Sudhir Sethi founder & chairman of Chiratae Ventures has been a key figure in transforming the nation’s venture capital landscape. The firm, recognised for supporting companies like Flipkart, Lenskart, PolicyBazaar, FirstCry etc., has nurtured many of India’s entrepreneurial successes.

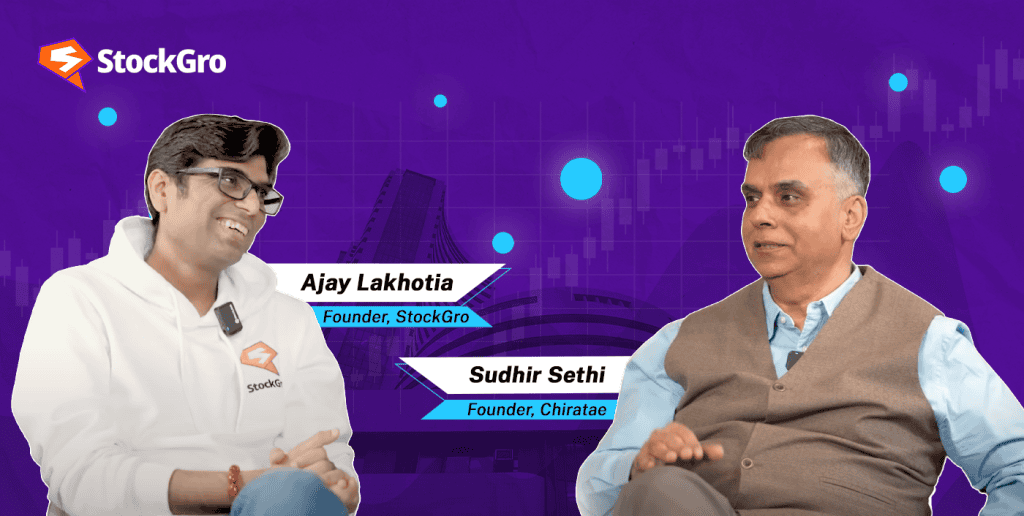

Read on to discover what he shares in conversation with Ajay Lakhotia in the latest episode of Money Mantra.

You may also like: Ajay Lakhotia reveals Nilesh Shah’s mutual fund success blueprint

How Sudhir Sethi’s venture capital journey started

Sudhir Sethi didn’t stumble into venture capital—he actively sought it out. After 12 years at Wipro, where routine had started to dull his drive, he found himself intrigued by the idea of investing in startups.

So, in 1998, he took an offer from Walden International. Venture investing in India is practically an uncharted territory. With no formal guidance, Sethi learned from scratch. His first step was a visit to a bookstore, where he bought a book on VC, absorbed it, and used it to craft his first presentation.

Walden exposed him to the raw energy of Indian entrepreneurs. In his initial year, he met 279 founders, gaining critical insights into how they think and operate. Over four years, he led investments in 11 companies, deploying $21 million. Not everything was a win, but the experience was invaluable.

The birth of Chiratae Ventures

When Walden pulled out of India in 2002, Sethi didn’t follow suit. He sensed something bigger was brewing. By 2006, with India’s startup ecosystem still in its infancy, Sethi, along with T.C.M. Sundaram and others, launched Chiratae Ventures.

The early days were gruelling. Fundraising efforts repeatedly fell short, and doubts loomed. Then came a crucial moment—an unexpected encounter with Patrick McGovern, chairman of IDG. A 30-minute chat extended to two and a half hours. The outcome? McGovern pledged $150 million, anchoring their fund and providing the launchpad they needed.

But Sethi wasn’t content with just foreign investment. He saw the need for homegrown funds backing Indian innovation. When many advised against it, he pursued domestic avenues, raising ₹120 crores for their second fund.

Chiratae Ventures extends its support beyond large startups, championing small-scale business owners as well. Sudhir Sethi shares a powerful story from the pandemic—a young woman, undeterred by the crisis, launched a makeup blog and harnessed digital platforms to grow her enterprise. With just a modest financial boost, her venture flourished, showcasing how local businesses can thrive with the right guidance and resources.

