The media and entertainment industry in India is booming. By 2025, experts estimate its value to reach about $35.4 billion. With this thriving sector, not only are people entertained, but India’s economy is also growing.

Sun TV Network Ltd. and Zee Entertainment Enterprises Ltd., two of the most prominent players in the industry, provide a wide variety of content that has captured the attention of viewers nationwide, despite the number of competitors in this field.

But which one demands space in your portfolio? Let’s find out as we analyse the financials, results, and growth drivers of these media powerhouses.

Also read: From print to digital: The story of India’s media and entertainment sector

Company profile

Sun TV Network Ltd

Sun TV Network is considered to be among the major television networks in Asia. The business was started in 1993 by Kalanidhi Maran. Among its many channels is Sun TV, India’s first Tamil channel that was entirely privately owned. Since then, it has expanded tremendously, and it now owns and manages multiple television stations in Tamil, Telugu, and Malayalam, among other Indian languages.

Sun TV Network, which has 37 channels in seven languages, is now India’s largest media conglomerate. The number of Indian homes they reach exceeds 140 million. In addition, viewers in 27 other countries may enjoy Sun TV Network’s programming, including several European nations, North America, and the United States.

The current market capitalisation of Sun TV Network Ltd. on BSE is ₹25,609.59 crore (As of May 8, 2024).

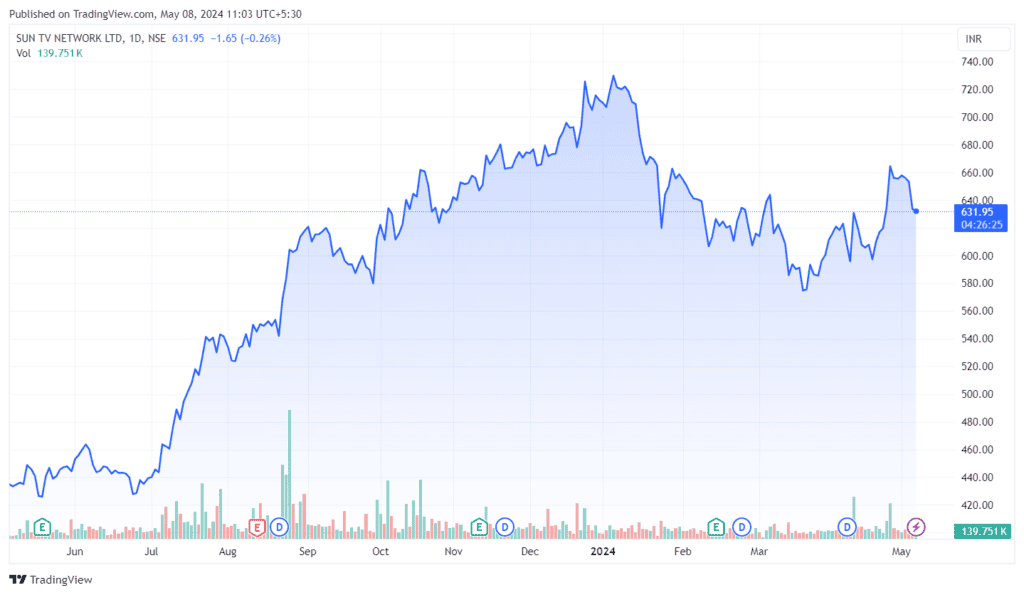

Sun TV share news

As of May 8, 2024, Sun TV’s share price was ₹629.25. According to Sun TV share price history, it has returned 44.63% in the last 1 year and 16.26% in the last 5 years.

Source: Tradingview

Sun TV results

According to Sun TV Network’s December quarter (Q3FY24) results, the total income increased by 6.63% to ₹1,014.81 crores, with PAT at ₹437.34 crores.

The company reported a significant increase in total income, up by approximately 14.19% to ₹3,572.95 crores for the nine months (9M FY2024).

Revenues also saw a healthy rise of about 13.11%, reaching ₹3,221.24 crores for the same timeframe. For the quarter, revenues were up by 3.26% to ₹885.48 crore.

Here’s a rundown of the results:

| Q3 FY24 | 9M FY24 | |

| Total Income (₹ crore) | 1,014.81 | 3,572.95 |

| Revenue (₹ crore) | 885.48 | 3,221.24 |

| Profit After Tax (₹ crore) | 437.34 | 1,476.38 |

Additionally, the company also declared an interim dividend of 50% on February 14, 2024, reflecting its strong financial performance and commitment to shareholder returns.

Also read: TV18 Broadcast Ltd.

Zee Entertainment Enterprises Ltd

Founded in 1982, connecting 1 billion+ people and offering material across diverse categories, languages, and channels, Zee is one of the leading worldwide content-delivering organisations.

The primary operations of Zee Entertainment Enterprises include the following activities: broadcasting satellite TV channels; acting as a space-selling representative for additional satellite television channels; and selling media content, including broadcast rights, movie rights, and audio rights.

The business provides 48 local channels and 41 international channels, broadcasting in 20+ languages and including over 5,000 film titles. With a 36% share of the Indian television market and over 1.3 billion daily users, Zee easily outpaces its competitors. Additionally, the business claims that Zee is India’s leading entertainment network, with 7 out of 10 TV viewers tuning in each week.

