Welcome to the thrilling world of life insurance in India, a landscape that is as dynamic as it is diverse. Did you know that India is the fifth largest life insurance market in the emerging world, growing at a staggering rate of 32-34% each year? By 2026, the insurance market in India is expected to reach a whopping $222 billion!

In this bustling marketplace, two giants stand tall – HDFC Life Insurance Company Ltd. and SBI Life Insurance Company Ltd.

HDFC Life, a shining example of innovation, has been instrumental in shaping the industry with its customer-centric approach and diverse product portfolio. On the other side of the ring, we have SBI Life, a powerhouse that has harnessed the strength of India’s largest bank, State Bank of India, to offer a wide range of life insurance products to the masses.

This article aims to provide an in-depth comparison between SBI Life vs HDFC Life, two of the leading players in India’s burgeoning life insurance industry.

Also read: From colonial legacy to global ambition: The Indian insurance sector

Company profiles

HDFC Life Insurance Company Ltd

HDFC Life Insurance Ltd, a joint venture between HDFC Ltd. and Standard Life Aberdeen, is a prominent life insurance firm in India. The company provides an extensive selection of insurance options for both individuals and groups, catering to diverse requirements including safeguarding, retirement planning, wealth accumulation, financial investment, and healthcare coverage. The business has become well-known for its reliable products and cutting-edge innovations, earning the trust of consumers.

A wide variety of life insurance policies, including term insurance plans, are available from HDFC Life. These policies provide monetary assurance to the beneficiaries of the insured, safeguarding them financially should an untimely demise occur. The firm also offers Unit Linked Insurance Plans (ULIPs), which combine the benefits of life insurance protection with the potential for investment growth.

Also read: Fundamental Analysis of HDFC Bank Ltd.

HDFC Life shares news

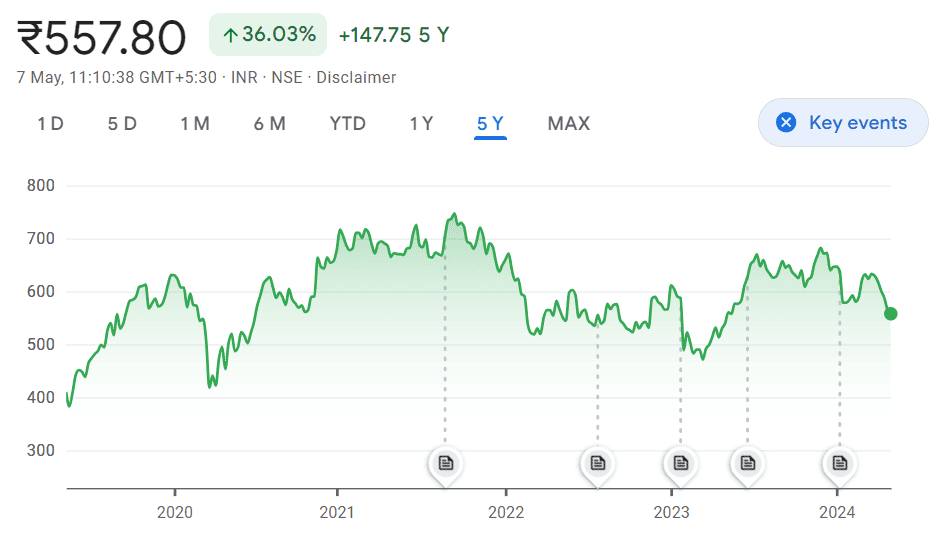

As of May 7, 2024, the HDFC Life share price is ₹557.80. Looking at the HDFC Life share price history, the return given by the stock for the past 5 years is 36.03%.

Source: Google Finance

According to ICICI Securities analysts, the HDFC Life share price target is ₹739, with a recommendation to maintain a buy.

SBI Life Insurance Company Ltd

SBI Life Insurance Company Limited, a joint venture between State Bank of India and BNP Paribas Cardif, is a distinguished entity in the insurance sector, recognised for its robust market dominance and dedication to service delivery powered by technology.

The company has carved a niche for itself as a top-tier brand in the industry, continually enhancing its market share and financial supremacy. Prioritising the trust of policyholders and maintaining high rates of claims settlement,

SBI Life has secured a significant portion of the market, holding a 22.26% stake in the individual-rated premium within the private sector, a 21.34% stake in the new business premium, and a 27.31% stake in the total count of new policies issued by private insurers.

SBI Life share news

As of May 7, 2024, the SBI Life share price is ₹1,444.60. Looking at the SBI Life share price history, the return given by the stock for the past 5 years is 125.00%.

