India, known as the ‘sweetest’ nation for its love of sugary delights, is also one of the largest producers and consumers of sugar globally. Surprisingly, India is also the 2nd largest exporter of sugar globally.

The sugar industry plays a substantial role in India’s economy, providing employment to millions and contributing to the nation’s GDP (Gross Domestic Product).

However, the sweetness turned slightly bitter when the recent sugar news of the Indian government announcing a ban on sugar exports made headlines.

This move, aimed at ensuring domestic availability and price stability, has stirred up a storm in the sugar industry.

Overview of India’s sugar industry

The sugar industry plays a crucial role in the rural economy, touching the lives of nearly 50 million sugarcane farmers and providing direct employment to about half a million workers in sugar mills.

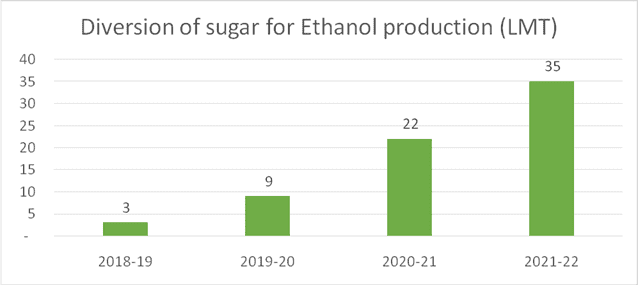

As the world’s leading sugar producer and consumer, India has been increasingly using its sugarcane crop for ethanol production, in line with its push for fuel plants to ramp up production. This shift not only diversifies the use of sugarcane but also contributes to the country’s energy needs.

You may also like: Is real estate growth in India sustainable? Opportunities vs Challenges!

In (October-September) 2021-22, India produced a whopping more than 5000 lakh metric tons (LMT) of sugar. Of this amount, 35 LMT of sugar was redirected for ethanol production.

Source: PIB

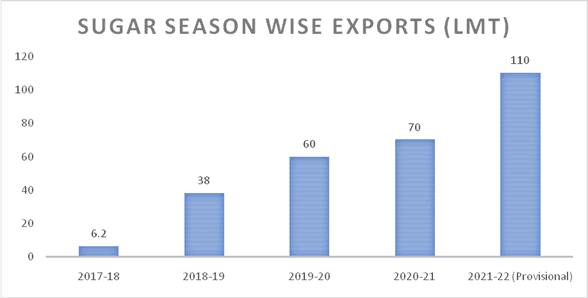

Further, in the same year of 2021-22, India achieved a record by exporting a whopping 110 lakh tonnes of sugar.

Source: PIB

As we move into the current marketing year of 2022-23, which runs from October to September, the estimated sugar production will be around 373 LMT.

However, the Indian government has restricted the exports to only 60 LMT, far behind the exports in the previous year.

But why?

Also Read: What is Consumer Price Index (CPI)? How does it shape your finances?

The ban on sugar exports

The country has been facing rising food prices, and the scanty rainfall leading to drought-like conditions, especially in key sugar-producing states like Maharashtra and Karnataka, has intensified the situation. This has led to a significant decrease in sugar production, prompting the government to cap sugar exports at 60 LMT in the 2022-23 sugar year.

The government has now decided to extend the ban on the export of various types of sugar, including raw, white, refined, and organic sugar, beyond October.

Looking ahead, there’s contemplation of shifting sugar exports from ‘restricted’ to ‘prohibited’ for 2023-24, owing to the weakest monsoon in years affecting sugarcane harvests.

The primary reason for the sugar export ban is to ensure sufficient domestic supply and control prices amidst rising food inflation. The El Niño weather phenomenon, causing disruptions in weather patterns, has contributed to a spike in global sugar prices, making exports less viable. This move, though aimed at stabilising domestic sugar prices and ensuring ample supply for local consumption, has broader implications.

For further understanding: El Nino: A threat to India’s econom

In order to stabilise the domestic sugar supply and prevent an increase in sugar prices, the government has implemented another new ban.

The ban on of use of sugarcane juice for making ethanol

In a notable policy shift, the Indian government has recently imposed a ban on the use of sugarcane juice and sugar syrup for ethanol production in the 2023-24 supply year.

Despite the new restrictions, the government has permitted the use of B-molasses for ethanol production. This decision has been welcomed by the sugar industry, as it represents a balanced approach: limiting some resources for ethanol production while still keeping the industry moving.

This policy change is a response to broader market conditions, including an anticipated decrease in sugar production of 8%, as projected by the Indian Sugar Mills Association (ISMA). Additionally, the reduction in sugar exports aligns with the government’s broader strategy to control food inflation and stabilise domestic markets.

Consequences on the ban – The good and the bad

The good

- Ensuring domestic sugar supply: The primary advantage of this ban is the assurance of sufficient sugar availability for Indian consumers. By limiting the use of sugarcane juice for ethanol, more sugar remains in the domestic market.

- Price stability: With more sugar available for domestic consumption, there’s a reduced risk of price hikes. This move helps in keeping sugar prices stable and affordable for the average consumer.

The bad

- Impact on ethanol facilities: The major downside is the direct impact on ethanol producers, especially those who exclusively use sugarcane juice. These facilities now face operational challenges and potential financial strain.

- Uncertainty in the industry: There’s a significant level of uncertainty regarding the future, particularly about the continuation of B-molasses for ethanol production after current contracts end. This lack of clarity can affect long-term planning and investments in the sector.

Also read: Cost inflation index – What, why and how?

The lift of the ban

The sugar export news and the ban on the use of sugarcane juice for ethanol production caused quite a stir. This decision was challenged, especially in Maharashtra, leading to a swift reassessment.

The government has now reversed its stance, allowing the use of both sugarcane juice and B-heavy molasses for ethanol. However, there’s a catch: the diversion of sugar for this is capped at 17 lakh tonnes. Union Food Secretary Sanjeev Chopra confirmed this new regulation, highlighting that sugar mills and oil marketing companies (OMCs) can decide how to split this quota.

This turnaround comes after protests and concerns from the sugar industry. It’s a relief for many, especially as around three dozen distilleries rely solely on sugarcane. The government’s decision reflects its responsiveness to industry demands and the importance of maintaining a balance between regulations and economic realities.

The government aims to review this policy periodically. Furthermore, there’s a possibility of increasing the sugar diversion limit for ethanol production later on. This would be based on a review in the coming months.

The industry also seeks a revision in ethanol prices derived from B-heavy and C-heavy molasses to aid the financial stability of millers. This situation underscores the dynamic nature of government-industry relations and the ongoing efforts to balance economic and regulatory demands.

Bottomline

India, a powerhouse in both sugar production and consumption, has been buzzing with increased sugar production. However, this promising landscape has been clouded by the imposition of a ban on sugar exports and the ban on the use of sugarcane juice for making ethanol, triggered by challenges like drought and worries over food inflation.

As India grapples with the complexities of this sugar export ban and the evolving policies on ethanol production, it is a waiting game to see how the nation’s love for sweets and the global sugar market will adjust to these shifting dynamics.