The technology industry, a vibrant and ever-evolving landscape, is a mirror reflecting the progress of our civilisation. Siemens, a beacon of innovation and quality, has been navigating the waves of the tech industry with remarkable resilience.

Recently, Siemens released its Q2 (Jan 2024 to March 2024) results on May 14, 2024. Following the announcement, Siemens saw an impressive 8% surge in its share price. This significant leap is not just a testament to Siemens’ robust performance but also a reflection of its strategic decisions and unwavering commitment to innovation.

In this article, we will unravel the story behind this surge, exploring the factors that fueled this rise and the implications it holds for Siemens and its investors.

About Siemens Ltd

Siemens Limited is a versatile entity that offers a wide array of products and holistic solutions, specifically designed for the industrial sector, with a particular focus on manufacturing. They have expertise in driving systems for various industries, intelligent infrastructure, and building solutions.

In the realm of energy, Siemens stands out for its efficient power generation from fossil fuels and oil & gas applications.

Their involvement extends to the conveyance and distribution of electric power, serving both passenger and freight transportation. This encompasses the supply of rail vehicles and the automation and electrification of railway systems.

Siemens has a substantial presence geographically, both within India and internationally. Roughly 84.59% of its operations are rooted in India, showcasing a robust domestic presence. Conversely, about 15.41% of its operations are based overseas, signifying an expanding global footprint. This equilibrium allows the company to capitalise on local markets while also exploring international opportunities.

Siemens share dividend: The firm boasts a reliable history of dividend distribution, having consistently announced dividends over the past five years. The dividend payout ratio for the year 2023 was 19%.

Must read: Siemens vs Hitachi Energy: Market strategies

Siemens Ltd quarterly performance

Siemens Ltd operates on a fiscal calendar that begins in October and ends in September. Therefore, the period from January to March 2024 represents the second fiscal quarter for the company.

Here are a few crucial financial indicators of Siemens Ltd Q2 FY24 results, compared with the same quarter from the preceding year:

| Q2 FY2024(₹ crores) | Q2 FY2023(₹ crores) | Change (%) | |

| Revenue | 5,314 | 4,465 | 19.01 |

| Operating profit | 788 | 555 | 41.98 |

| Profit before tax | 1,163 | 682 | 70.52 |

| Net profit | 896 | 516 | 73.64 |

| EPS | 25.17 | 14.49 | 73.71 |

Source: Screener

Siemens is experiencing a surge in demand, bolstered by the country’s robust economic expansion. Key sectors such as electronics, hydrogen energy, railway infrastructure, data centres, and semiconductors are witnessing significant growth prospects.

Despite a sequential dip of approximately 13% in Q2 order inflows, amounting to roughly ₹5180 crore, this is attributed to the temporary impact of general elections causing postponements in order confirmations.

Must read: Neuland Laboratories Q4 results: Shares fall amidst financial fluctuations

Market reaction – Siemens share news

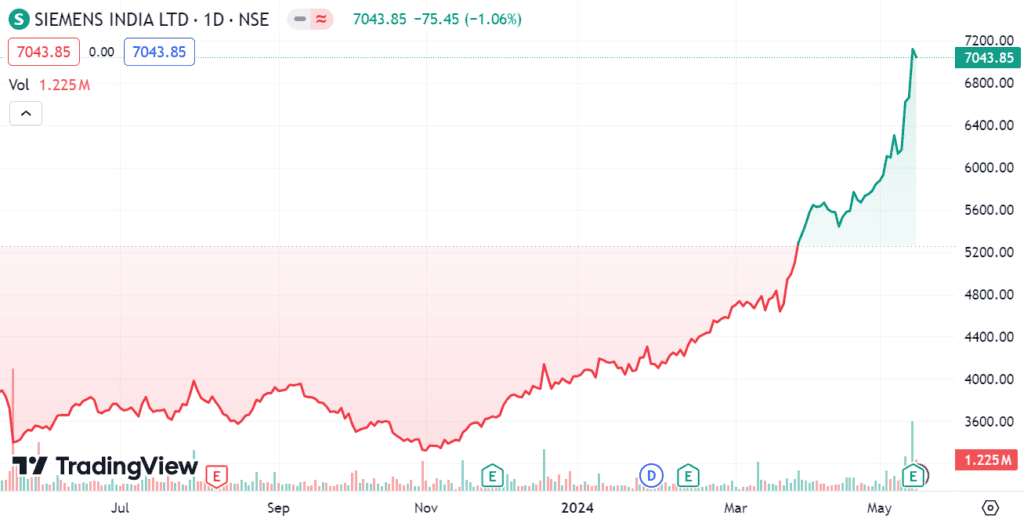

Siemens India share price: On May 15, the Siemens share price soared, registering an impressive gain of over 8%, and reached a 52-week high, trading at ₹7,249.05 per share on the National Stock Exchange, marking a significant milestone for the company in India’s industrial products and solutions market.