Source: Google Finance

According to ICICI Securities analysts, the SBI Life share price target is ₹1,795, with a recommendation to maintain a buy.

Financial profiles

Let’s compare the key financial metrics for both companies.

| HDFC Life Insurance Company Ltd(as of March 2024) | SBI Life Insurance Company Ltd(as of March 2024) | |

| Revenue (₹ crores) | 101,482 | 131,988 |

| Operating profit (₹ crores) | 452 | 400 |

| Profit before tax (₹ crores) | 977 | 2,078 |

| Net profit (₹ crores) | 1,574 | 1,894 |

| EPS (₹) | 7.32 | 18.91 |

| Market cap (₹ crores) | 1,19,851 | 1,44,021 |

| Price to earning | 76.2 | 76.0 |

| ROCE (%) | 6.61% | 14.9% |

Source: Screener

Reasons for growth

HDFC Life Insurance Company Ltd

- Strong promoter profile: As of December 31, 2023, HDFC Bank, India’s leading private sector bank, owned a substantial 50.37% stake in HDFC Life. The bank’s powerful brand image, extensive network of 7,821 branches, and its dominant shareholding in HDFC Life, coupled with its presence on the board of directors, equip HDFC Life with considerable strategic benefits and backing.

- Leading market position: HDFC Life, ranking as the second-largest private life insurance provider with a 10.4% market share in individual APE and an 8.0% share in total new business premium as of 11MFY2024, prides itself on its well-rounded product portfolio and a wide-ranging distribution network.

- Diversified distribution network: HDFC Life’s expansion is bolstered by a varied distribution network, encompassing bancassurance, corporate agents, direct channels, agencies, and brokers. With over 300 partners and approximately 500 branches nationwide, HDFC Life’s distribution network has grown, offering enhanced opportunities for cross-selling and upselling.

SBI Life Insurance Company Ltd

- Diverse product portfolio: The organisation provides an extensive array of insurance solutions tailored to diverse customer requirements, which has been instrumental in its expansion.

- Strategic partnerships: Partnerships with banks and various distribution networks have broadened the company’s accessibility and reach, thereby improving customer satisfaction and confidence.

- Financial management: Wise financial tactics, such as the absence of capital injection since 2008 and no outstanding debts, have bolstered strong internal earnings and prospects for growth.

- Customer centricity: Emphasising customer satisfaction with high-quality service, prompt resolution of complaints, and cutting-edge digital resources has enhanced customer loyalty and retention.

Also read: How to leverage debt financing for business expansion?

Company strategies

HDFC Life Insurance Company Ltd

- Operating performance: The company is setting its sights on enduring expansion, with strategies focusing on key indicators such as substantial growth across diverse market sizes and locations, with a special emphasis on Tier 2/3 cities.

- Product innovation: The company plans to persistently introduce innovative products, designed to cater to the changing needs of customers. This approach is expected to contribute to the growth of their revenue and build momentum for the financial year 2025.

- Financial and operating metrics: The company is concentrating on preserving a balanced portfolio of products and healthy profit margins from new business. This objective is being realized by making calculated investments in foundational facilities, workforce development, and technological advancements.

- Distribution expansion: The company aims to broaden its reach across various regions and customer demographics, fully utilising the potential of its distribution networks, and augmenting the number of customer interaction points.

SBI Life Insurance Company Ltd

- New business growth: The corporation is dedicated to sustaining its momentum in acquiring new clients and endeavours to uphold its position as the foremost entity in both individual and collective market segments.

- Product offering: SBI Life is strategising to diversify its product portfolio to cater to the varied needs of consumers and aims to establish an equilibrium in its distribution channels.

- Cost efficiency: The firm is resolute in its pledge to preserve industry-leading cost efficiency and to ensure the consistency of customer retention rates.

- Customer-centric approach: The enterprise emphasises the importance of achieving enduring profitability and comprehensive advancement for every party involved, placing the gratification of its clientele as the fundamental priority in its business activities. It is devoted to elevating the experience and satisfaction of policyholders, as evidenced by the notable rise in the Net Promoter Score (NPS) to 72 in FY2024, up from 59 in the previous year.

Bottomline

The comparison between SBI Life Insurance Company Ltd. and HDFC Life Insurance Company Ltd. reveals two formidable contenders in India’s thriving life insurance landscape. Both companies showcase robust financial profiles, strategic growth drivers, and customer-centric approaches, positioning them as leaders in the industry.

Looking ahead, both firms are dedicated to fostering expansion by pioneering new products and prioritizing the needs and preferences of their customers. By aligning their strategies with evolving market trends and customer needs, SBI Life and HDFC Life are well-positioned to capitalise on the immense opportunities offered by India’s burgeoning life insurance market.