per the official website, the Sahara group has a net worth of ₹2,59,900 crores and over 9,000 customers. Sahara was once the second largest employer in the country, just after the Indian railways, as per TIME magazine. In 2004, the Sahara Group had an employee base of 1.2 million.

With several awards and laurels, the Sahara Group and Subrata Roy were topping their games until things began taking a downturn after 2010.

The Sahara scam

All was well for Sahara until one of its wings, Sahara Prime City, decided to go for an IPO (Initial Public Offering).

The Sahara group was functioning comfortably with public deposits until 2008 when the Reserve Bank of India banned the group from collecting further deposits. As an alternative, the group decided to collect funds through the issue of Optionally Fully Convertible Debentures (OFCD). The money collected thereof, was used to fund various projects.

It was in 2009 when the group filed its Red Herring Prospectus (RHP) with the Securities and Exchange Board of India (SEBI) for IPO, when things started going downhill.

The SEBI, during its regular background check of the company, found the issue of OFCDs in 2008 without necessary approvals. Arguments about the matter not falling within SEBI’s purview went on for a long time until the Supreme Court agreed to SEBI’s order in 2014.

The Sahara Group was asked to return all the money it borrowed from the public, with an interest of 15%.

Subrata Roy was arrested in 2014 owing to this and was released in 2016 on parole. It happened again, and in 2020, the court warned Subrata Roy to cancel his parole if he did not repay ₹62,600 crores to investors (Interest, principal, and fines included).

The group denied the order and claimed to have returned most of the money collected.

Sahara funds – The way forward

The Sahara Group failed to deposit the whole amount as ordered by the court. Until 2021, the group had deposited ₹15000 with SEBI, which was used to pay off investors.

Based on the annual report of SEBI for 2022-23, below is the status of repayment to investors:

19,526 applications to claim refunds were received, of which the SEBI cleared 17,526 applications amounting to ₹138.07 crores, including interest.

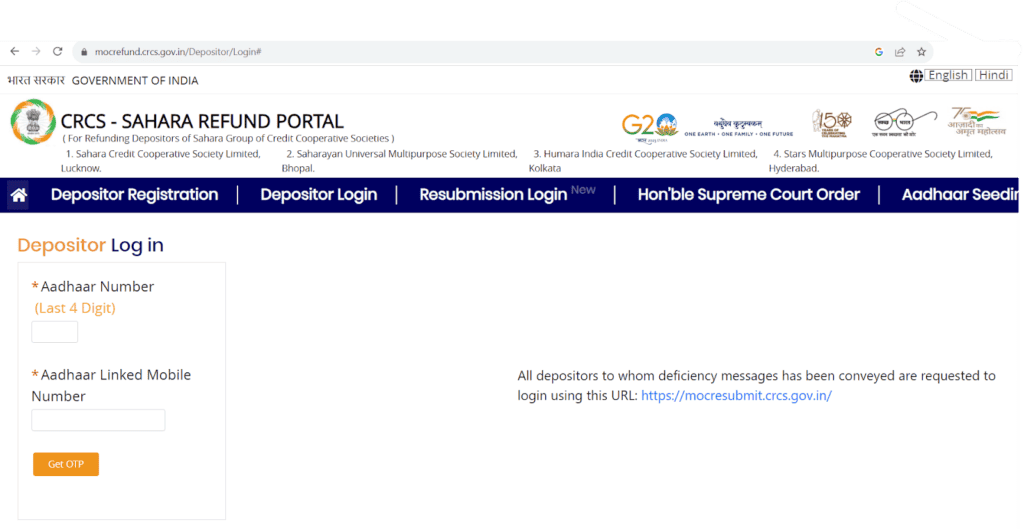

The Sahara Refund Portal launched by the Central Government on July 18, 2023, is a ray of hope to all the investors who have lost money in the Sahara scam. The government has guaranteed the refund within 25 days of registration under this portal.

Source: CRCS

The Central Registrar of Cooperative Societies is responsible for the refund. In this direction, the statutory body ordered the SEBI to transfer ₹5,000 crores to clear the dues.

The table below has the necessary information to register under the Sahara refund portal:

| Website link | https://mocrefund.crcs.gov.in/Depositor/Login# |

| Eligibility | Investors in: – Humara India Credit Cooperative Society Limited, Kolkata (Deposits made before 22 March 2022) – Sahara Credit Cooperative Society Limited, Lucknow (Deposits made before 22 March 2022) – Saharayan Universal Multipurpose Society Limited, Bhopal (Deposits made before 22 March 2022) – Stars Multipurpose Cooperative Society Limited, Hyderabad (Deposits made before 29 March 2023) |

| Documents needed | Registration number, Deposit account number, Aadhar linked mobile number, Certificate of deposit/passbook, PAN card |

| Fees to claim refund | Nil |

| Bank account | An Aadhar-linked bank account is mandatory |

Bottomline

The Sahara scam is a classic case of a Ponzi scheme by Subrata Roy, where new investments were used to pay off old investors. It continued until they were unable to raise further funds, leading to the issue of OFCDs without approvals from the SEBI.

While the death of the Sahara group’s owner might have caused worries among investors, the interference of the central government and the active involvement of SEBI is a matter of relief.

Further reading: BYJU’s faces ED probe over Rs. 9754 Cr foreign transfers