Traits of successful founders

When Ajay Lakhotia inquired about the qualities that distinguish exceptional entrepreneurs, Sudhir Sethi pointed to a series of key characteristics.

- Clear sense of direction: First and foremost, these individuals possess crystal-clear direction. They don’t just have lofty ambitions—they can chart the path that will take them there.

- Flexibility and adaptability: The standout founders show unmatched flexibility. In a rapidly evolving environment, where markets shift and technologies change, they pivot and recalibrate swiftly. Sticking rigidly to one strategy can spell disaster, especially in a landscape that demands agility.

- Attracting top talent: A crucial, often overlooked, trait is their ability to magnetise high-calibre people. These entrepreneurs surround themselves with seasoned professionals, ensuring the business is driven by collective expertise. They understand that the strength of their leadership lies in the team they build.

This mix of clarity, flexibility, people leadership, and moral strength defines the entrepreneurs who shape industries. While no single trait guarantees success, together, they form a solid foundation for building transformative companies.

The evolving startup ecosystem in India

Ajay Lakhotia raised an insightful question when speaking with Sudhir Sethi: how is India’s startup environment evolving, and what distinguishes it today?

India’s entrepreneurial scene has undergone a radical shift. In the early 2000s, local ventures often mirrored successful businesses from the US or China. Today, things are different.

Indian entrepreneurs are now leading the way with homegrown solutions, tackling challenges unique to their market. What’s even more notable is that some of these innovations are gaining international traction, setting global standards rather than following them.

One major change is the rise of younger founders. A decade ago, most business leaders were in their 30s or 40s, usually after building a career in established industries. Now, it’s common to find ambitious individuals in their twenties who are fluent in technology and capable of adapting rapidly. This emerging generation approaches problems with fresh eyes and bold thinking, driving the startup scene in new directions.

Another critical shift is the increasing availability of homegrown investment. In the past, the Indian startup ecosystem depended on foreign investors. That’s no longer the case. Domestic funding has surged, creating more stability and ensuring a longer-term commitment to India’s growth story. This influx of capital from within the country reduces reliance on global markets and aligns investment more closely with India’s development.

Moreover, these ventures are addressing tangible, everyday challenges. They are not merely focused on scaling fast or turning profits. Instead, they aim to improve access to healthcare, financial inclusion, and education. By developing businesses that impact millions, these companies are focusing on long-lasting change, not just short-term gains.

The entrepreneurial environment is also more dynamic and competitive than ever before. Ventures are no longer just aiming to survive—they are pushing to thrive. With cutting-edge technologies and an ever-growing pool of talent, the competition to build scalable, impactful companies has intensified.

You may also like: Mukul Agarwal’s path to stock market success revealed by Ajay Lakhotia

The importance of domestic capital in India’s venture ecosystem

The guest of the podcast emphasises the critical role of local funds in shaping the future of Indian startups. Ajay Lakhotia’s question during their discussion highlights this shift: “How do you see the role of Indian investors evolving in the venture space?” This brings us to the core issue – relying on foreign capital alone is unsustainable in the long run.

Why domestic capital matters?

- Local understanding: Indian investors can act quicker, with better insight into the country’s socio-economic landscape.

- Long-term view: Domestic capital is less influenced by global markets, providing stability.

- Cultural relevance: Local investors fund solutions that address India-specific problems, rather than merely copying global models.

Foreign capital brought opportunities, but also risks. Dependence on external markets made startups vulnerable to global economic shifts. With more local funds, startups are gaining independence and greater control over their direction. The reliance on foreign markets is fading, which builds a stronger foundation for Indian entrepreneurship.

Domestic capital backs ventures solving critical localised challenges—healthcare, financial inclusion, and rural markets. Sudhir Sethi shared how PolicyBazaar and Lenskart disrupted industries by addressing issues unique to India. Local capital is driving impactful, sustainable innovation rather than short-term profit models.

The rise of individual investors, family offices, and angel networks is also significant. These smaller investors provide vital early-stage funding, helping entrepreneurs who might otherwise struggle to get started. India’s growing angel ecosystem offers young companies the chance to grow with support that goes beyond money. In fact, India’s AIF (Alternative Investment Funds) landscape is growing.