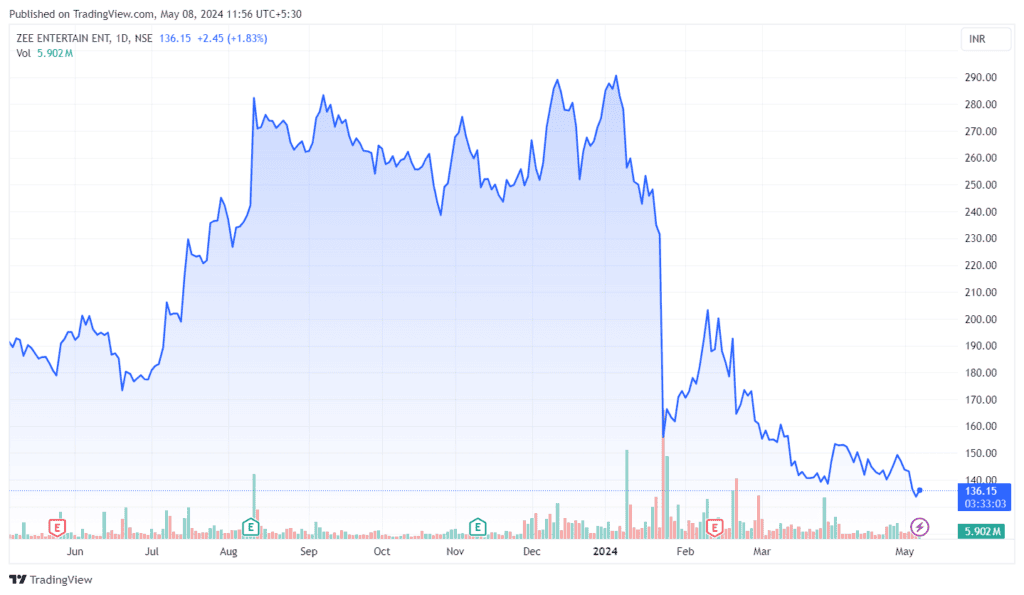

Zee Entertainment share news

Zee Entertainment’s share price as of May 8, 2024, was ₹135.65. According to Zee Entertainment’s price history, the stock has dropped -29.13% in the last 1 year and -63.46% in the last 5 years.

Source: Tradingview

Zee Entertainment results

In the third quarter of FY24, the company witnessed a positive trend in its financial performance. Advertising revenues experienced a 4.9% quarter-over-quarter increase, while subscription revenues grew by 9% year-over-year.

The digital platform ZEE5 showed robust growth, with a narrowing EBITDA loss and a 14.9% rise in revenue compared to the same period last year. The broadcasting business maintained its health and continued to capture more market share. However, the movie segment faced a downturn in revenues, attributed to a reduced number of releases.

On a brighter note, the music division sustained its strong performance. Operational efficiencies led to a 12.8% reduction in operating costs quarter-over-quarter, contributing to an EBITDA margin of 10.2%. These highlights reflect the company’s strategic adaptability and resilience across its diverse business units.

Financial profiles (as of May 8, 2024)

| Value | Sun TV | Zee Entertainment |

| Market cap (Rs. crore) | 25,022 | 12,948 |

| EPS (Rs.) | 48.0 | -0.71 |

| Net Profit last quarter (Rs. crore) | 454.09 | 58.54 |

| Return on Capital Employed (%) | 25.5 | 7.94 |

| ROE (%) | 19.2 | 0.35 |

| Book value (₹) | 256 | 112 |

| Dividend Yield (%) | 2.63 | 0.00 |

Also read: HUL vs ITC shares – Which FMCG stock is your pick?

Strategic reasons for growth

Sun TV Network Ltd

- Excellent presence in the market

Sun TV, the main channel of Sun TV Network Ltd., has a large audience and ranks first in the general entertainment category for viewers and impressions. Sun TV Network Ltd.’s channels are among the most rated in every South Indian language.

Over the last many years, it has maintained strong TRPs because of its enormous content library. This has ensured revenue visibility in the advertising and subscription categories. Its sports franchise income increased from 8% in FY2023 to 16% within nine months in FY2024.

- Impressive financial history

The progressive transition of subscribers from television to OTT and the competitiveness of the sports genre may impact advertising income and subscription revenue, respectively. Therefore, the revenue growth from this crucial revenue segment is anticipated to be moderate in the near future. The company’s financial picture is still good, with high profitability and coverage metrics.

- Integrating operations vertically

With a track record spanning more than 20 years, the business has grown its television broadcasting base to 37 channels, covering a wide range of genres and languages. In the overall entertainment category, Sun TV, the company’s main channel, has some of the highest viewership in 2024.

Zee Entertainment Enterprises Ltd

- Strategic focus on quality content and a diverse portfolio

ZEE’s sharp focus on creating high-quality content positions it well in the competitive entertainment industry. Quality content attracts viewership, enhances brand reputation, and drives sustained growth.

Broadcasting in markets both locally and globally, producing and distributing films in multiple languages, debuting top music labels, organising live entertainment events, and media distribution via ZEE5 are all parts of ZEE’s diverse portfolio.

- Strategic business portfolio review

ZEE’s plan to reevaluate its entire business portfolio and prioritise value-added segments reflects a proactive approach to adapting to market dynamics. This strategic focus can enhance profitability and position the company for sustainable growth.

Additionally, recent changes in board responsibilities, including the expansion of the advisory panel’s role to include ‘Investigation Assessment’, and the appointment of new independent directors, further strengthen governance and oversight, ensuring that strategic decisions are well-aligned with the company’s growth objectives.

Conclusion

As India’s media and entertainment industry continues to captivate audiences and investors alike, Sun TV shares and Zee Entertainment shares stand out as potential investment avenues.

However, like any investment decision, a thorough evaluation of the companies’ financials, competitive strengths, and risk factors is essential.