In the electrifying world of energy, two giants stand tall: Siemens, the German powerhouse with a rich history dating back to the 19th century, and Hitachi Energy, a dynamic player from the Land of the Rising Sun. Both are renowned for their innovative solutions and significant contributions to the energy sector. But how do they stack up against each other?

Comparing Siemens and Hitachi Energy is not just about putting two industry titans against each other. It’s about understanding their strategies, dissecting their growth trajectories, and uncovering the secrets behind their success.

Company profiles

Siemens Limited

Siemens Limited provides a diverse range of products and comprehensive solutions for industrial applications, specifically tailored for the manufacturing sector. They also specialise in drive systems for process industries, smart infrastructure and building solutions. In the energy sector, Siemens excels in the efficient generation of power from fossil fuels and oil & gas applications.

They are also involved in the transmission and distribution of electrical energy, catering to both passenger and freight transportation. This includes the provision of rail vehicles, as well as the automation and electrification of rail systems.

The company has a significant geographical presence that spans both within and outside India. Approximately 84.59% of its operations are based within India, demonstrating a strong domestic footprint. On the other hand, about 15.41% of its operations are located outside India, indicating a growing international presence. This balanced distribution allows the company to leverage local markets while also tapping into global opportunities.

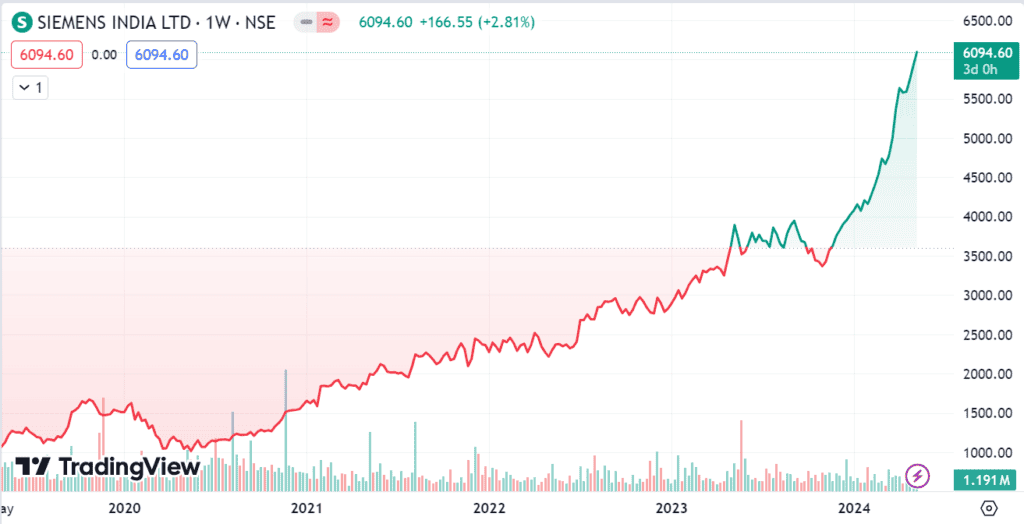

Siemens share news

As of May 7, 2024, the Siemens share price is ₹6094.60. Looking at the Siemens share price history, the return given by the stock for the past 5 years is 464.16%.

Source: Tradingview

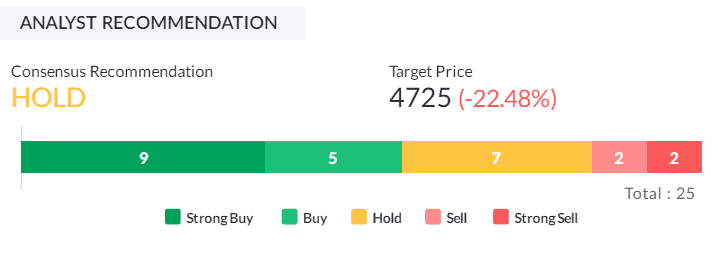

Siemens share price target, according to the consensus recommendations by 25 brokerage analysts:

Source: Trendlyne

Hitachi Energy

Hitachi Energy India Ltd (formerly known as ABB Power Products and Systems India Ltd.) was created in 2019 as a Joint Venture between Hitachi and ABB’s Power Grids. The company serves utility and industry customers, with a complete range of engineering, products, solutions, and services in areas of Power technology.

The company boasts a substantial presence geographically, both in India and abroad. With around 73.45% of its operations rooted in India, it showcases a robust domestic influence. Conversely, nearly 26.55% of its operations are conducted internationally, signifying an expanding global footprint. This equilibrium in distribution enables the company to capitalise on local markets while simultaneously exploring worldwide opportunities.