Also read: Mutual Fund vs PMS vs AIF: Key Differences

What it takes to join a venture capital firm

Joining a venture capital firm requires more than just financial knowledge. It demands the ability to adapt quickly and understand that nothing stays constant in this dynamic environment. Flexibility is a core skill.

One must grasp evolving market trends and technological innovations, which shift more frequently than before. The role involves a deep understanding of business models, which don’t remain static, and products that change rapidly.

Critical traits include being open to new ideas and having the capacity to evaluate risks. A venture investor must stay ahead of trends, recognising emerging opportunities and adapting strategies in response.

Lessons from failure

Every investor or entrepreneur will face difficult periods, where investments don’t perform as expected. While success stories are celebrated, the path to achieving them often involves navigating unforeseen challenges.

Sethi acknowledges this, stressing that no venture can avoid tough phases. He recalls how critical it is to analyse failures, not just for the company but for future ventures too..

Investors, like entrepreneurs, often have to make emotionally charged decisions, especially when it involves walking away from an investment. Sethi admits that it’s never easy to tell a founder that their venture isn’t working, but it’s a reality of the industry.

The ability to balance empathy with practicality is crucial in ensuring both the fund and founder learn and move on from setbacks.

Ultimately, both Sethi and Lakhotia agree that success in venture capital is about taking the long view. Failure is not just a possibility but an integral part of the journey. Ventures that understand this are better equipped to turn setbacks into stepping stones for growth.

The future of venture capital

The world of venture capital is undergoing rapid transformation, with new trends shaping its trajectory. As funding ecosystems shift, it’s crucial to understand where the future of venture investment lies.

Historically, Indian startups were heavily reliant on foreign investment. However, this has changed. A stronger focus on raising capital locally is emerging. As Sudhir Sethi points out, over 50% of their ₹5,000 crore fund now comes from Indian investors. Ajay Lakhotia asked, “What needs to change to further fuel this domestic growth?”

The answer lies in policy reform. Taxation structures for venture investments still favour international funds, something that needs rethinking. If domestic investments are treated on par with public market investments, local capital could grow significantly, making the Indian venture ecosystem less vulnerable to global market fluctuations.

The rise of technology-driven ventures

Today’s entrepreneurs are younger and bolder. Unlike the earlier generation, which took years to scale, these founders are using advanced technologies to build companies at an unprecedented pace. With rapid advancements in AI, blockchain, and biotechnology, companies can pivot faster and solve bigger problems.

Speed and agility

Startups today need to be more adaptable than ever before. Business models that worked a year ago may not work today. Founders must be ready to pivot. Whether it’s launching a new product amidst a pandemic or tweaking a business model when faced with unforeseen challenges, agility has become a core trait for success.

For VCs, identifying such traits in founders is key. The ability to change course rapidly, absorb feedback, and continue innovating are critical qualities investors now seek. As competition increases, only those founders who embrace change will thrive.

Shift in investment strategies

VC firms are no longer just looking for growth; they’re searching for businesses that address fundamental challenges within society. Health, education, and sustainability have come to the forefront.

Sudhir notes, for example, that tackling the gap in healthcare access—whether through digital platforms or affordable medical products—has become a focus for many investors. This points to a larger trend where funding isn’t just about returns; it’s about real-world impact.

The evolution of funding models

With the rise of more complex technologies and bigger market problems, there’s been a fundamental shift in how capital is deployed. Funding rounds now move faster, and the scale is often larger, particularly for those that show early potential.

Summary

This Money Mantra episode brought out conversations regarding how the future lies in nurturing innovative, homegrown enterprises. Throughout his journey with Chiratae Ventures, he’s observed that a combination of adaptability, strategic foresight, and integrity sets successful founders apart.

As the startup ecosystem continues evolving, especially with younger entrepreneurs leading the charge, the role of domestic investors becomes increasingly crucial. By focusing on solutions for uniquely Indian challenges, the ecosystem is poised for sustained, impactful progress.