This can be clearly seen in this chart, showing Siemens share price history for the past year:

Source: Tradingview

Siemens share price target:

In the wake of Siemens’ recent performance, various brokerage houses have provided their insights and revised their share price targets for the company.

Jefferies, a global brokerage firm, has shown optimism towards Siemens’ growth, highlighting the company’s plans to invest over ₹10 billion in capex. They forecast a 35% CAGR from FY23-26 and predict the ROE to surpass 20%. Jefferies has upheld a ‘buy’ recommendation on the stock and escalated the target price to ₹8,000, a significant increase from the previous ₹5,575.

InCred Equities asserts that Siemens has demonstrated strong profitability and is strategically positioned for India’s capex upcycle. They have sustained an ‘add’ rating on the stock and elevated the target price to ₹7,565, a substantial rise from the earlier ₹4,400.

Motilal Oswal observed that Siemens’ 2QFY24 result exceeded their predictions, largely due to robust margin performance and increased other income. They have maintained a ‘buy’ rating on the stock and established a target price of ₹7,800.

Kotak Institutional Equities announced that Siemens had a 23% beat in EBITDA, primarily propelled by productivity gains. They have kept a ‘sell’ rating on the stock but have increased the target price to ₹4,900.

Proposed demerger of energy business

Siemens Limited is considering a strategic move to demerge its energy business into a distinct entity, proposed to be named Siemens Energy India Limited (SEIL). This is aimed at allowing both the energy business and the remaining operations of Siemens Limited to concentrate on their core activities and markets with greater focus and independence.

Demerger details:

- Entities involved: Siemens Limited and its wholly-owned subsidiary, SEIL.

- Business segment: The energy business, which includes products, solutions, and services across the energy value chain.

- Objective: To foster strategic autonomy and enhance the operational concentration for both the energy business and the other divisions of Siemens Limited.

Benefits of the demerger:

- Strategic autonomy: Each organisation will possess the capacity to enact decisions optimally aligned with the unique demands and strategic plans of their individual market segments.

- Market focus: The separation will enable each entity to customise its strategies to align with the evolving market conditions and specific risks within their respective industries.

- Value unlocking: It is anticipated that shareholders will gain from the autonomous valuation of their shares in SEIL, which will be determined by market forces once it is publicly traded.

The demerger process, including obtaining the required approvals and subsequently listing Siemens Energy India Limited, is expected to be completed by 2025.

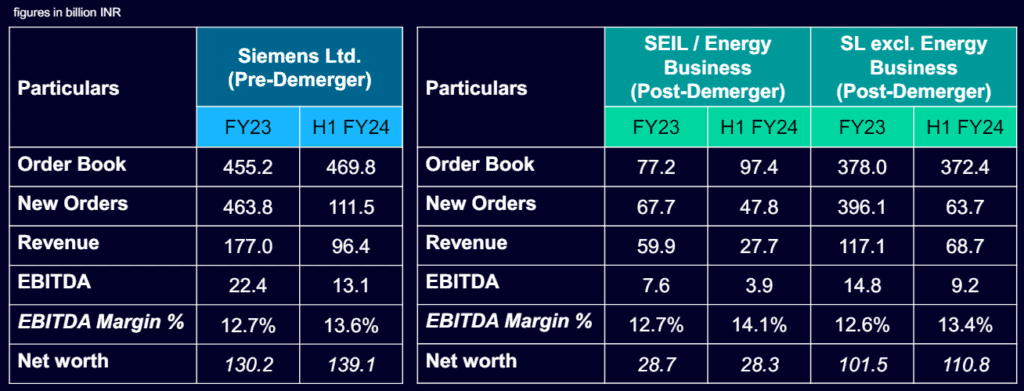

This chart compares financial metrics for Siemens Ltd. before the demerger and the SEI/SL business after the demerger, providing a clear snapshot of the financial performance across different fiscal periods.

Source: Siemens Limited – Analyst Call Presentation – Q2 FY 2024

Also read: Mergers vs. Acquisitions – How are they different from one another?

Bottomline

Market reactions to Siemens’ Q2 FY2024 performance have been overwhelmingly positive, with the stock reaching a 52-week high on the National Stock Exchange. This optimism is further bolstered by revised share price targets from various brokerage houses, who have recognised Siemens’ strategic investments and strong profitability.

The proposed demerger of Siemens’ energy business into Siemens Energy India Limited is a strategic move aimed at enhancing operational focus and unlocking shareholder value. This split will enable both units to chase market opportunities independently, benefiting shareholders through SEIL’s separate valuation once listed.