Also read: Hitachi Energy India Ltd: Shareholding pattern and stock trend

Hitachi Energy India share price news

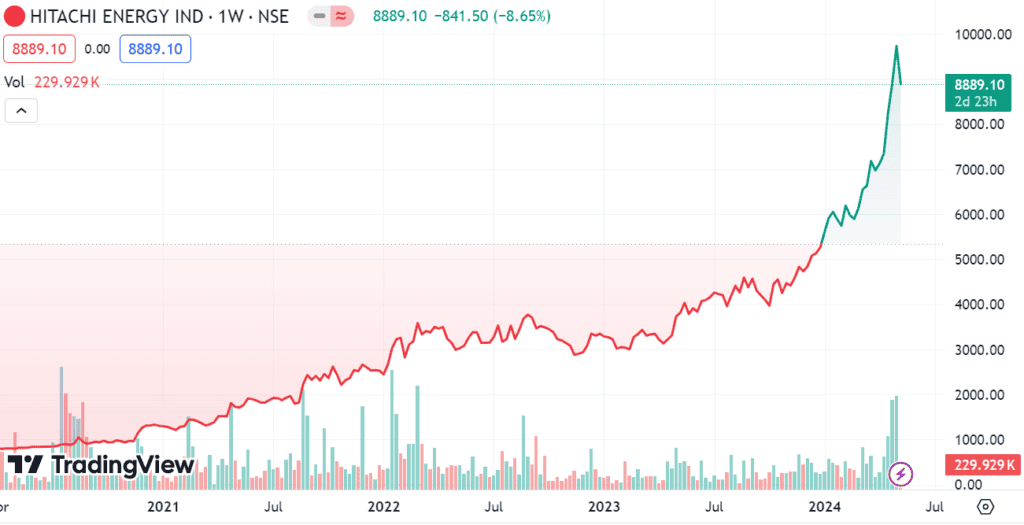

As of May 7, 2024, the Hitachi Energy share price is ₹8889.10. Looking at the Siemens share price history, the return given by the stock for the past 5 years is 1207.22%.

Source: Tradingview

Hitachi Energy share price target, according to the consensus recommendations by 7 brokerage analysts:

Source: Trendlyne

Financial profiles

Let’s compare the key financial metrics for both companies.

| Siemens(as of Dec 2023) | Hitachi Energy(as of Dec 2023) | |

| Revenue (₹ crores) | 4,436 | 1,274 |

| Operating profit (₹ crores) | 523 | 68 |

| Profit before tax (₹ crores) | 622 | 34 |

| Net profit (₹ crores) | 463 | 23 |

| EPS (₹) | 13.01 | 5.42 |

| Market cap (₹ crores) | 2,16,924 | 37,734 |

| Price to earning | 112 | 374 |

| Debt to equity | 0.01 | 0.28 |

| ROCE | 20.7% | 12.9% |

Source: Screener

Also read: Decoding the significance of market capitalisation

Reasons for growth

Siemens

- Diverse portfolio: Siemens Limited boasts a comprehensive array of technology solutions encompassing sectors such as energy, infrastructure, manufacturing, and mobility. This diverse portfolio equips them aptly to cater to the multifaceted needs of India.

- Innovative solutions: The company’s commitment to innovation is highlighted by its substantial contracts, like providing 1,200 locomotives to Indian Railways, demonstrating its ability to manage extensive projects.

- Digital transformation: Siemens Limited places a strong emphasis on digital transformation. Their Siemens Xcelerator platform provides 100 digital use cases that are relevant to India and span across various industries, thereby enriching their service offerings.

- Sustainability commitment: Their DEGREE sustainability framework and initiatives such as the Siemens Scholarship Program exemplify their dedication to sustainability and social responsibility. This commitment aligns with the values of contemporary consumers and investors.

Also read: 1853 to 2023: A case study on Indian railways, its birth and growth

Hitachi Energy

- Innovative solutions: The company is engaged in progressive initiatives such as electric vehicle charging stations, repurposing of wood waste, and battery energy storage systems. These endeavours highlight their commitment to innovation and sustainability.

- Operational excellence: The company places a strong emphasis on operational excellence as a means to enhance productivity and quality. This is clearly reflected in their substantial order backlog amounting to ₹7,552.3 crore, which offers a revenue forecast for roughly 22 months.

- Strategic partnerships: The company’s active participation in industry dialogues and partnerships with stakeholders such as Hitachi Energy & Global underscores its strategic methodology for expansion.

- Safety and employee engagement: The company places a significant focus on safety and the well-being of its employees, as evidenced by initiatives such as HSE week and employee engagement programs. These efforts highlight the company’s dedication to its workforce.

Company strategies

Siemens

- Digitalisation focus: Siemens Limited is striving to fortify its standing as a top technology firm by concentrating on areas of high growth that have synergies across various businesses, with a particular emphasis on the shift from electrification towards automation and digitalisation.

- Portfolio optimisation: The company intends to streamline its portfolio as a strategic instrument, generating value and cash by merging businesses in areas with high growth potential.

- E-mobility expansion: Siemens Limited is poised to broaden its e-mobility business division by taking over the electric vehicle segment of Mass-Tech Controls Private Limited. This move will bolster its ability to supply certified EV charging infrastructure within India.

- Dividend distribution: Following the divestment of its low voltage motors and geared motors businesses, Siemens Limited plans to distribute 100% sale proceeds, after deducting applicable taxes, as a special dividend to its shareholders.

Hitachi Energy

- Sustainability 2030 goals: The company is striving to achieve carbon neutrality in its operations by 2030. The company has successfully reduced its CO2 equivalent emissions by 45%. Additionally, it has managed to cut down waste disposal and freshwater usage by 50%.

- Renewable energy integration: The company is concentrating on the integration of renewable energy sources, with ambitions to spearhead the expansion of solar and wind capacities. Furthermore, it is committed to supporting the government’s objective of augmenting renewable energy capacity.

- Digitalisation and grid modernisation: The company is channelling investments into digitalisation to streamline energy consumption and management. This includes the implementation of smart metering across its facilities and the use of advanced metering technology to boost energy efficiency.

- Expansion in services and exports: The company is broadening its service portfolio and capitalising on its manufacturing prowess to penetrate new markets and fuel growth. Currently, a quarter of its orders are driven by exports.

Bottomline

Siemens and Hitachi Energy are both industry leaders with a strong focus on innovation and sustainability, driving their growth in the energy sector. Siemens leverages digitalisation and a diverse portfolio, while Hitachi Energy emphasises operational excellence and renewable energy integration.

Both companies have shown impressive financial metrics, with Siemens having a larger market cap and Hitachi Energy boasting a higher return in share price over the past five years. Their distinct strategies suggest promising prospects, with Siemens advancing in digital and environmental solutions and Hitachi Energy pushing towards a sustainable energy future.